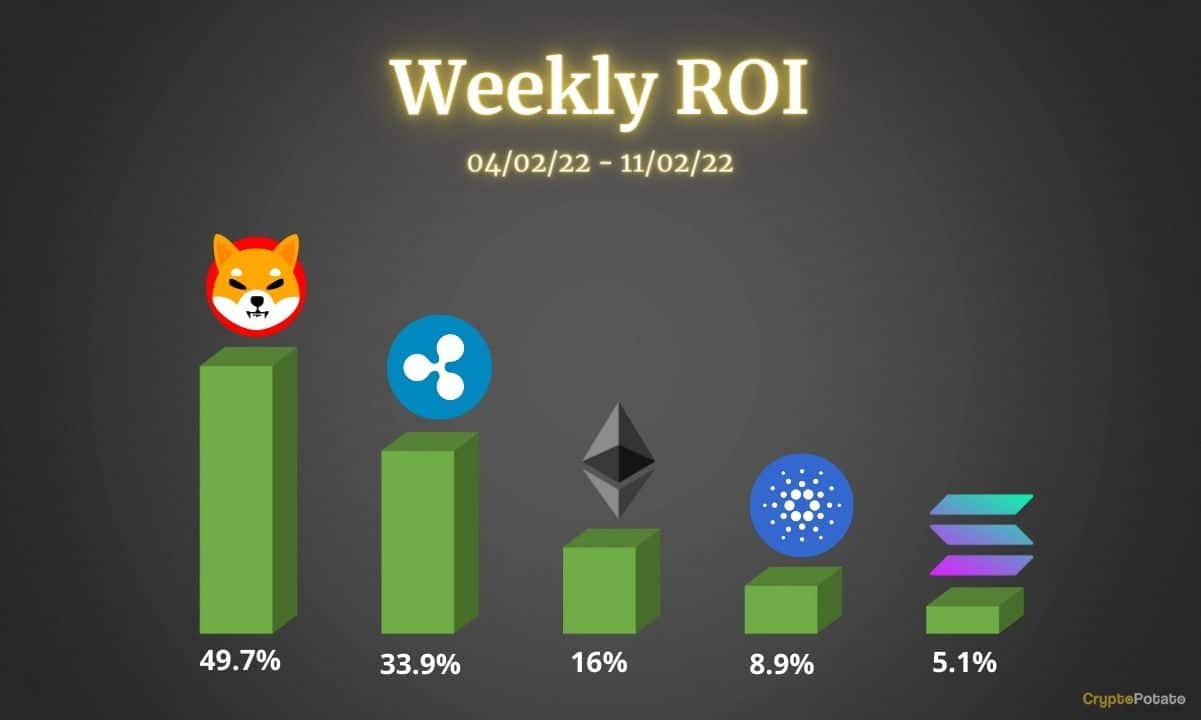

Crypto Price Analysis Feb-11: Ethereum, Ripple, Cardano, Solana and Shiba Inu

This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Shiba Inu.

