Blockchain’s Impact Over The Next Decade: Recapping ARK Invest’s “Big Ideas” Report

We recently highlighted ARK Invest’s big crypto take recently, released as part of their “Big Ideas 2022” report. The big idea that we covered was one of ARK’s most loud takes in the entire report, a modeling of bitcoin’s potential path to a $1M price per token by 2030.

However, there’s more to digest out of the Big Ideas report – an annual digest of innovation, five years in the running, from the team at ARK Invest. So let’s take a look at some other crypto and blockchain related insights from the ARK team that came to light in this recent paper.

Bringing The Big Ideas…

There are a variety of blockchain and crypto related buckets that the Big Ideas report covers, so while we’re spare you the content and perspective around electric vehicles, AI, and 3D printing, we’ll of course take a dive into ARK’s sentiment on Ethereum, Web3, digital wallets, and more.

ARK sees blockchain technology advancing at a 43% compound annual growth rate (CAGR) over the next 8 years, expanding from a current market cap of roughly $1.4T to a 2030 market cap of roughly $49T. This is a more aggressive CAGR than any of the other major categories that ARK outlines with the exception of robotics.

Furthermore, the firm sees blockchain technology at large as a vessel to a world where “everything could become money-like: fungible, liquid, quantifiable” and that digital wallets hold massive disruption power, adding that wallets could allow consumers to “hold the power of a bank branch in their pockets and demand wholesale pricing for many financial transactions.”

Related Reading | ‘Bitcoin Rush:’ Small-Time Solo Miners Strike Gold With Full BTC Blocks

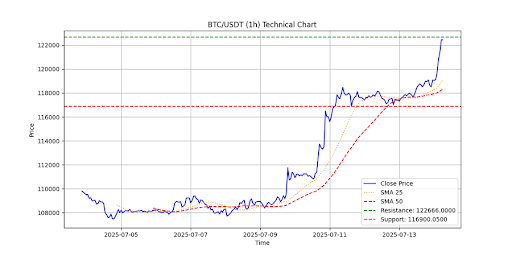

When in doubt, zoom it out. The 5-year BTC chart is a stark reminder that big price forecasting for BTC isn’t necessarily unreasonable. | Source: BTC-USD on TradingView.com

More On Digital Wallets

Centralized and not necessarily crypto-centric digital wallets have already sprouted to become massive players in finance. Cash App, Venmo, and competitors are taking personal finance by storm, and ARK anticipates scaling growth at an annual rate of nearly 70%. Digital wallets surpassed cash at point of sale transactions last year, and blockchain and crypto can certainly absorb some of that growth as well. Additionally, ARK aptly notes that digital wallets also can serve as a touchpoint to onboard Web3.0 assets, such as NFTs.

Let’s Talk Broader Blockchain

As crypto continues to evolve, ARK is still focused on the genesis that is BTC, stating that the firm “believe(s) bitcoin is the most profound application of public blockchains,” but adding that it has spurred DeFi and Web3.0 revolutions. ARK Invest emphasizes and celebrates public blockchain infrastructure at large for their decentralized and permissionless nature, their open-source networks, and the broad user participation and engagement. Furthermore, the report cites a vision of public blockchains impacting vast asset classes (cryptocurrencies, crypto-equities, NFTs, DAOs, etc.) in the same way that the internet revolutionized a variety of asset classes (such as online radio, tv, news, and e-commerce).

This idea is fleshed out further, and broken out into three buckets of revolution: money, financial, and internet. The graphic below, pulled directly from the Big Ideas report, paints this picture in interesting fashion:

Further in the report, there is also a dedicated section for Ethereum and DeFi, as well as Web3. In these sections, ARK highlights DeFi and NFTs driving demand for Ethereum, leading to Ethereum 2.0 anticipation, and spurring demand for Layer 2 solutions. Meanwhile, ARK Invest forecasts Ethereum to potentially grow over 50x in market cap over the next decade. Additionally, ARK calls out the permissionless, frictionless, transparent, and public nature of DAOs as especially unique, and cites digital ownership as an accelerator for society’s continued shift to a more online world.

Finally, while NFTs today are a bit more ‘siloed,’ ARK Invest envisions a blurring of the line between consumption and investment, and a more holistic experience around NFT and Play-to-Earn worlds.

More ‘Big Ideas:’ A Focus On Bitcoin

As the ARK team has done previously, they dedicated an entire section of the Big Ideas report to Bitcoin and Bitcoin alone. ARK sees network participants as maturing and having a particular focus on the long-term, while still showing exceptional growth year-over-year by nearly any metric – including average transaction values, average daily transfer volumes, and cumulative annual transfer volumes. How will this continue? The report highlights Lightning Network growth, increased adoption, and growing institutional holders – among other things.

In fact, according to the report and as of numbers collected in November 2021, “exchange traded products, countries, and corporations held 8% of bitcoin’s supply.” The deck goes on to address environmental, social, and governance (ESG) concerns that are often mentioned by critics, and highlights crypto mining as “a digital-monetary energy network” – citing mining as having the potential “revolutionize energy production” by way of green energy incentivizes.

Of course, we’d be remiss not to call out the boldest take of them all – and what brought us to this point today – the $1M BTC token price. Pinch me in 2030.

Related Reading | How The Fed’s Move Could Affect The Crypto Market

Featured image from ark-invest.com, Charts from TradingView.com The writer of this content is not associated or affiliated with any of the parties mentioned in this article. This is not financial advice.