The Bitcoin futures contango

As the crypto market matures, Bitcoin’s spot price is increasingly influenced by global geopolitical events, regulatory changes, traditional financial market movements, and other relevant macroeconomic events. However, the growing Bitcoin derivatives market also shapes Bitcoin’s price movements, albeit a smaller one.

Futures and options contracts are particularly insightful for predicting Bitcoin’s future movements as they reflect the sentiment of a sophisticated market segment. However, merely looking at the volume of derivatives contracts or open interest doesn’t provide a comprehensive view of market sentiment. Instead, considering more nuanced metrics, such as the Bitcoin futures annualized three-month rolling basis, is also essential.

The Bitcoin futures annualized three-month rolling basis measures the difference between the current (spot) price of Bitcoin and the price of a futures contract for Bitcoin that expires in 3 months. This difference is calculated on a rolling basis and expressed as an annual percentage rate.

Contango

A negative rolling basis indicates that futures prices are lower than the spot price, a situation known as “backwardation.” Conversely, a positive rolling basis, where futures prices are higher than the spot price, is called a “contango.”

Contango is a critical concept in traditional markets, especially commodities, as it reflects the cost of carry or storage until the contract’s expiration. In the context of Bitcoin, contango suggests that traders are willing to pay a premium for Bitcoin futures as they expect the price to rise in the future.