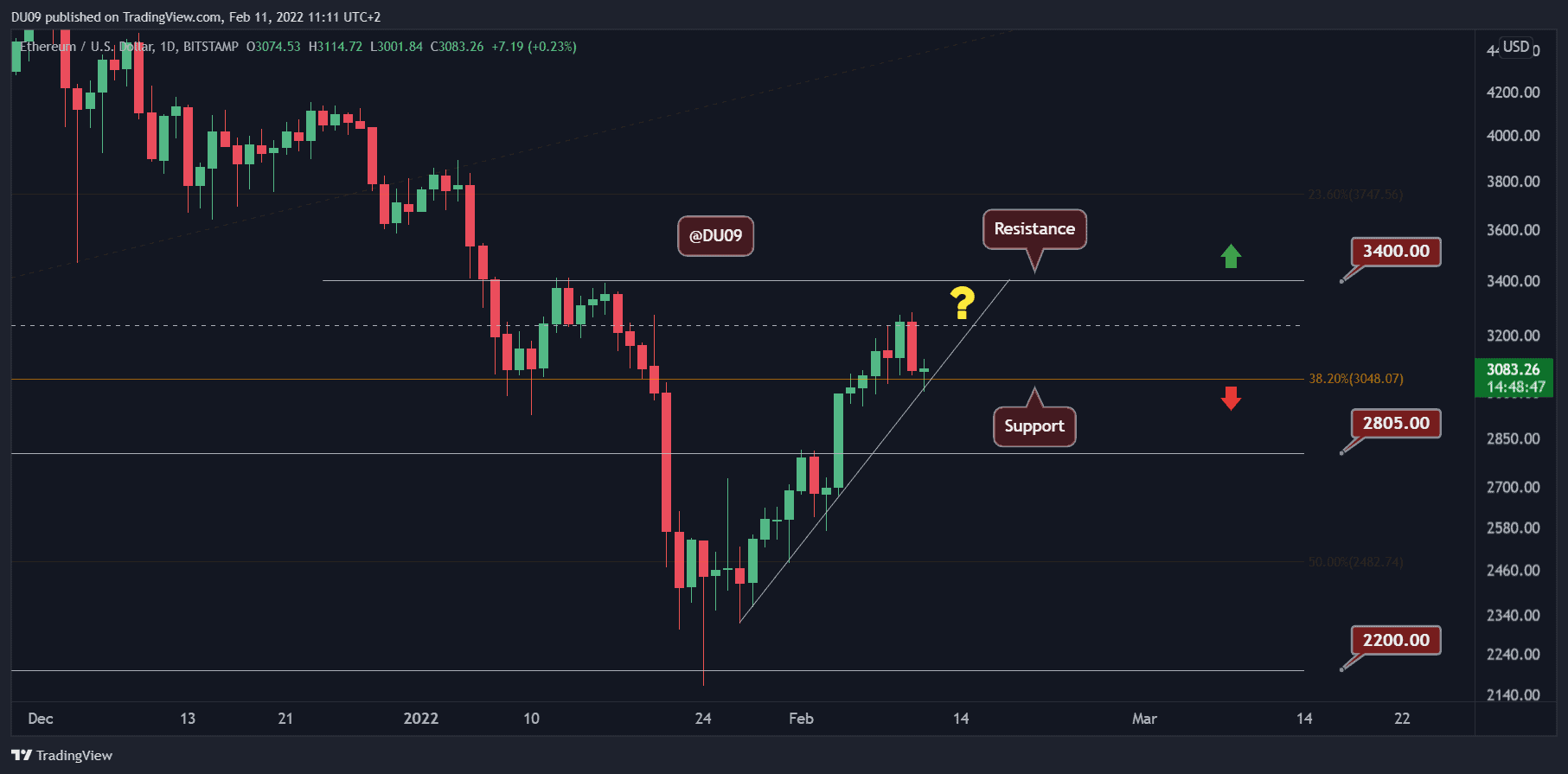

Ethereum (ETH)

