Is The Banking Turbulence Good For Pepe, Uniswap And Collateral Network?

The post Is The Banking Turbulence Good For Pepe, Uniswap And Collateral Network? appeared first on Coinpedia Fintech News

Over the last month, activity throughout the cryptocurrency market grew exponentially as uncertainty increased throughout the banking market. With the First Republic on the brink of collapse, market experts believe that Pepe (PEPE), Uniswap (UNI) and Collateral Network (COLT) could surge in value. Here’s why.

Collateral Network Could Revolutionize A $7.4 Trillion Market

With more people moving towards DeFi technology, projects like Collateral Network are in a strong position to gain market share from traditional businesses. Collateral Network is designed to disrupt the crowdlending industry and has already experienced a 40% price rise during its presale.

Instead of needing to sell their physical assets to raise cash, Collateralnetwork.io lets borrowers take out a DeFi loan against their assets by bringing them on-chain as an NFT. Each NFT is fractionalized and sold directly to lenders on the platform, who earn a fixed interest rate for the duration of the loan.

This innovative approach can provide borrowers with access to cash in just 24 hours without impacting their credit scores. Additionally, due to fractionalization, lenders can lend an amount that suits their budget.

The platform is designed to be easy to use, with cross-chain compatibility and borderless transactions to make raising a loan easier than ever. COLT tokens are currently available at $0.014 a token, and are predicted to rise to $0.35 by the end of the project’s presale.

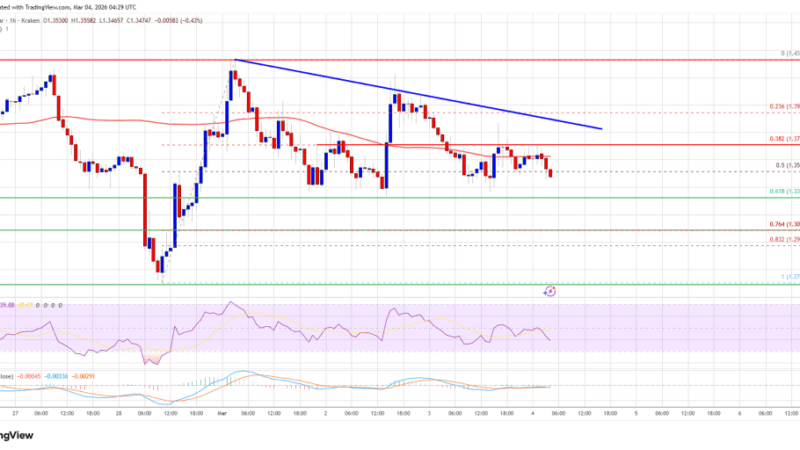

Uniswap Rises 1.43% In The First Week Of May

Uniswap (UNI), one of the world’s largest decentralized exchanges, has experienced an increase in its user base following recent turbulence with centralized banks. As investors in both fiat and cryptocurrency begin to doubt the security of their finances, it’s believed that platforms like Uniswap (UNI) will grow in popularity. However, Uniswap (UNI) itself performed poorly throughout April.

Over the last month, Uniswaps (UNI) value has decreased by 12.70%, taking Uniswap (UNI) to lows of $5.21. The project has since bounced back to $5.30 and is expected to rise over the next few weeks following its recent Gauntlet update. While its recent performance has been one of ups and downs, Uniswap (UNI) plays an integral role in the decentralized economy and is only going to grow as investors lose hope in centralized exchanges. As a result, additional banking turbulence could drive up the price of Uniswap (UNI), making it a strong long-term investment.

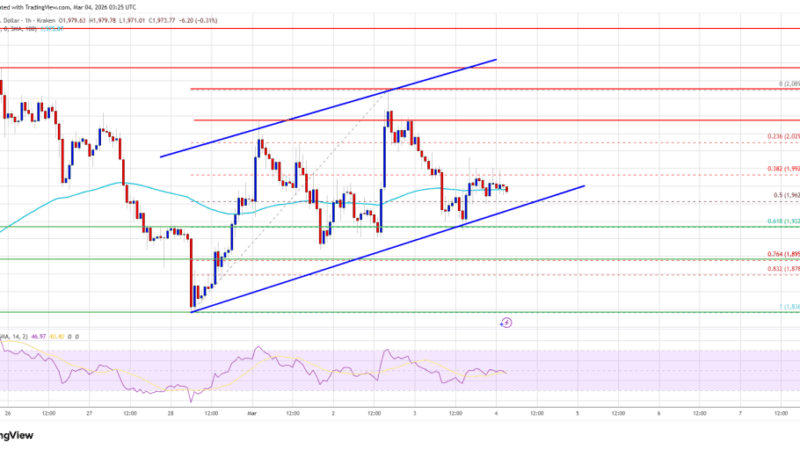

How High Will Pepe (PEPE) Go In May?

The Pepe (PEPE) meme has become one of the latest DeFi projects to make headlines. Its recent price increase of over 1000% shocked investors and analysts worldwide, and now Pepe (PEPE) continues to rise in value. Should Pepe (PEPE) follow financial trends in a similar way to Shiba Inu and Dogecoin, banking turbulence will almost definitely push its value up further.

Pepe (PEPE) has quickly grown a huge fanbase, with over 227,000 followers on Twitter alone. The project showcases hundreds of memes to create hype around the Pepe (PEPE) brand, which has pushed the value of Pepe (PEPE) up to $0.000001307 over the past week.

Pepe (PEPE) is trending on social media and platforms such as Coinmarketcap, with over $250 million worth of Pepe (PEPE) tokens being traded daily. Now ranked the third largest memecoin in the world, analysts are split as to whether or not the Pepe (PEPE) token will rise or fall over the next few weeks, though it could become one of 2023’s best investments.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk

| Disclaimer: This is a press release post. Coinpedia does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. Coinpedia should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their own research before taking any actions related to the company. |