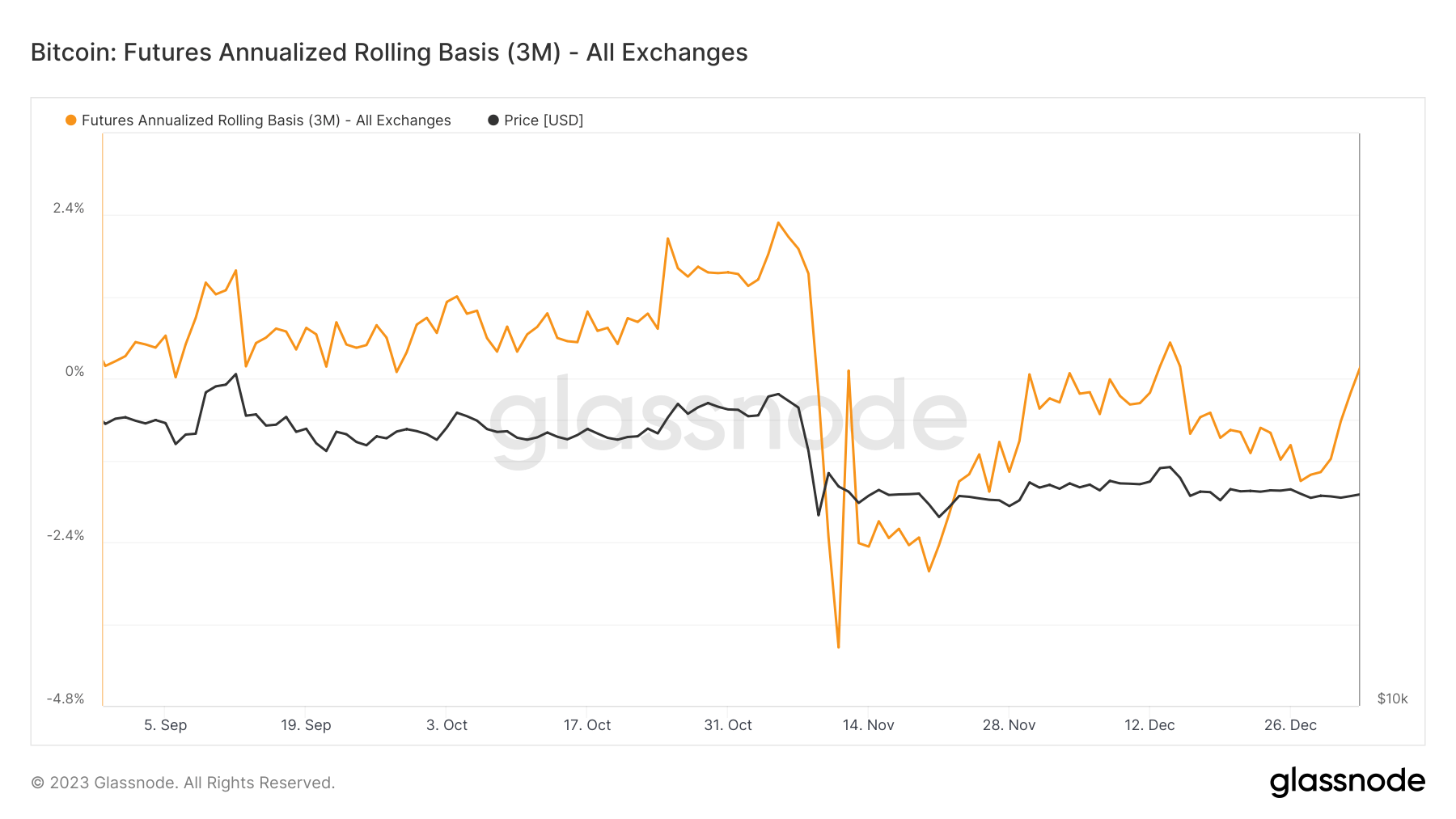

Between November 2022 and January 2023, the annualized three-month rolling basis was mostly negative, correlating with Bitcoin’s sharp plunge from $21,200 to $15,500. This negative rolling basis reflected a bearish market sentiment during this period, showing that traders expected Bitcoin’s price to depreciate even further.

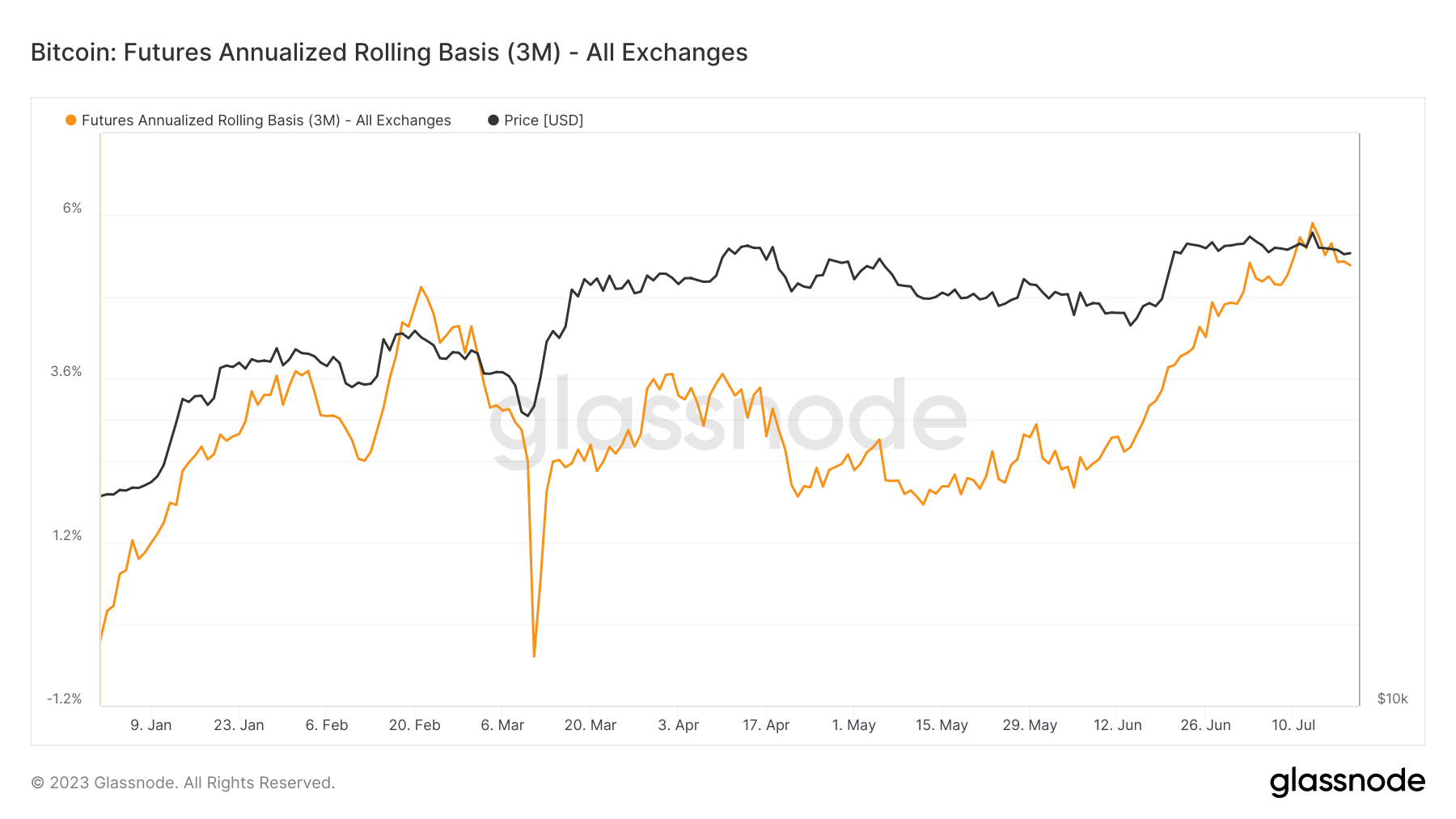

However, the rolling basis turned positive in 2023, growing from 0.197% on January 2 to a 17-month peak of 5.883% on July 13. This shift to contango suggests a bullish market sentiment, with traders willing to pay a premium for Bitcoin futures.