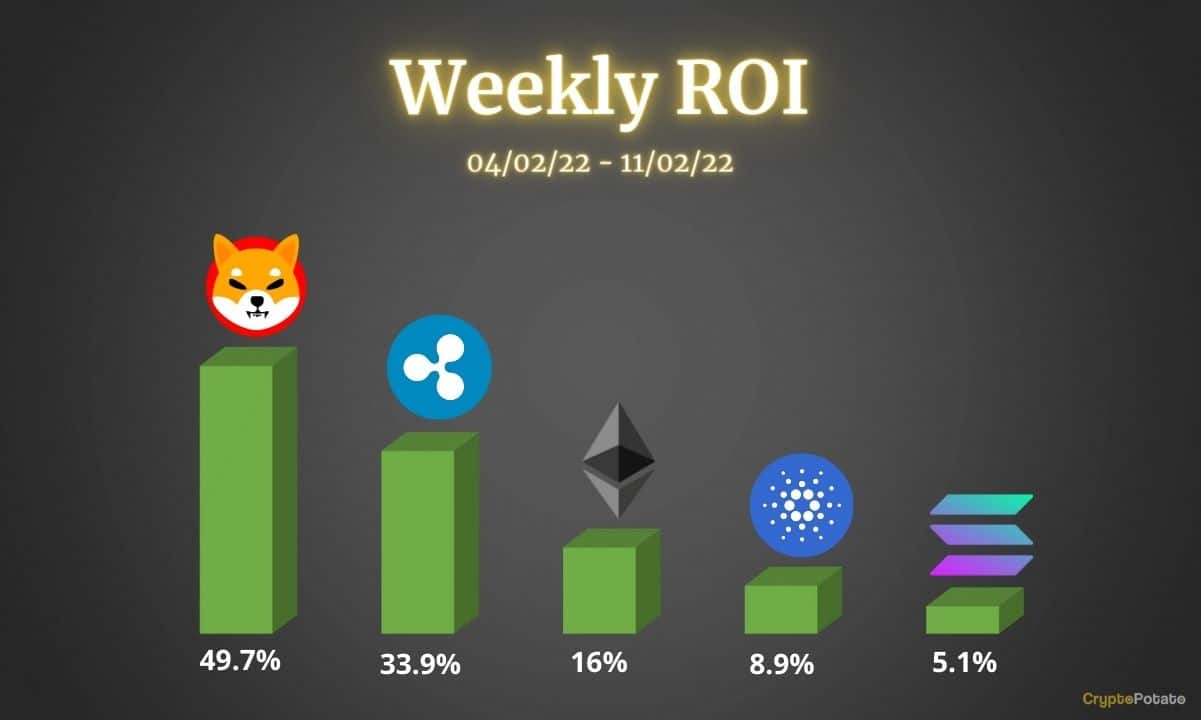

ETH failed to push above $3,200 this week and fell back on the $3,000 support level yesterday, where the price is now consolidating. Despite this most recent pullback, the cryptocurrency had a stellar performance this week, with a 16% price increase in the past seven days.

The big question is if ETH can hold above $3,000. If it manages to do so, then bulls might be in a position for another shot at the $3,200 resistance in the coming week. If they fail, however, the cryptocurrency could fall to the next support level at $2,800, which would make it lose a critical psychological level ($3,000).

Looking ahead, the indicators remain bullish, which gives reasons to be optimistic. Buyers need to defend the $3,000 level. Otherwise, sellers may take over the price action in the coming week.

