Bitcoin Back Under $30K, Rejected within Aggressive Seller Zone, What’s Next for BTC Price Ahead?

The post Bitcoin Back Under $30K, Rejected within Aggressive Seller Zone, What’s Next for BTC Price Ahead? appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

Bitcoin yet again failed to nullify the bearish impact as the prices slid down $30,000 in the early trading hours. The asset was expected to break out of the descending trend line with the recent surge beyond $32,000.

However, the asset failed to withstand around the $31,500 to $30,300 area which is also a ‘high selling zone’. Currently, the bulls who are trapped above $32,000 may have to either close the deal in a loss or else wait for an extended period for a break-even deal.

As usual, Bitcoin’s long liquidation has had a major impact that dragged the price below $30,000. Data fetched from Coinglass shows nearly $530 million longs have been just whipped out of the market by nearly 1,05,573 traders.

Out of this more than $336.33 million in liquidations were of BTC longs only, which is the highest in the past couple of months. Therefore, raising concerns over the trader’s confidence in the market as they are now compelled to close positions with minor jumps of just 5% to 6%.

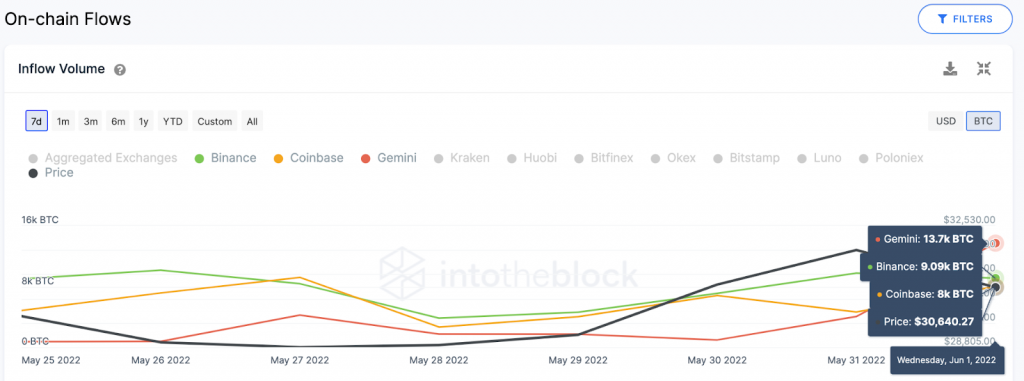

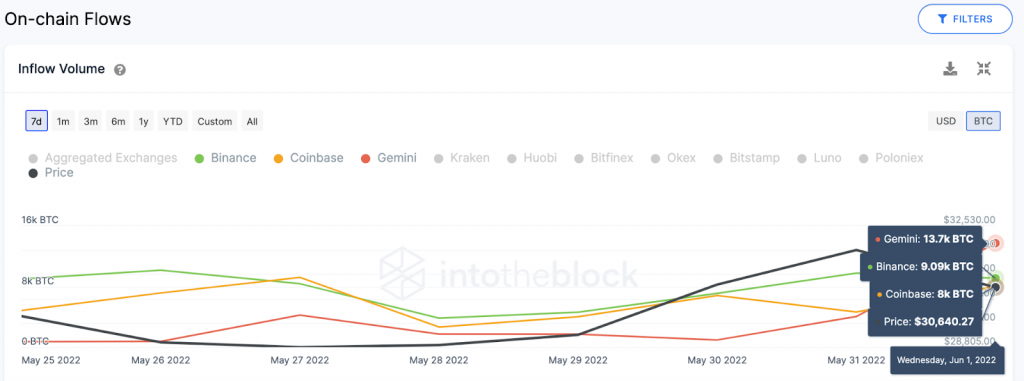

Bitcoin In-Flow

Now considering the exchange inflows, as many as 43.79K BTC have been flooded into the exchanges. Out of which, nearly 13.7K BTC have lonely flown into Gemini exchange alone in a single day.

On the other hand, Binance and Coinbase registered an inflow of 9.09K and 8K BTC respectively. With huge selling pressure mounting within the space, the next BTC rally has become pretty uncertain at the moment. Currently, no short liquidations are happening which indicates that traders are pretty sure of the rally heading towards the south.

On the other hand, the speculation of BTC miners letting off their rewards is also making some rounds. Therefore, the miners who appear to be in a spot of bother right now could just capitulate very soon which is more dreadful for the BTC price ahead.