Bitcoin Volatility Amplifies as Fed Chair Speaks at Jackson Hole

Federal Reserve chairman Jerome Powell spoke about FOMC’s future goals at the annual Jackson Hole symposium on Friday. He said that FOMC’s overarching directive remains to bring inflation back down to 2%, which “will likely require maintaining a restrictive policy stance for some time.”

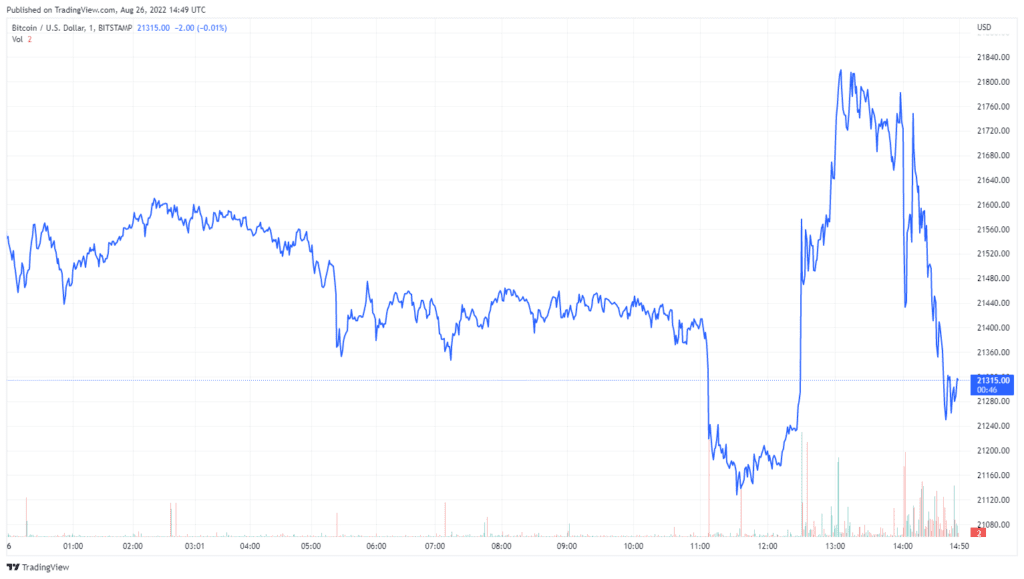

After a preliminary pump, Bitcoin’s price swung wildly following his comments.

- Trading at $21,234 at 12:30 UST on Friday, Bitcoin quickly pumped to $21,819 by 13:05 UST – just an hour before Powell’s comments.

- Bitcoin then dipped to $21,433 as the chairman delivered his remarks. It then bounced back up again to $21748 by 14:09, and back down to $21,315 at writing time.

- Bitcoin’s price has a history of seeing short-term volatility when Powell speaks – yet not always in a predictable direction. However, investors and analysts generally agree that Bitcoin and crypto markets closely track equities, all of which have been hammered during the Fed’s monetary tightening this year.

- Both the S&P500 and NASDAQ briefly fell by about 1% right as Powell’s speech began, but quickly bounced back afterward.

- Crypto enthusiasts like Galaxy Digital CEO Mike Novogratz and BitMEX co-founder Arthur Hayes have predicted that the Fed will “flinch” before being able to quell rising prices. However, Powell’s words signaled that the Federal Open Markets Committee is ready to face economic pain.

-

“Reducing inflation is likely to require a sustained period of below trend growth,” he stated. “There will very likely be some softening of labor market conditions.”

- The chairman gave no indication of how much FOMC plans to raise its target interest rate heading into its September meeting.

The post Bitcoin Volatility Amplifies as Fed Chair Speaks at Jackson Hole appeared first on CryptoPotato.