Unshaken Bitcoin mining industry navigates fluctuating share prices

Quick Take

Recent data analysis has shown that Bitcoin miners’ share prices have undergone significant fluctuations over the past few years. According to analyst Dylan Le Clair’s assessment of an equal-weight public miner index, the shares are currently down by a staggering 54.5% from their mid-July peak.

This follows a series of dramatic swings: a rise of 6,213% from the 2020 low to the 2021 high, a sharp fall of 95% from the 2021 high to the 2022 low, a recovery of 487% from the 2022 low to the 2023 high, and another 54% dip from the 2023 high to today according to Le Clair.

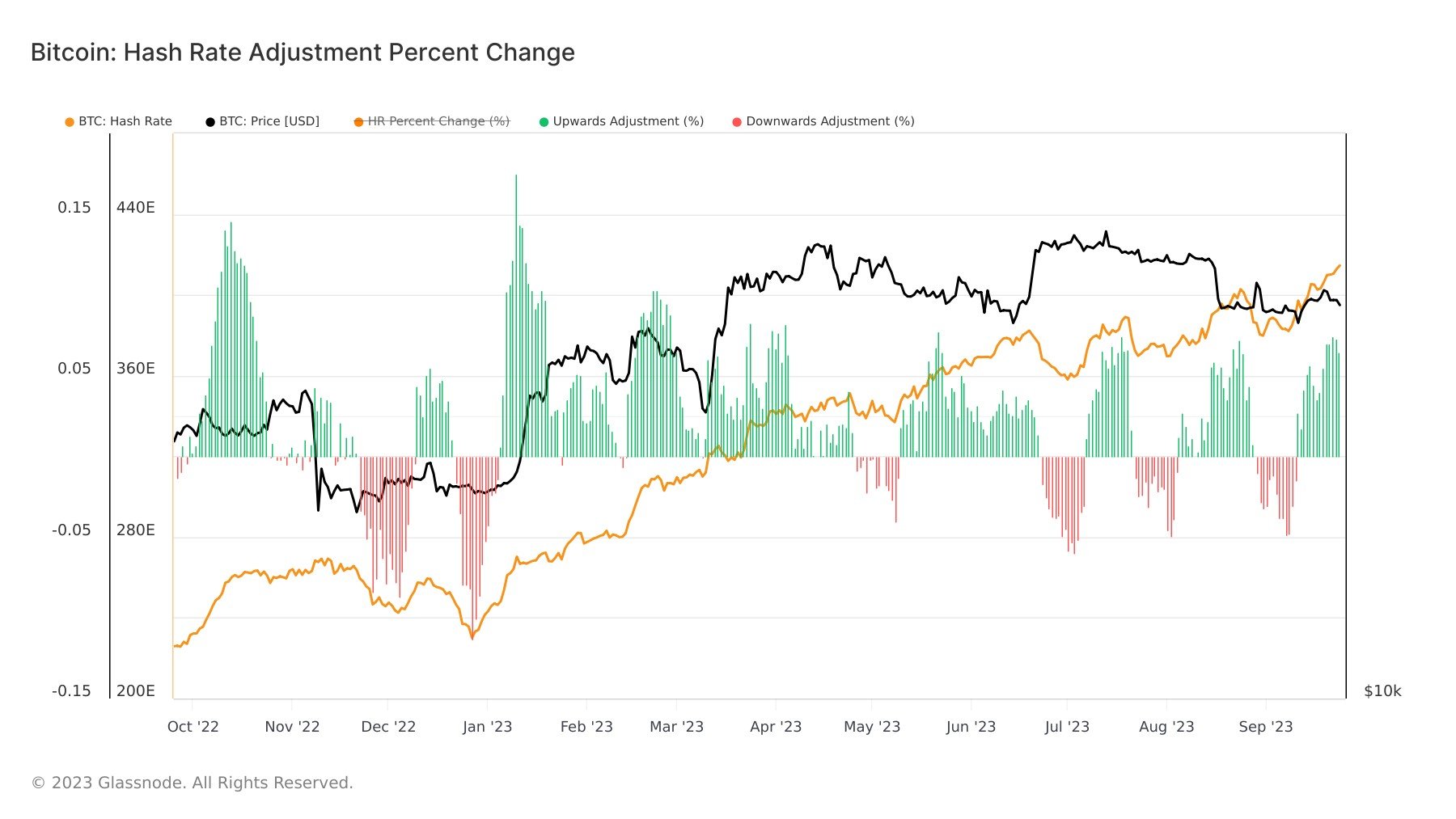

Despite these drastic share price movements, there are signs of resilience within the Bitcoin mining industry. The Bitcoin hash rate, a key indicator of miners’ profitability, continues to climb to all-time highs, suggesting that mining activities remain profitable. Over the past two weeks alone, the hash rate saw an increase of 8%, indicating that miners are not in financial distress despite the falling share prices.

The post Unshaken Bitcoin mining industry navigates fluctuating share prices appeared first on CryptoSlate.