J.P. Morgan Acknowledges Ripple’s XRP Ruling as a Significant Victory for the Crypto Sector

The post J.P. Morgan Acknowledges Ripple’s XRP Ruling as a Significant Victory for the Crypto Sector appeared first on Coinpedia Fintech News

In an exclusive research note published on Friday, J.P. Morgan, the esteemed banking giant, emphasized that the U.S. Southern District Court’s recent ruling in favor of Ripple, the payments network, stands as a groundbreaking victory for the crypto industry. The court’s decision not only provides much-needed clarity regarding the definition of security but also carries significant implications for the entire cryptocurrency ecosystem, J.P. Morgan analysts asserted.

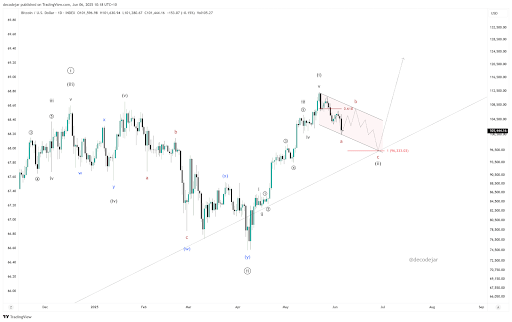

What effect did the court ruling have on cryptocurrency prices, specifically Bitcoin? Let’s find out.

The research paper noted that legislative uncertainty has discouraged major capital pools from entering the industry and slowed crypto ecosystem innovation, adoption, and valuation. Regulatory initiatives have worsened these issues in the past year. J.P. Morgan believes this industry-defining judgment provides legal certainty and protection by defining security. However many industry insiders have long supported this result.

A Call for Crypto Prices Rally?

The ruling, issued on Thursday, concludes that Ripple’s XRP token should not be considered a security when sold through exchanges or programmatic sales. The news prompted a rally in crypto prices, demonstrating the immense importance of this verdict to the industry. Bitcoin (BTC) experienced a 3.6% surge on Thursday, followed by a slight retreat of approximately 1.4% on Friday.

While acknowledging Ripple’s triumph, J.P. Morgan cautioned that the regulatory battle for the crypto industry is far from over. The Securities and Exchange Commission (SEC) retains the ability to challenge the ruling and is expected to pursue similar cases in the future.

The research note stated, “We believe the industry has now secured a stronger position for the time being, which could impact ongoing cases and the pace of litigation. However, it is important to note that the regulatory overhang does not merely disappear; rather, it diminishes.”

Overall, the analysts emphasized that numerous unresolved legal questions still hinder the industry from operating at its full potential. Therefore, they stressed the significance of closely monitoring the tone and developments emanating from lawmakers and regulators in Washington D.C. in order to understand the trajectory of the crypto industry.