A Move To $2K or an Imminent Correction for ETH? (Ethereum Price Analysis)

Ethereum started a rally after breaking above $1000 and gained 50% in six days. Largely propelled by the Merge anticipated in September, many are calling for the $2K price target, although there is serious resistance before that.

Technical Analysis

By Grizzly

The Daily Chart

On a daily time frame, the bulls took another step closer to reclaiming $2,000. ETH was able to recover above $1280 and break out of the sideways trend after a month. However, it’s important to note that the positive divergence in the Momentum indicator also caused the index to break the baseline. So far, whenever it hit the descending line (in yellow) – over the past three occasions – the market had dropped aggressively. Currently, the Momentum has touched the yellow line, and if it can break above it, the bullish sentiment will likely increase further.

The bulls have no choice but to break above the resistance zone at $1,500-1,700 (in red) to develop a sustainable positive trend in the market. If successful, this may even propel ETH to $2,000 and perhaps even confirm a mid-term trend reversal.

Key Support Levels: $1280 & $1000

Key Resistance Levels: $1500 & $1700

Daily Moving Averages:

MA20: $1176

MA50: $1335

MA100: $1933

MA200: $2456

The ETH/BTC Chart

ETH performed better than BTC this week and achieved an upside breakout from the monthly consolidation phase. The price has now touched the 200-day moving average line (in white) after breaking the horizontal resistance at 0.065 BTC (in yellow).

The structure is entirely bullish as far as the buyers hold the price above 0.065 BTC. Presently, ETH seems to need more momentum to break above the MA200. Therefore, any correction towards 0.065, which is a chance to gain the required momentum, is healthy.

Sentiment Analysis

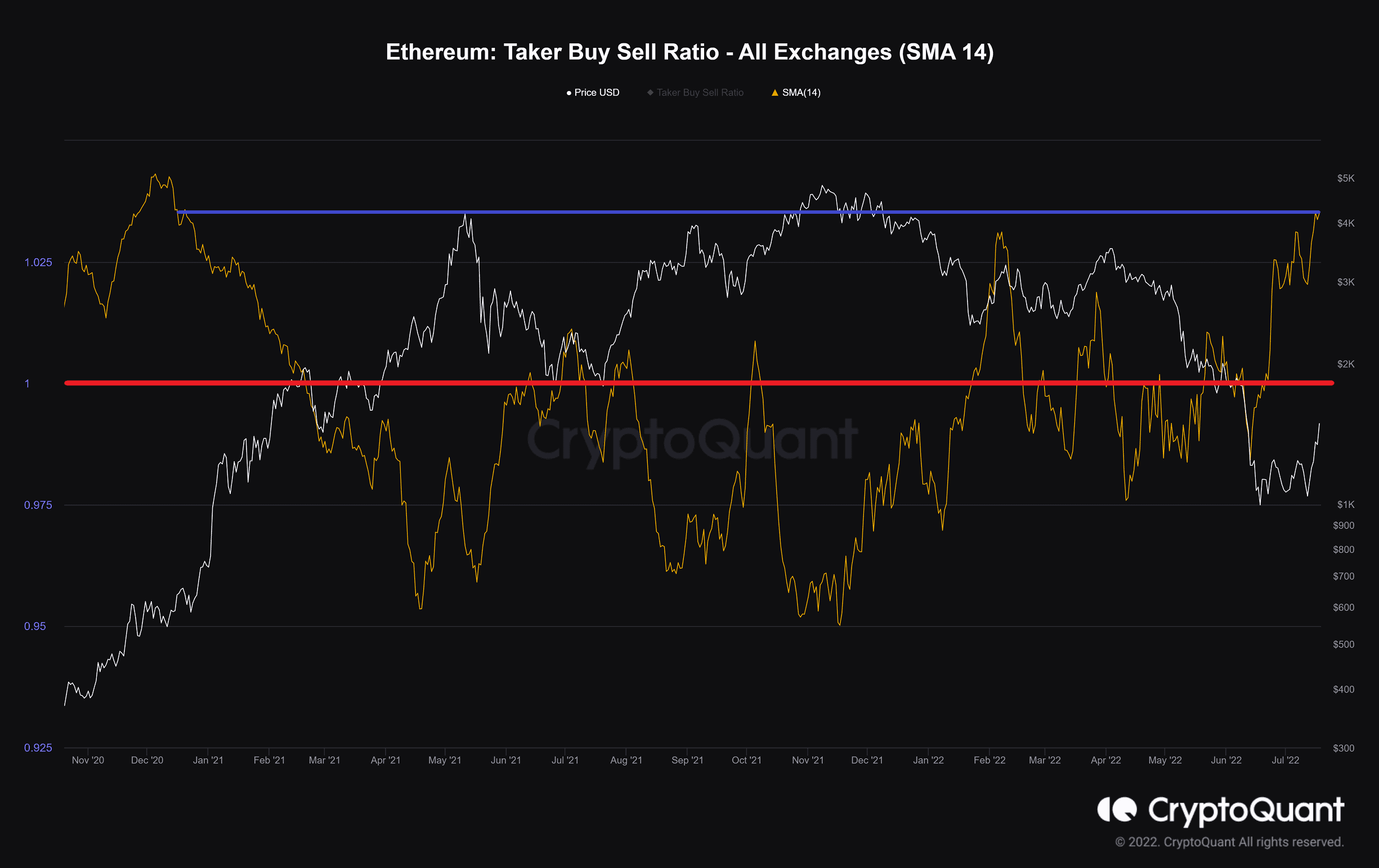

Taker Buy Sell Ratio

Definition: The ratio of buying volume divided by selling volume of takers in perpetual swap trades. Values over 1 indicate that the bullish sentiment is dominant. Values under 1 indicate that the bearish sentiment is dominant.

Takers have filled more buy orders after the last market crash. This caused the bullish sentiment to prevail in the derivatives market. This metric has now reached its highest level since the end of 2020. At that time, Ethereum recorded a historic bull run. The derivatives market is very hot, and many positions, mostly short, were liquidated in the last 24 hours.