Analyst Warns Investors as Bitcoin Might Be Setting up a Huge ‘Bull Trap’

The post Analyst Warns Investors as Bitcoin Might Be Setting up a Huge ‘Bull Trap’ appeared first on Coinpedia Fintech News

Investors are waiting to see if Bitcoin (BTC), the flagship digital asset, can break through the barrier at this level and trade above $25,000. In the previous few days, Bitcoin briefly reached $24,900, the flagship asset’s highest price in six months.

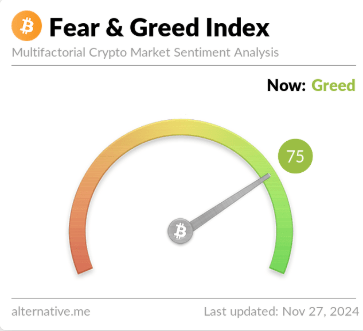

The market appears to be gathering up momentum, and individuals are ignoring any bearish news, which are signals that many in the sector believe the worst is over, suggesting that the market bottomed in November and has now turned positive.

An analyst is warning cryptocurrency investors against loading up on Bitcoin right away when the table seems to have turned. Crypto expert Nicholas Merten explained in a new strategy session that Bitcoin’s price is expected to decline, creating a bull trap for traders who recently went long on BTC’s recent positive price action.

In order to show that a liquidity trap is building at the current levels, he warned that Bitcoin has not yet traded and held support above the 200-week moving average.

The analyst said that investors are already chasing the price rather than simply waiting for it to stay above the 200-week and find support there. He then highlighted that Bitcoin is in the same supply zone or resistance range that it was in August, perhaps just a little bit higher to pique interest and generate excitement, breaking above the price action in August and a couple of times breaking slightly above that 200-week moving average without being able to form support.

“And that’s the big mistake that everyone’s making because that is a liquidity trap, Classic 101 example of how to market investors or more specifically institutional investors can trick retail traders and take advantage of that output side pressure in order to serve as exit liquidity for positions.”