Bitcoin Unstoppable Rise: Price Breaks Through $31,000 Setting New Annual High

Bitcoin (BTC), the largest cryptocurrency in the market, is continuing its unstoppable uptrend. After consolidating for a short period between $29,900 and $30,300, BTC has marked a new annual high and breached the $31,000 mark, which it had not surpassed since June 2022.

As of this writing, the leading cryptocurrency in the market is trading at $31,300, representing a surge of over 4% in the last 24 hours.

This recent price increase is a positive development for Bitcoin, demonstrating the resilience and potential for continued growth and adoption in the cryptocurrency market. The consolidation period that preceded this new high indicates that investors were likely accumulating BTC in anticipation of a breakout.

Could Bitcoin Reach $35,000 Soon?

There’s good news for Bitcoin bulls, as the cryptocurrency has broken its nearest resistance level at $31,000 and aims to reach $31,500. If Bitcoin can break this last bear threshold, the road to $35,000 may be served on a silver platter for the bulls.

Additionally, the recent news of Blackrock’s Bitcoin spot ETF and major Wall Street giants expressing interest in investing in Bitcoin may further fuel investor sentiment and propel Bitcoin’s bull run.

However, Bitcoin must hold its current price level to prevent this price action from being just a short squeeze followed by a further pullback. If the current price level is sustained, it could provide a solid foundation for continued growth and upward momentum.

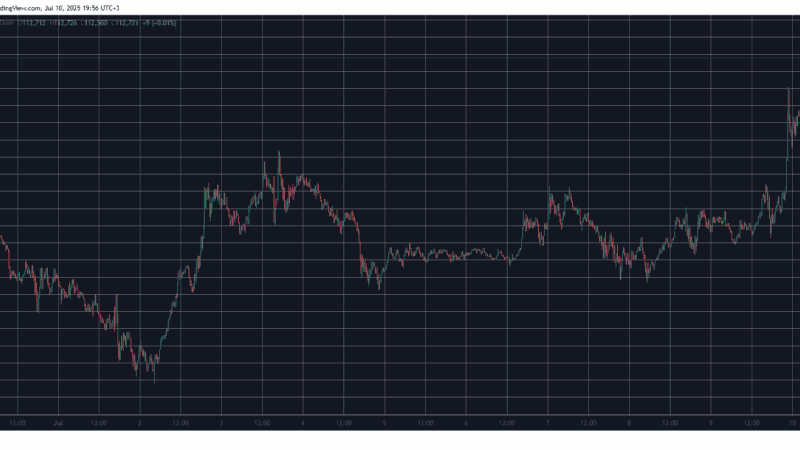

As the chart above indicates, Bitcoin’s ADX (Average Directional Index) is currently peaking upwards, signifying the current trend’s strength. The ADX is a technical indicator commonly used to quantify the strength of a trend in the financial markets.

The ADX calculation is based on a moving average of the price range expansion over a given period. It measures the degree to which a market is trending, and it provides traders with a way to identify the strength of a trend and determine whether it is worth trading.

When the ADX rises, the trend gains strength, while a falling ADX indicates that the trend is losing momentum. A high ADX reading suggests a strong trend is in place, while a low ADX reading suggests that the market is in a range-bound or choppy state.

Bitcoin’s ongoing uptrend shows no signs of slowing down, and the cryptocurrency is gaining momentum, causing concern for bears. However, the influx of new investors entering the BTC market may increase its volatility, posing the risk of liquidating late long positions that could impede Bitcoin’s bullish movement.

Overall, Bitcoin’s recent performance is a trend to watch in the coming weeks and months, as it will likely have a significant impact on the broader cryptocurrency market and may attract increased attention from investors, regulators, and the public.

Featured image from iStock, chart from TradingView.com