U.S. exchanges are seeing fewer outflows than offshore competitors

Monitoring exchange inflows and outflows is a crucial aspect of market analysis. These metrics often serve as a barometer for market sentiment, providing insights into investor behavior and potential price movements.

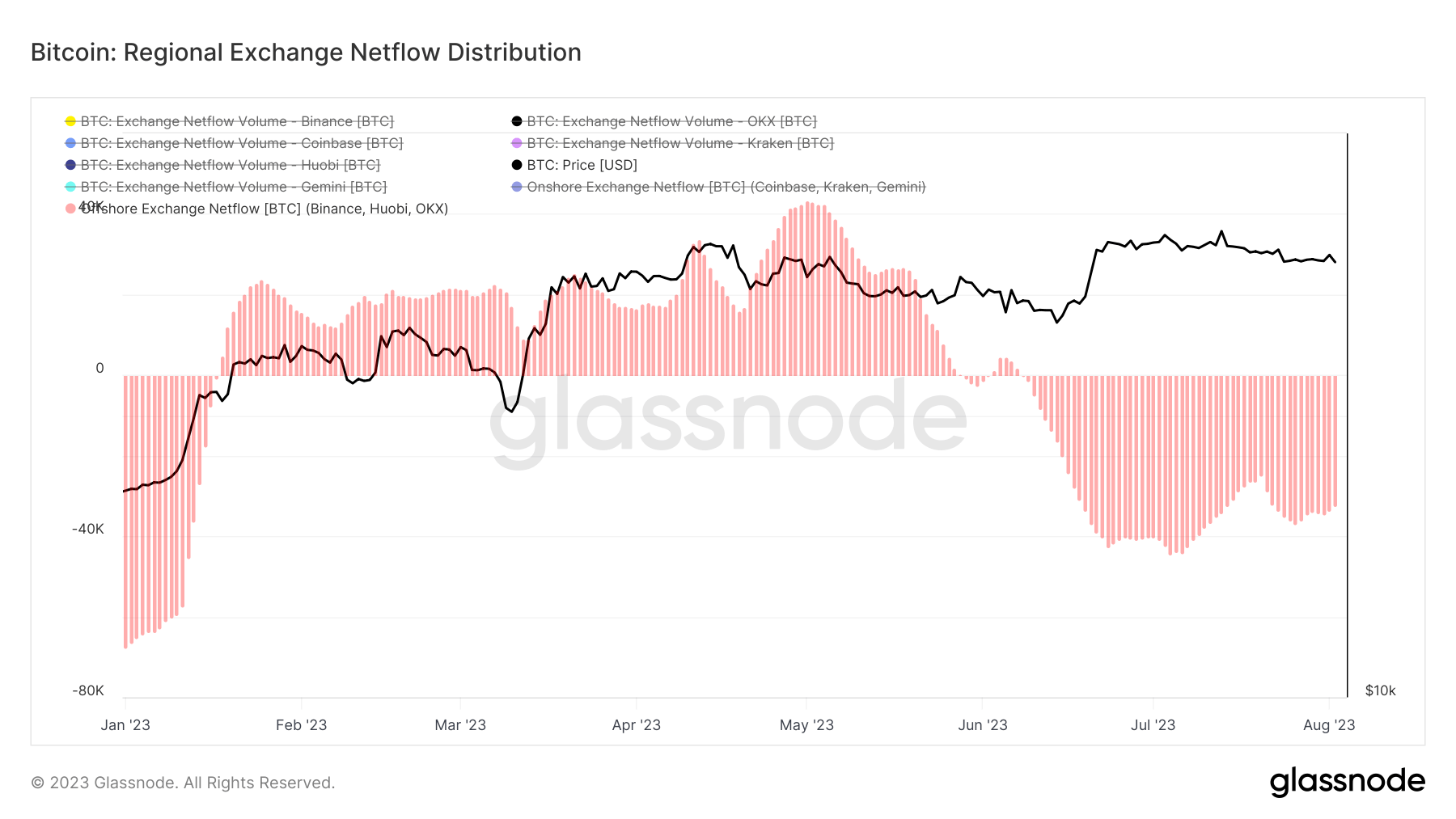

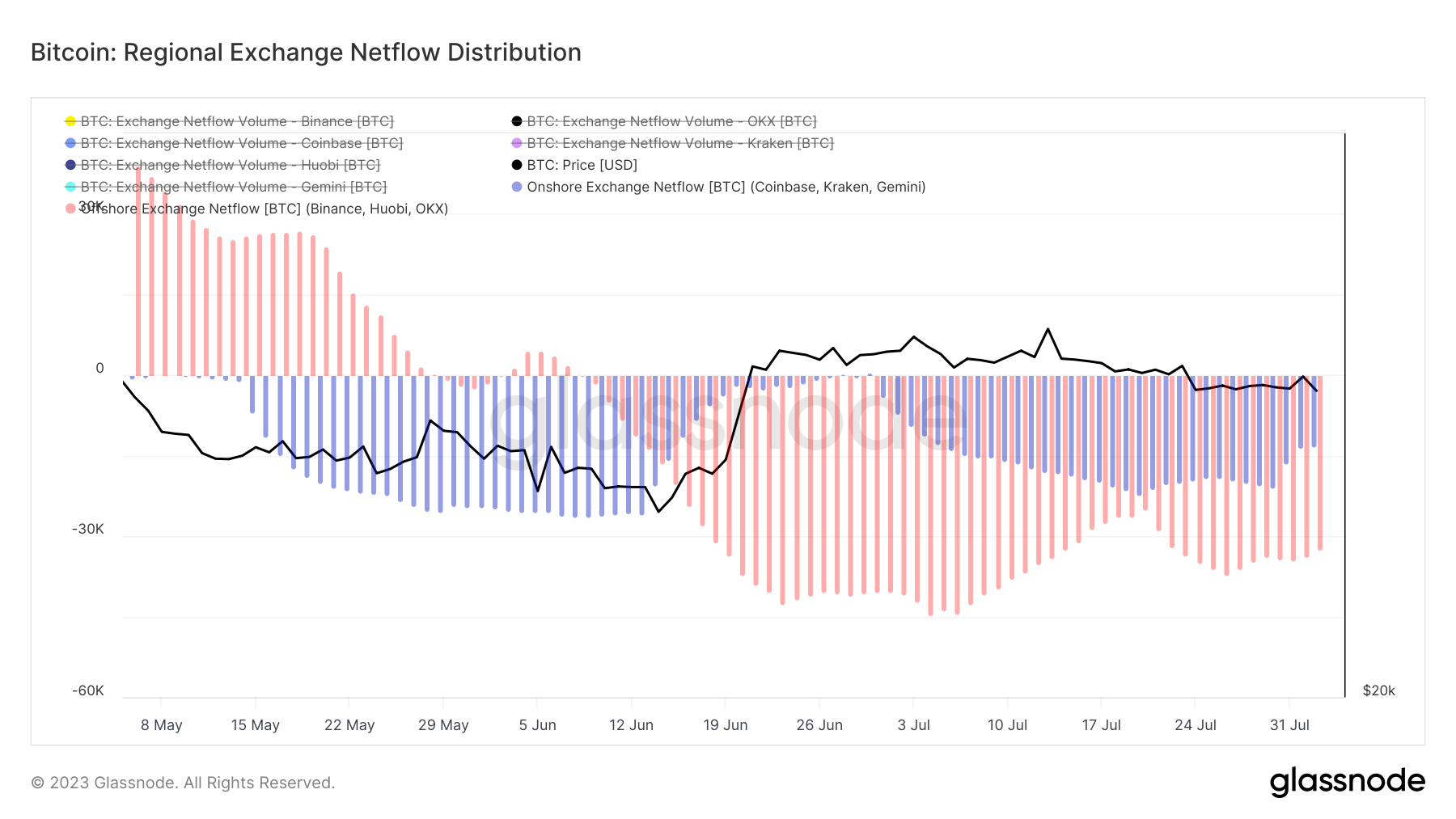

Recent data analysis reveals a noteworthy trend in the cryptocurrency market: U.S.-based exchanges are seeing significantly fewer Bitcoin outflows than their offshore counterparts. Data from Glassnode, a blockchain analytics firm, categorizes leading exchanges by region, marking Coinbase, Kraken, and Gemini as onshore (U.S.) exchanges and Binance, Huobi, and OKX as offshore exchanges, primarily serving the Asian market.

Despite the aggregate trend of Bitcoin outflows across all exchanges, offshore platforms bear these losses. After five consecutive months of Bitcoin inflows, offshore exchanges saw a significant drop in their Bitcoin holdings from June 2023. This downward trend peaked in July, with 44,555 BTC leaving the three offshore exchanges, representing the cumulative monthly outflow.