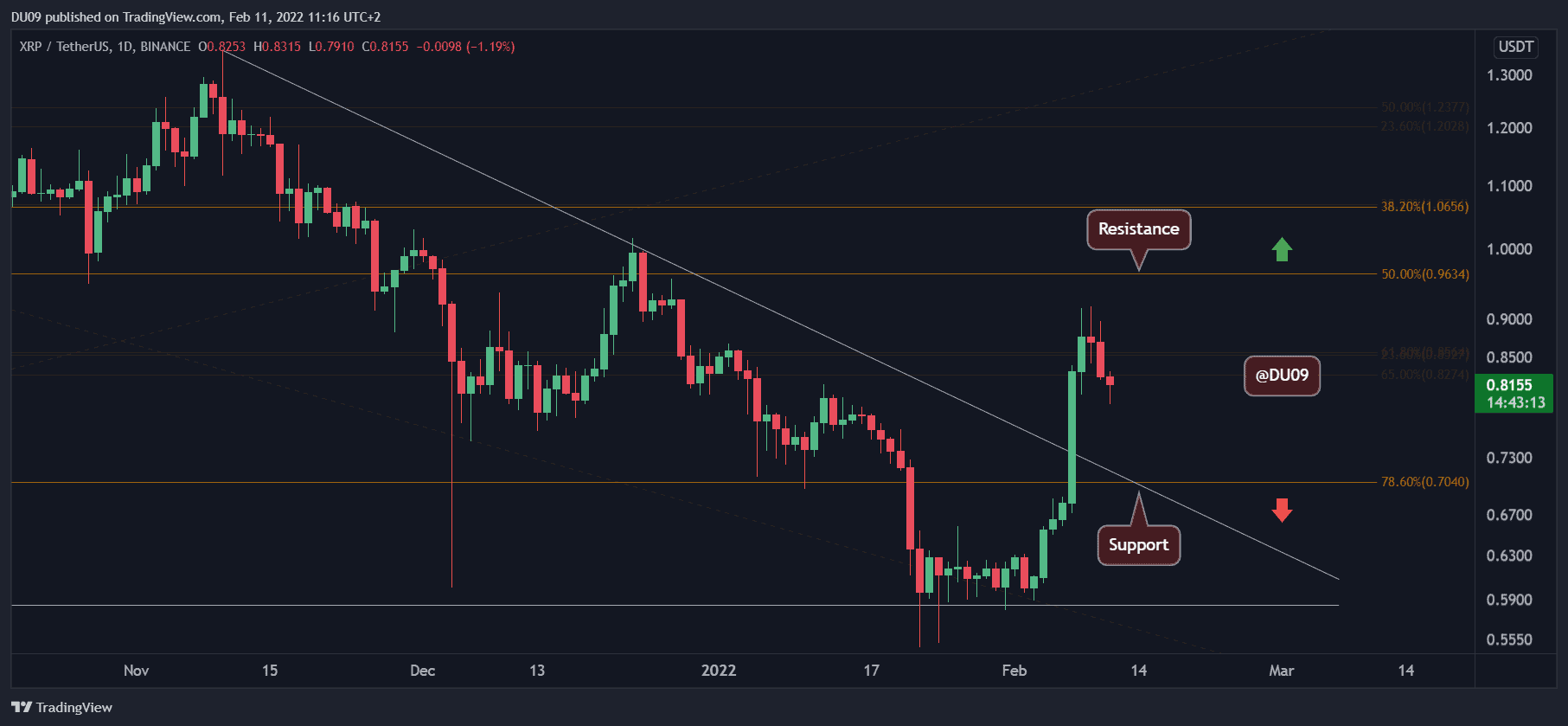

Ripple (XRP)

XRP had a major breakout this week, with the price moving above the key resistance at $0.70 and quickly reaching $0.90 after that. Overall, it was a fantastic week for XRP with a 34% price increase.

However, it failed to push above $0.90 and is now found in a correction with support at $0.80. This is not surprising, considering the massive rally that happened not too long ago. If $0.80 fails, then XRP may fall all the way back on the $0.70 level, which is now acting as support (was resistance before the breakout).

The indicators are still bullish for XRP, and this pullback can also be explained by the daily RSI, which briefly entered overbought conditions during the rally and now fell back below 70 points. Once this correction is over, XRP may attempt a new rally to test the critical psychological level at $1.

