Bitcoin’s Break Above $20,000 Sees Market Liquidations Cross $1 Billion

Tuesday has proven to be a good day for bitcoin and the crypto market in its entirety as gains have been the order of the day. Bitcoin has finally been able to clear the $20,000 territory even when indicators pointed towards the more sluggish movement for the digital asset. As expected, there have been ripple events from the gains in the market. Liquidations are now the order of the day and short traders are getting the ‘short’ end of the stick.

Crypto Liquidations Cross $1 Billion

The crypto market has now recorded its worse liquidation trend so far in 2022. Bitcoin’s recovery above $20,000 was swift and the liquidations were just as fast. The result of this is more than $1 billion being liquidated across the crypto market in the last 24 hours.

Given the recovery, short traders have suffered the worst of it. Data from Coinglass shows that over 87% of all liquidations recorded in the past day have been from short traders. This means that short traders have lost more than $700 million in a single day.

Amid this, FTX exchange recorded the largest liquidation event in history with more than $700 million liquidated on the crypto exchange. This puts the majority of the market liquidations on FTX (74.7%) with all other exchanges making up about 25% of the remaining figure.

24-hour liquidations cross $1.1 billion | Source: Coinglass

Approximately 156,000 traders were caught in the crossfire of this bloody trading day. The largest single liquidation was recorded on the Okex – ETH-USDT-SWAP pair for a total of $3.05 million. Total market liquidation values now sit at $1.12 billion at the time of this writing.

Bitcoin Gearing Up For More

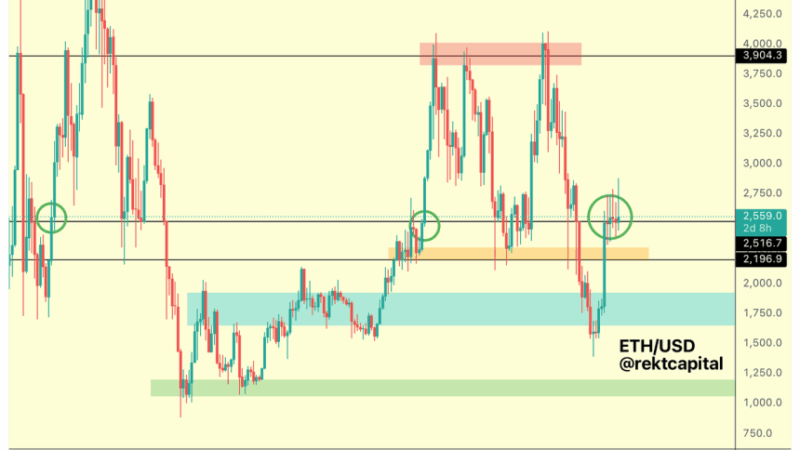

Bitcoin has landed in the mid-$20,000s after the current rally but the digital asset does not seem to be done yet. The recovery put it firmly above its 50-day moving average, which cements its short-term bull trend.

Additionally, the correlation with the stock market remains high and bitcoin is bound to follow the performance of its largest counterpart. If the current positive sentiment across the financial market continues, then it is possible that BTC would test the $21,000 resistance before the close of the trading day on Wednesday.

BTC price at $20,600 | Source: BTCUSD on TradingView.com

High inflation rates across the world are also triggering investors’ move to bitcoin. Forecasts have put countries around the world at even higher inflation rates going into the end of the year, which could paint a bull picture for cryptocurrencies going forward.

BTC is currently trading at $20,600 at the time of this writing. It is up 6.98% in the last 24 hours and has a current market cap of 396 billion. It has also seen $61.7 billion in trading volume, a 136% increase in the last day.

Featured image from ITPro Today, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…