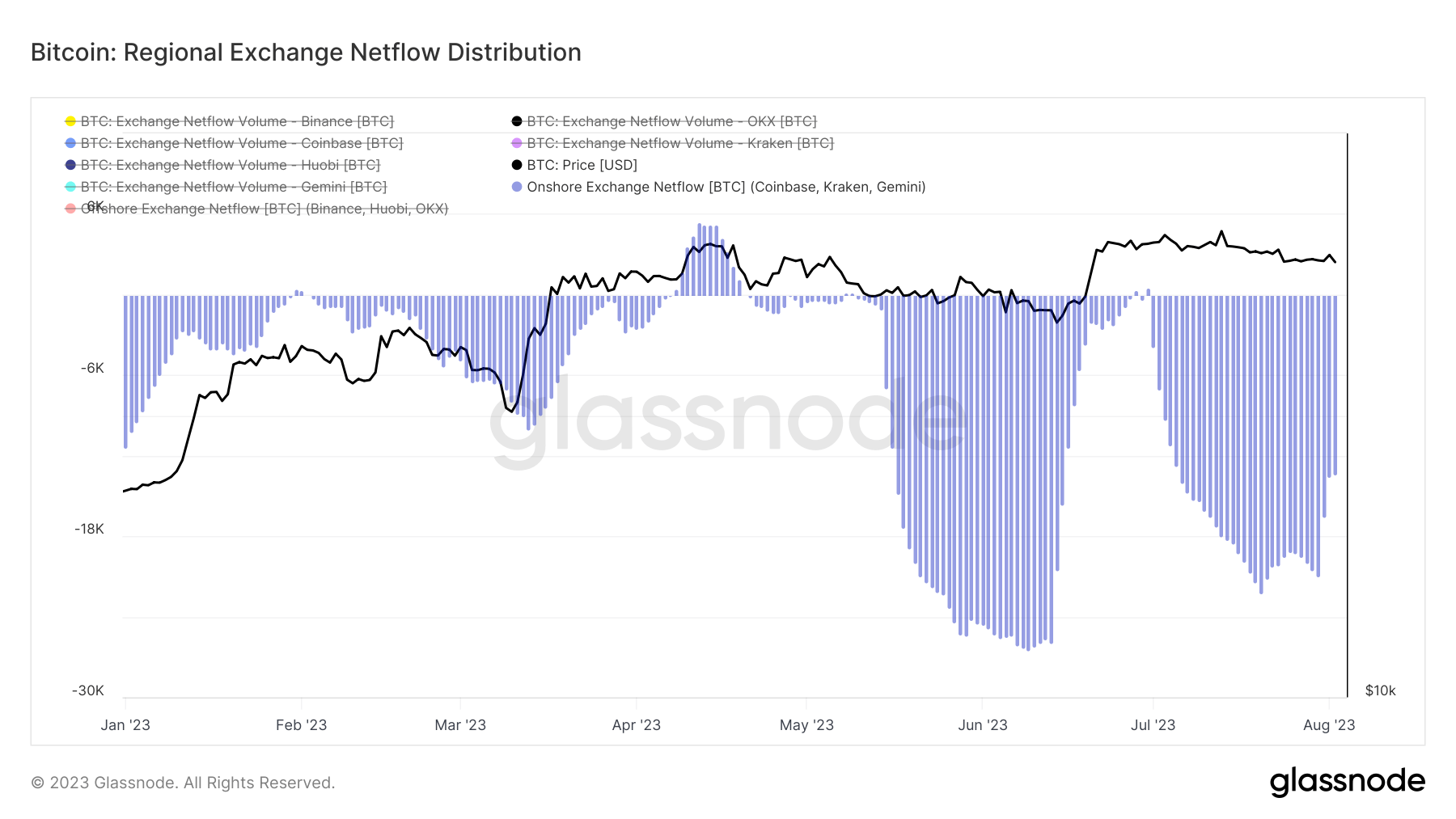

Interestingly, despite facing increased regulatory scrutiny, U.S. exchanges have seen notably fewer outflows. The highest monthly outflow for Coinbase, Kraken, and Gemini occurred on July 20, with 22,241 BTC leaving these platforms.

As of August 2, U.S. exchanges registered a monthly outflow of 13,346 BTC, significantly less than the 32,466 BTC outflow observed in offshore exchanges.

Most Bitcoin outflows from offshore exchanges originate from Binance, which is facing significant legal challenges, including a high-profile lawsuit from the SEC. These challenges have led to a sharp decline in Binance’s trading volume and market share.

The increased outflows from offshore exchanges, especially Binance, might signal a significant shift in investor sentiment. While the regulatory environment in the U.S. is tightening, traders may perceive U.S. exchanges as more stable and reliable, leading to lesser outflows. However, monitoring these trends closely is crucial, as the crypto market’s dynamic nature and regulatory landscape can lead to swift changes.

The post U.S. exchanges are seeing fewer outflows than offshore competitors appeared first on CryptoSlate.