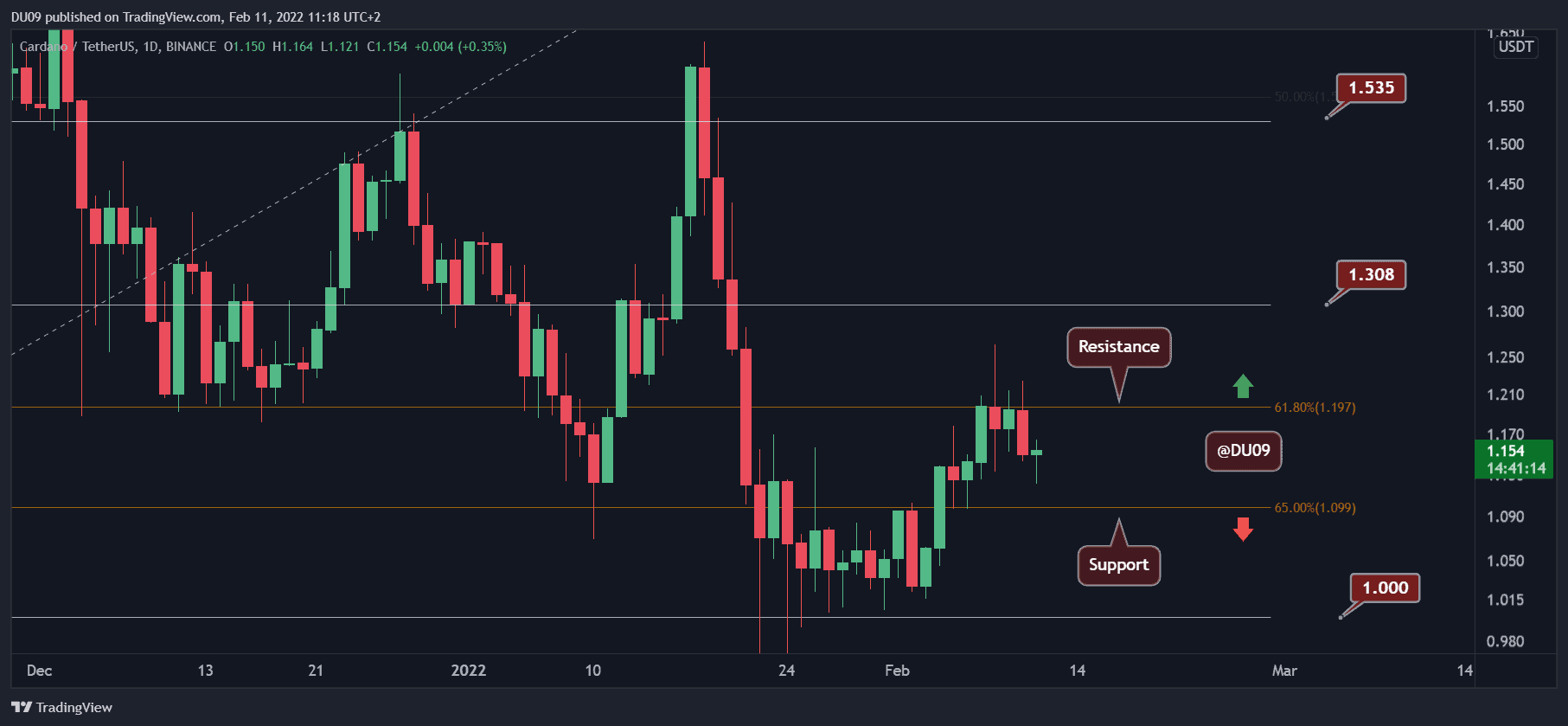

Cardano (ADA)

ADA also had a good week, but the resistance at $1.2 did not allow it to move higher, and it has been struggling since then. Nevertheless, the cryptocurrency closes the last seven days in green with a nice 9% price increase.

Considering the ongoing correction, ADA may fall back on the key support at $1.1 before any renewed rally can be expected. Even if this happens, the overall price action remains bullish, and after the pullback, ADA may rally once more and try to cross above $1.2.

The indicators remain bullish and seem likely to stay if ADA does not fall under the key support. This should prepare it for a nice rally next week if the bullish momentum resumes. On the other hand, a drop under $1.1 would likely push ADA into a bearish trend.

