BTC Explodes to $35K But is a Correction Imminent? (Bitcoin Price Analysis)

Bitcoin’s price has effectively breached the $30,000 resistance threshold and is presently experiencing robust upward momentum.

While BTC appears unstoppable at this juncture, there remains a noteworthy likelihood of a transient correction.

Technical Analysis

By Edris

The Daily Chart

On the daily chart, it becomes apparent that the price has experienced fervent rallying subsequent to its breakout above the 200-day moving average, situated around the $28,000 mark. The $30,000 resistance level has been decisively surmounted, ushering in a new bullish phase.

Simultaneously, the Relative Strength Index (RSI) is registering values exceeding 70%, signifying a pronounced overbought condition. This could be construed as a bearish indicator, hinting at a potential retracement or consolidation in the short term.

The 4-Hour Chart

When assessing the 4-hour timeframe, it is discernible that the price commenced its recent parabolic ascent following a breakout from the bullish flag formation located between the $27,000 and $28,000 levels.

Multiple resistance levels, including the $28,000 and $30,000 thresholds that had effectively suppressed the price for an extended duration, have now been breached.

With no significant resistance level looming prior to the $38,000 region, the RSI once again plunges into deep overbought territory, amplifying the likelihood of an impending correction.

On-Chain Analysis

By Edris

Bitcoin Miner Reserve

As Bitcoin’s price surges beyond the $30,000 resistance level following months of consolidation, investors are keen to determine whether this recent move marks the inception of a new bull market or a significant bull trap. To ascertain the likelihood of each scenario, it is imperative to conduct a thorough analysis of the actions undertaken by various cohorts of market participants.

Miners occupy a pivotal role within the Bitcoin market. They not only bear responsibility for upholding the network’s security but also exert control over the total market supply by determining whether to vend or retain their freshly mined BTC. Consequently, analyzing their behavioral patterns can offer invaluable insights.

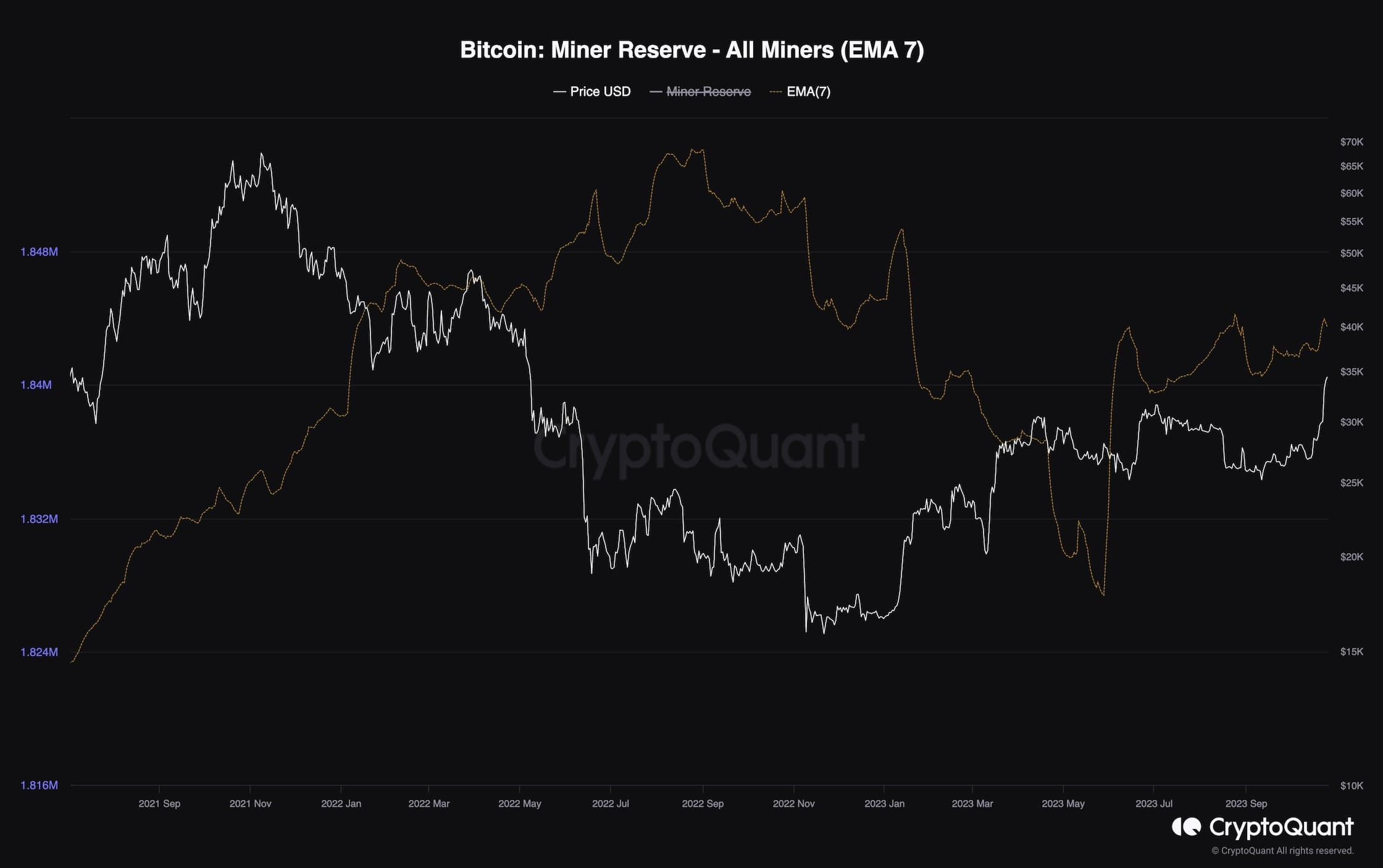

The chart presented below illustrates the Bitcoin miner reserve metric, quantifying the number of BTC maintained within miners’ addresses.

It is evident that during the recent rally, in stark contrast to prior bullish price movements in the preceding months, miners have not merely held onto their coins but have increased their holdings. This substantiates the notion that miners hold a bullish stance towards Bitcoin, which, in turn, is poised to constrict the supply of BTC, potentially culminating in a sustainable uptrend in the immediate future.

The post BTC Explodes to $35K But is a Correction Imminent? (Bitcoin Price Analysis) appeared first on CryptoPotato.