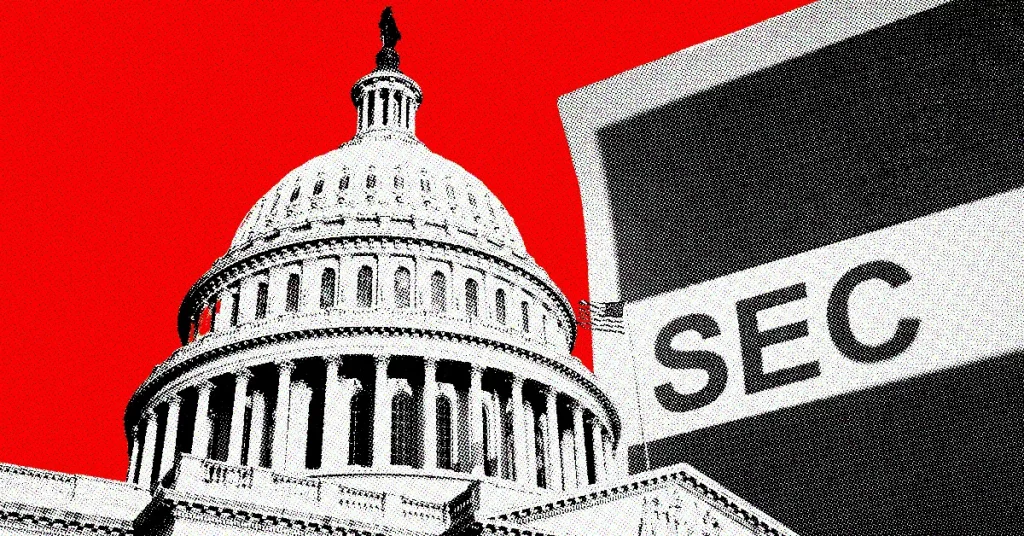

XRP Lawsuit Update: Judge Criticizes SEC’s Inconsistent Legal Arguments in Crypto Cases

The post XRP Lawsuit Update: Judge Criticizes SEC’s Inconsistent Legal Arguments in Crypto Cases appeared first on Coinpedia Fintech News

In her filing rejecting the SEC’s appeal in the Ripple-SEC case, Judge Torres highlighted the inconsistencies in the Securities and Exchange Commission’s (SEC) legal arguments about cryptocurrency cases. This critical observation has reignited conversations surrounding the SEC’s evolving stance on digital assets.

A Shifting Stance on Crypto

Recently, CryptoLaw, a renowned firm specializing in cryptocurrency legislation, shed light on the judge’s observations. The main point of contention arose from the SEC’s varying arguments on its legal perspective concerning ‘Other Distributions.’

Specifically, the SEC initially posited that these distributions were unregistered offers due to their non-cash consideration nature. However, the agency later shifted its stance, suggesting that these distributions were indirect offers to the public. This inconsistency in their argument was flagged and duly noted by the court.

Adding to the complexity, the SEC proposed that Ripple had “gifted” their cryptocurrency, XRP, to third parties. Despite this assertion, no charges were made against Ripple in this regard. This ambiguity further underlines the agency’s inconsistent approach to the issue.

How The Howey Test Plays Into It

Ashley Prosper, another keen observer in the crypto industry, brought attention to the Howey test, a standard used to determine whether certain transactions qualify as investment contracts. Highlighting Judge Torres’s remarks, Prosper suggested that the judge challenged the SEC’s broad application of the test.

For instance, a digital asset buyer purchasing XRP from an exchange, driven by its increasing price and the intent to profit, may not necessarily be influenced by Ripple or any third party’s efforts. This scenario challenges the conventional application of the Howey test in the context of cryptocurrencies.

The bottom line is that Judge Torres and industry insiders’ recent observations emphasize the need for the SEC to revisit and refine its arguments. At the time of writing, the SEC hasn’t reacted to the Judge’s decision.