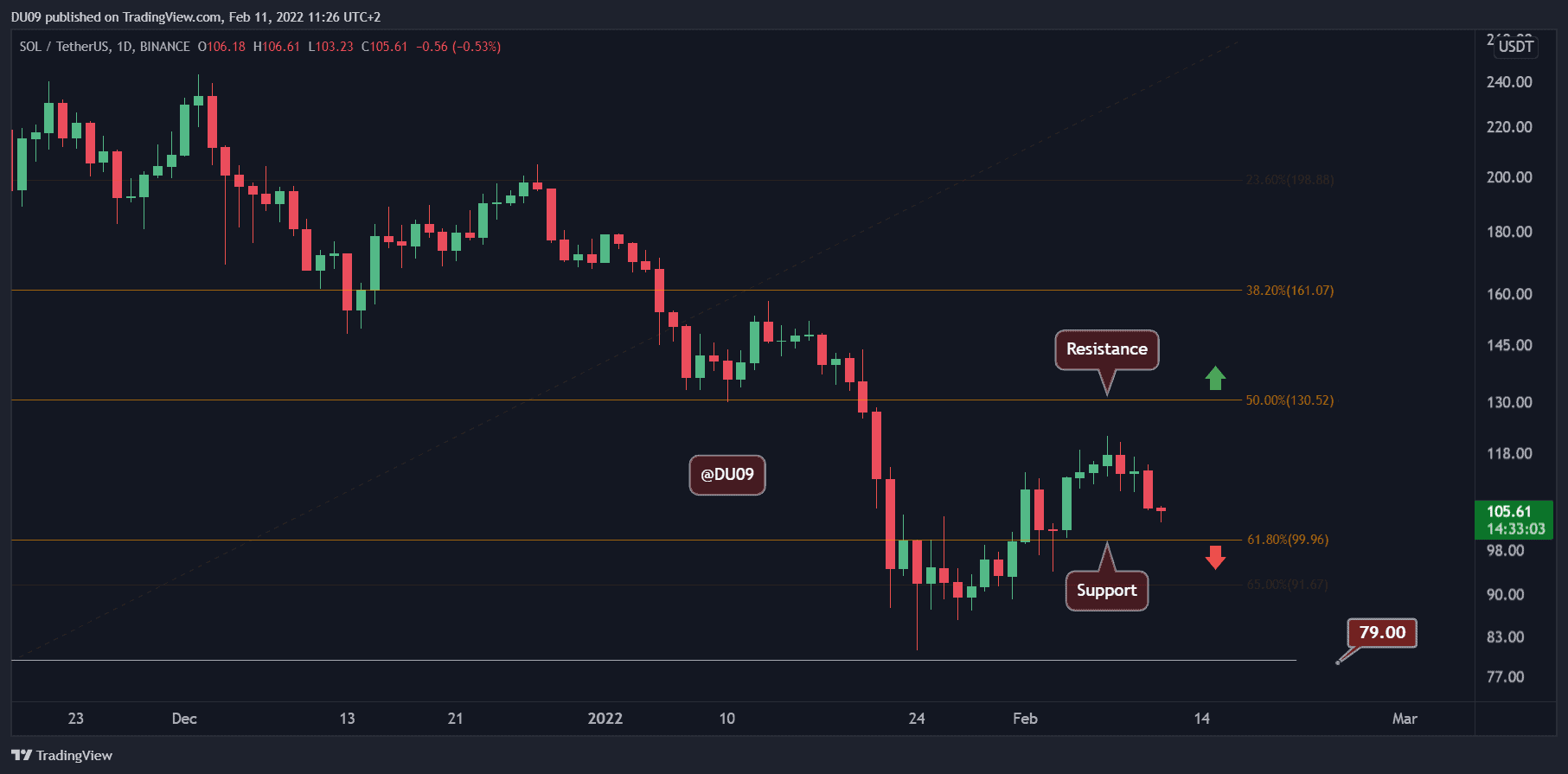

Solana (SOL)

After a rally to $120, SOL failed to move higher, and since then, the price has been falling towards the key support at $100. It is unlikely for SOL to turn back right now, and a test of the key support appears probable. Despite the current correction, SOL still managed to close the past seven days in green with a 5% price increase.

Volume has been falling as price went higher last week, which was an early signal that SOL did not have the momentum to sustain the rally. The MACD remains bullish on the daily timeframe, but the histogram is showing a loss of momentum with lower highs.

Next week will be crucial for SOL, and buyers have to do their best to defend the $100 level. Any failure there will only embolden sellers to take SOL under $100, which would be a significant defeat.

