Crypto Market Analysis: Analyst Advises Patience, Awaits 10-30% Price Dips for Buying Opportunities

The post Crypto Market Analysis: Analyst Advises Patience, Awaits 10-30% Price Dips for Buying Opportunities appeared first on Coinpedia Fintech News

The cryptocurrency market has witnessed significant developments. Bitcoin (BTC) broke above the $32,000 mark, stirring up excitement and greed among traders. Meanwhile, several altcoins, including Chainlink (LINK), Aave (AAVE), and Solana (SOL), have posted substantial gains, fueling the fear of missing out (FOMO) among investors.

However, despite these positive signs, the crypto market’s overall valuation dipped by approximately 2.2 percent in the past 24 hours, currently at around $1.29 trillion. This suggests that a further correction may be on the horizon before the bull run resumes.

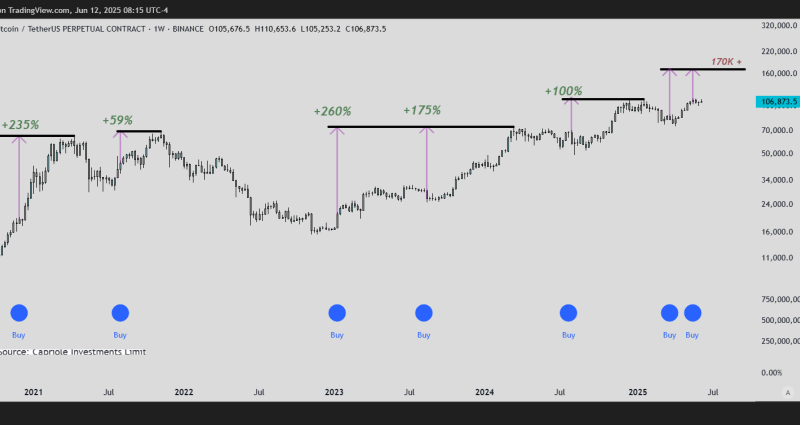

Analyst Van de Poppe’s tweet reflects optimism about Bitcoin and Chainlink’s recent strong performance. He anticipates further potential gains in the next two years. However, cautioning against rushing to invest at current levels, the analyst recommends waiting for 10-30% price dips as buying opportunities.

Specifically, he advises patience for Bitcoin, implying it may be currently overvalued. This tweet encourages a strategic, patient approach to cryptocurrency investing, aligning with the principle of buying during market dips to maximize potential returns in the volatile crypto landscape.

Bitcoin’s On-Chain Activity:

Examining on-chain data, it becomes evident that Bitcoin’s whales and dormant accounts have been reawakening. This uptick in crypto trading activity may propel the Bitcoin price toward a crucial support/resistance zone between $31,000 and $32,000. Poppe emphasizes the importance of Bitcoin holding this support level to pave the way for a potential rally towards $38,000 shortly.

The recent surge in Bitcoin prices has partly been driven by speculation around spot exchange-traded funds (ETFs). However, it’s important to note that actual news events and the forthcoming fourth halving event are expected to create a significant supply vs. demand shock. Crypto holders who have been patiently accumulating assets during winter in anticipation of a broader bull run are poised to reap substantial profits, even in the face of market corrections.

Conclusion

The cryptocurrency market is experiencing a surge in greed and FOMO, fueled by Bitcoin’s recent performance and the impressive gains of various altcoins. However, caution is advised, as a correction may be imminent.

Michaël van de Poppe’s long-term optimism suggests that better opportunities lie ahead for investors. Moreover, on-chain data hints at the potential for further Bitcoin price gains if crucial support levels are maintained. Ultimately, those who exercise patience and strategic accumulation may benefit significantly in the evolving crypto landscape.