Binance US Delists 101 Trading Pairs Following SEC Freezing Order

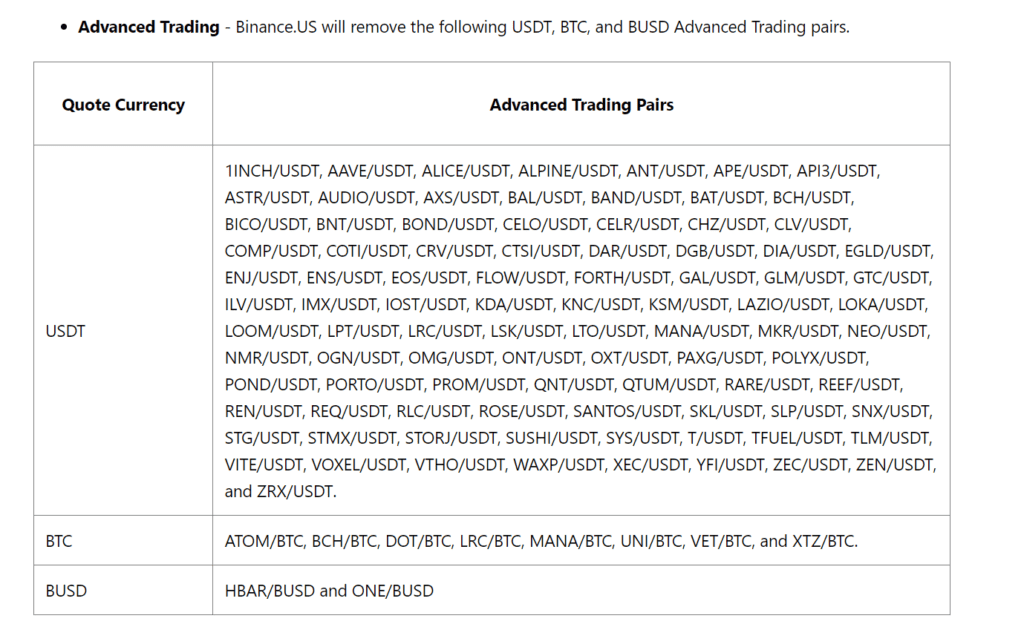

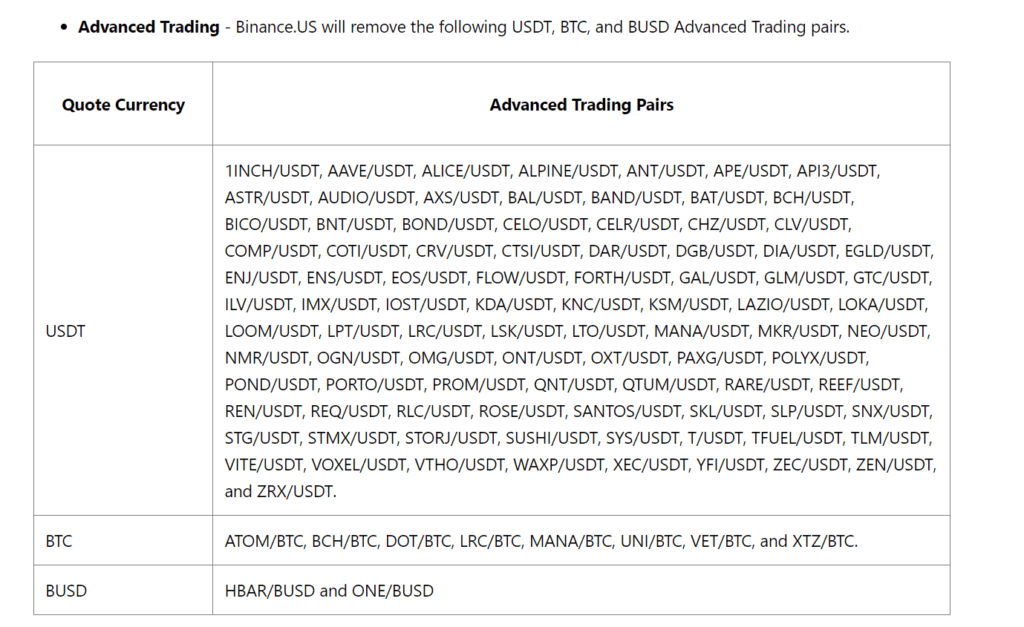

Binance’s U.S. subsidiary announced the removal of over 100 advanced trading pairs on Wednesday and paused its OTC trading portal following legal pressure from the SEC to freeze its assets earlier this week.

Some of the targeted pairs include AAVE/USDT, COMP/USDT, EOS/USDT, and BCH/BTC.

Binance US Legal Trouble

Binance US did not specify why the sudden pair removals were necessary, but assured users that their assets “remain safe” on the platform. The action will take effect at 12 pm EDT on June 8, and deposits and withdrawals will continue to process normally.

The change brings the platform’s supported “convert” trading pairs down to 226. Buy, sell, and convert options remain available for most top cryptocurrencies by market capitalization, including BTC, ETH, USDT, USDC, DOGE, and others.

The exchange made no indication that it plans to bring such trading pairs back. While its OTC desk is currently “paused,” the firm said it will notify users when it’s available again “In the upcoming weeks and months.”

The Securities and Exchange Commission launched a restraining order against Binance US on Tuesday to freeze its assets, just one day after the agency launched its 136-page lawsuit against the exchange and its international parent company.

The exchange was also ordered to repatriate customers for all fiat currency and digital assets held on the Binance US platform within 10 days of receiving the restraining order. That included assets related to its staking-as-a-service program, for the SEC, which targeted Coinbase’s equivalent program the same day.

Commingling of Funds?

The filing placed particular emphasis on placing all customer assets back under the control of Binance US that are otherwise being controlled by either Binance or its CEO Changpeng Zhao. While Binance and Binance US are supposed to be independent entities, the SEC’s lawsuit on Monday alleged that billions of dollars from both platforms had been “commingled” within a Zhao-owned entity called Merit Peak Limited.

“Within 5 days of this Restraining Order, Defendants will… remove Defendant Binance, Defendant Zhao, and any of the Binance Entities as a signatory or authorized person to transfer or withdraw assets from all accounts and/or wallets containing Customer Assets,” read the filing. Within 30 days, all customer funds must be held in wallets controlled by new private keys and administrative keys.

The post Binance US Delists 101 Trading Pairs Following SEC Freezing Order appeared first on CryptoPotato.