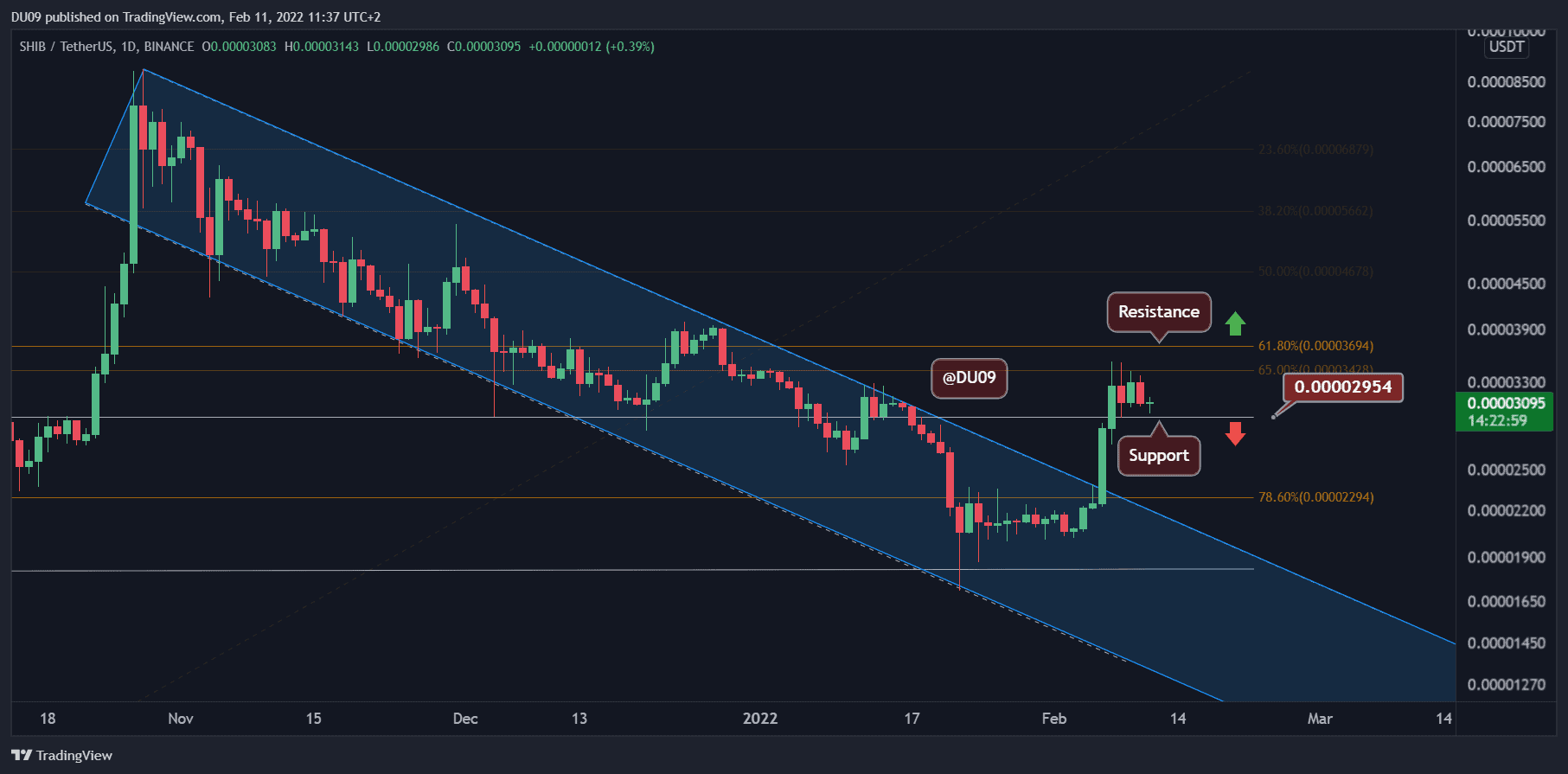

Shiba Inu (SHIB)

SHIB has been the best performer from our list, with a 50% price increase in the past seven days after a major breakout from the descending channel (in blue on the chart). Now, the price is consolidating above the key support at $0.000029.

If this consolidation continues and the support level holds, then SHIB may chart another leg up, which could take it all the way to $0.000040. The indicators remain bullish for now, and the only concern is the decreasing volume, which may cast some doubts on the strength of this rally.

Looking ahead, SHIB has put an end to the downtrend and started a new surge with a bang. It is unlikely for SHIB to make a lower low considering this latest development. Therefore, the most probable scenario now seems to be a consolidation or continuation of the rally.