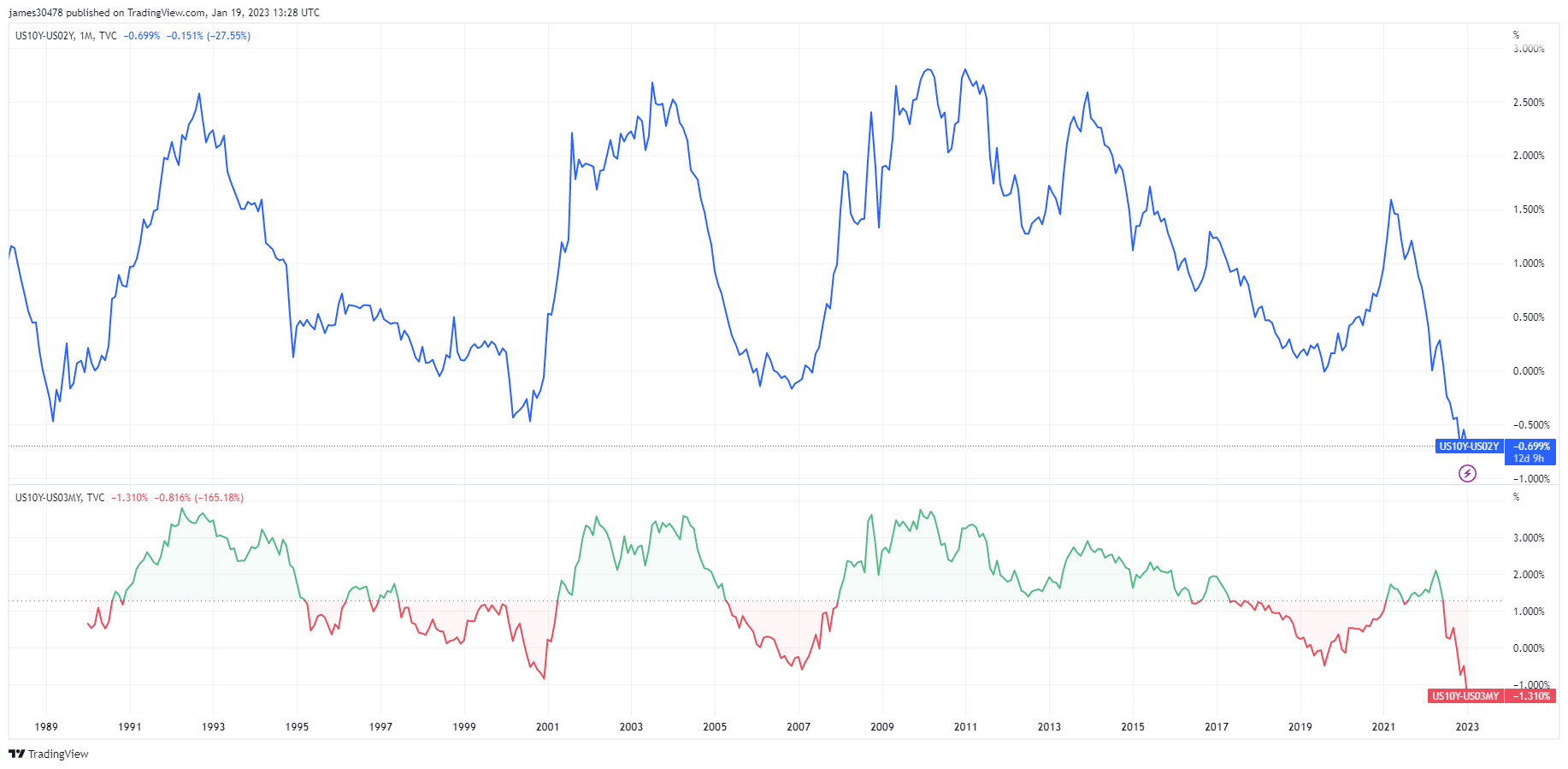

Deepest inversion since 1981, high probability of recession 2H 2023 or early 2024

Definition

An inverted yield curve is when interest rates on long-term bonds fall lower than those of short-term bonds. This can signify an impending recession; an inverted yield curve emerges roughly 12-18 months before a recession.

Quick Take

- Many different inversions have occurred across the yield curve, with the US10Y – US02Y deeply inverted as low as the 1980s.

- The 2/10 spread has inverted almost 30 times since 1900; in 22 instances, a recession has followed.

- In addition, the 3m10y spread has reached a -100 bps inversion, the deepest in several decades.

- This inversion points out the fed policy error that the fed will break inflation but could also break the economy.

The post Deepest inversion since 1981, high probability of recession 2H 2023 or early 2024 appeared first on CryptoSlate.