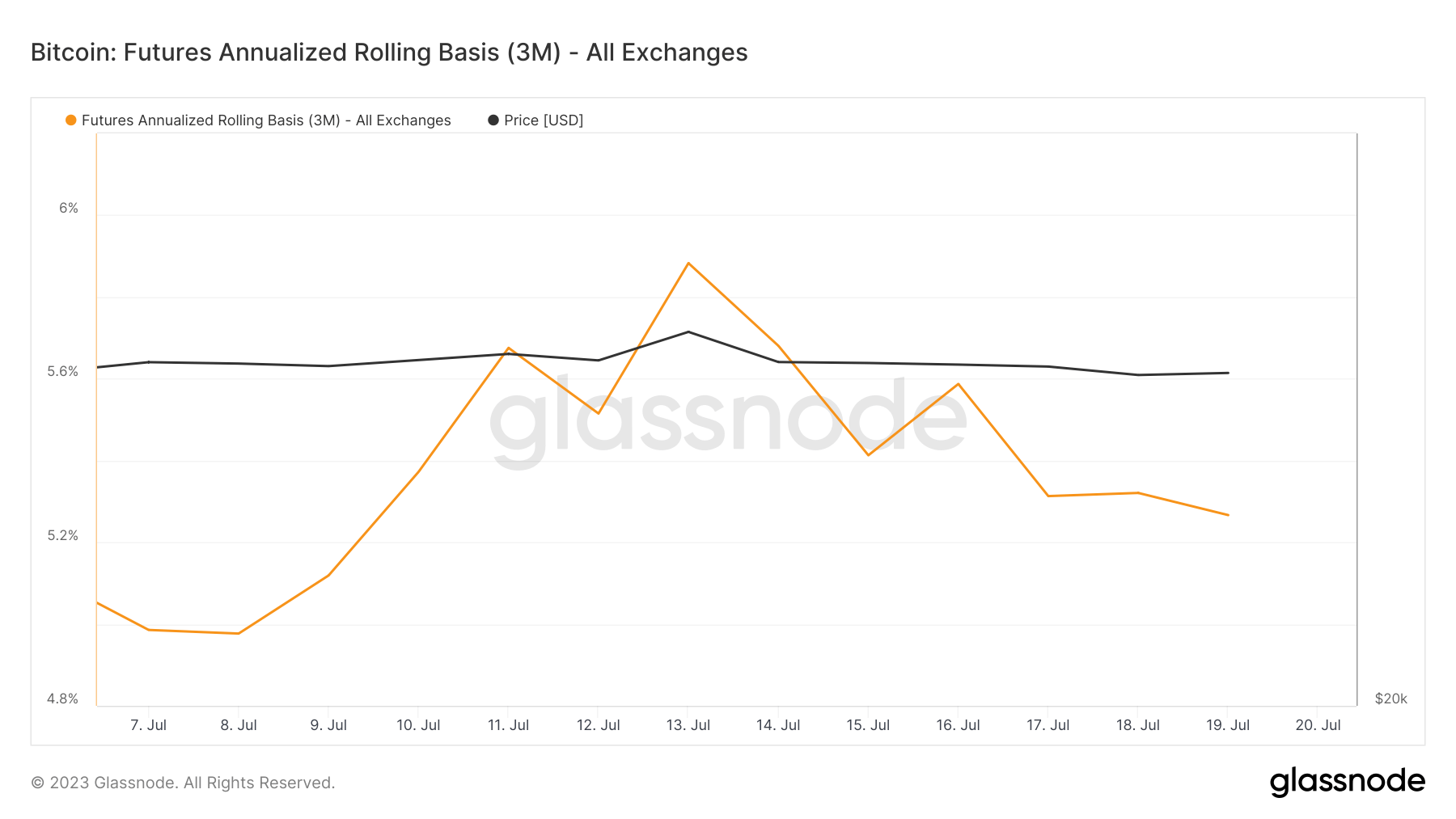

The 3 Month Futures Annualized Rolling Basis dropped to 5.321% on July 18 from 5.883% on July 13, while Bitcoin’s price fell to $28,854 from $31,454. This decrease in the rolling basis, coupled with the drop in Bitcoin’s price, suggests traders in the futures market are slightly less optimistic about the price of Bitcoin increasing over the next three months than on July 13.

However, the basis is still positive, which means the market is still in a state of contango where the futures price is higher than the spot price. This indicates that the overall sentiment in the futures market remains bullish, but traders seem to have recalibrated their expectations to factor in a more conservative price range.

The post The Bitcoin futures contango appeared first on CryptoSlate.