Bitcoin Sets Up New Bullish Target – Will BTC Price Hit $37K In Coming Days?

The post Bitcoin Sets Up New Bullish Target – Will BTC Price Hit $37K In Coming Days? appeared first on Coinpedia Fintech News

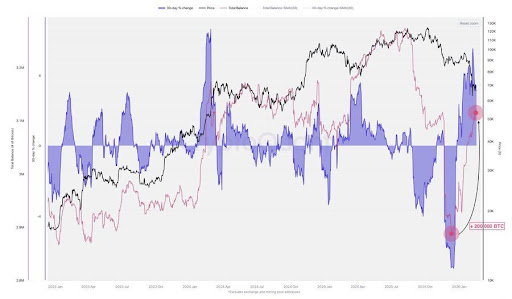

A popular analyst by the name Crypto World on YouTube has predicted a massive breakout for the largest cryptocurrency by market capitalization–Bitcoin. After some important developments and events, Bitcoin has now breached the important resistance level at $30k. At the time of writing, the king coin is up by more than four percent and it looks like the party has just begun.

On the daily Bitcoin chart, the analyst has witnessed a confirmed breakout above a descending line of resistance near $27,000. This breakout was anticipated and could lead to a run toward resistance of around $28,000. However, the price has surged higher, reaching around $30,000 at the time of writing.

Nevertheless, there is still significant resistance ahead, particularly around $30.5K, which coincides with the neckline of the cup and handle pattern. On the support side, the range between $24.3K and $25.3K has proven to be strong support, with recent bounces.

While the $37K price target is a possibility, there are other levels of resistance to consider along the way. A short-term cool-off period may be imminent, as indicated by the overbought RSI on the 12-hour timeframe. According to the Super Trend indicator on the four-day timeframe, it is still in a larger bullish trend. The point of invalidation for this trend would be a confirmed break below approximately $24.3K.

Looking at the daily Bitcoin price oscillators, the RSI has turned bullish in the last day. Previously, the RSI had been mostly neutral over the past month. The recent formation of a higher high in the RSI indicates a more bullish sentiment.

Additionally, the daily MACD is currently looking bullish, having confirmed a bullish cross a few days ago. These indicators suggest that there may be further upside potential before encountering resistance at previous highs seen in April and May.