On-Chain Data Reveals Bitcoin (BTC) Price Can Hit Bottom Anytime Soon

The post On-Chain Data Reveals Bitcoin (BTC) Price Can Hit Bottom Anytime Soon appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

It looks like The cryptocurrency market will continue its weekend bear movements as the world’s first cryptocurrency, Bitcoin, is still hovering around $19,000 price levels. At the time of reporting, Bitcoin is selling at $19,741 with a fall of 0.24% over the last 24hrs.

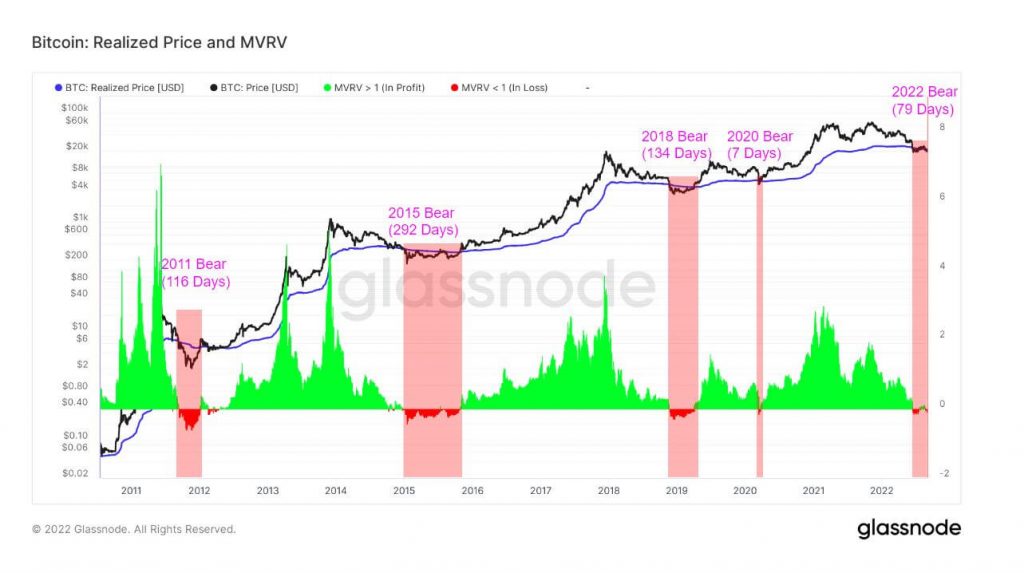

Meanwhile, to know Bitcoin’s bottom there are two main on-chain indicators that one needs to look into, realized price and MVRV ratio.

Firstly, the realized price indicator is the one through which the average cost of Bitcoin supply for a day that each currency last transacted on-chain. This metric is considered one of the important indicators which help to know the market’s cost basis.

On the other hand, the MVRV ratio is the one that calculates the ratio between Bitcoin supply’s market capitalization along with its realized value. Through this ratio, Bitcoin’s present trade is positioned above or below the fair value and this calculation is used to understand net market profitability.

Whenever the spot price of Bitcoin is trading below that of realized price, the MVRV ratio will definitely trade below 1. This suggests that investors and traders are preserving their holdings below their cost basis and unrealized loss.

Next, when the MVRV has a consistent movement, there is a formation of support and when this is considered along with realized price, it may signal a bottom.

It is observed that even during earlier bear markets Bitcoin price has plunged below the 200-week moving average realized price. Also since 2011, this trade below the realized price is seen till 180 days, but in March 2020 the downfall was only for 7 days.

Now it’s been 79 days for the Bitcoin price positioned below the MVRV ratio since Terra collapsed in May. Though BTC price saw a leg up above the MVRV ratio in August, it’s still not the right time to say that Bitcoin’s bottom has found its end.

Bitcoin Price To Surpass $20,000 Area?

This depicts that $20,000 is the strong resistance area and this area suggests market strength and how low could the price drop in the days to come.

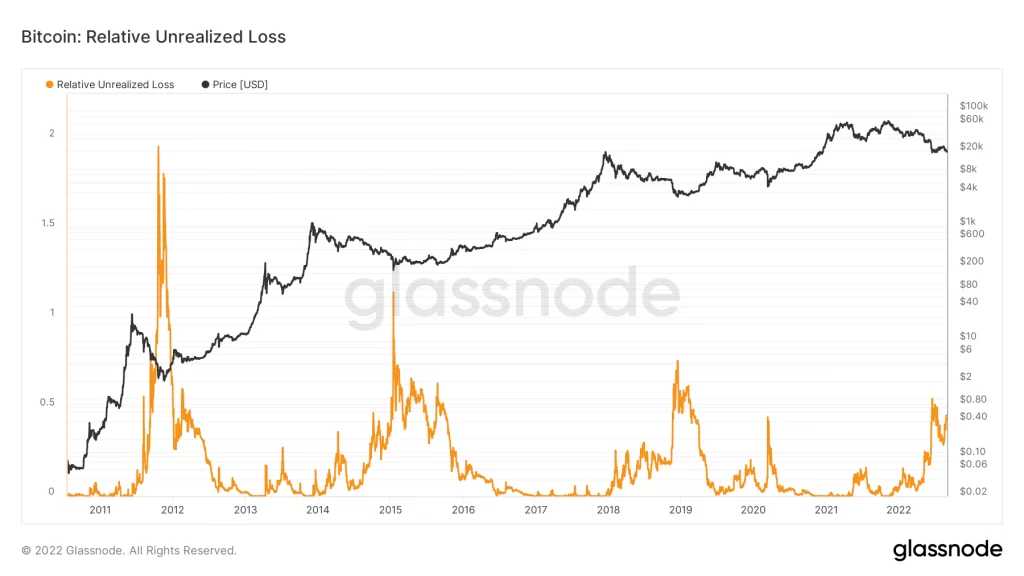

The Glassnode data suggests that in August Bitcoin experienced a significant jump in its relative unrealized loss after a surge at the start of summer. When there is an increase in unrealized loss score, it refers that addresses are still holding on to investment amidst their relative devaluation.

As per previous stats whenever unrealized relative loss has surged, Bitcoin showed higher lows. In the very next cycle, Bitcoin made a move towards the height that its last hit before the bearish cycle but failed.