$113 Million In Longs Get Rekt As Bitcoin Plunges Back To $34,000

Data shows the cryptocurrency longs have taken a beating today because of the plunge towards $34,000 that Bitcoin has observed.

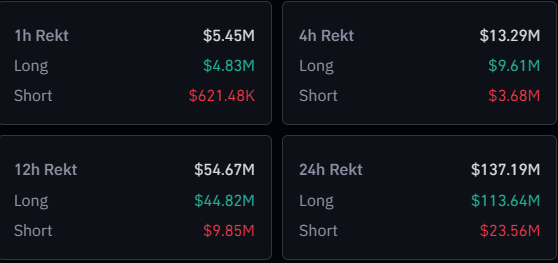

Cryptocurrency Futures Market Has Seen Liquidations Totaling $137 Million Today

According to data from CoinGlass, a large amount of liquidations have taken place in the cryptocurrency futures market during the past day. “Liquidation” here refers to a forced closure of a futures contract being done by the derivative contract with which said position is open.

A contract is liquidated when it amasses losses equal to a certain percentage of the margin (that is, the initial collateral that the holder had put forth when opening the contract).

As it’s easy for traders’ bets to fail during volatile periods, it’s not surprising that the volatility from the past day has induced liquidations throughout the market. The below table shows the data for the liquidations that have occurred in the sector during the last day.

As you can see, the cryptocurrency futures market has seen liquidations amounting to about $137 million in the past day. Out of these, around $113 million of the contracts were long positions.

This means that more than 82% of the liquidation flush in this period has involved the long holders. This is consistent with the price action, as most of the liquidations have been triggered by a plunge in the Bitcoin price from above $35,400 to the $34,000 mark.

Such large liquidation events are popularly called “squeezes.” Since the squeeze from the last 24 hours has seen the longs on the losing side, the event was a “long squeeze.”

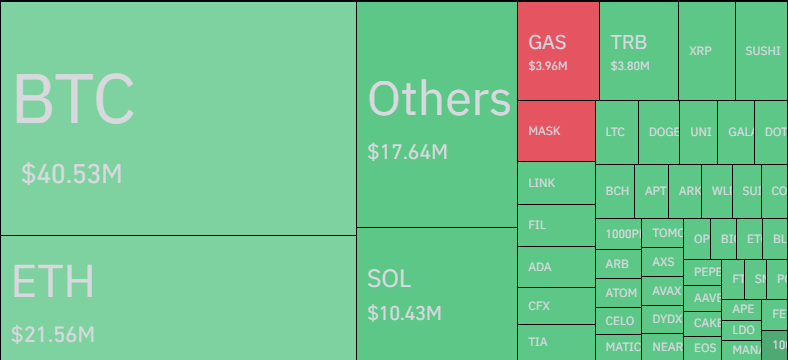

As the below table displays, Bitcoin-related contracts have unsurprisingly contributed the most towards this latest squeeze.

Bitcoin saw $40 million in futures liquidations, while Ethereum registered almost half of those at $21 million. Out of the altcoins, Solana (SOL) observed the highest liquidations.

SOL has seen a bit of an explosion recently, so it’s not unexpected that it has attracted a large amount of speculators towards it. As a natural consequence of this higher interest in the cryptocurrency, its liquidations have been more than the other altcoins.

Mass liquidation events like today’s aren’t exactly a rare occurrence in the cryptocurrency sector, due to extreme amounts of leverage being easily accessible and the volatility that most of the coins witness on the regular.

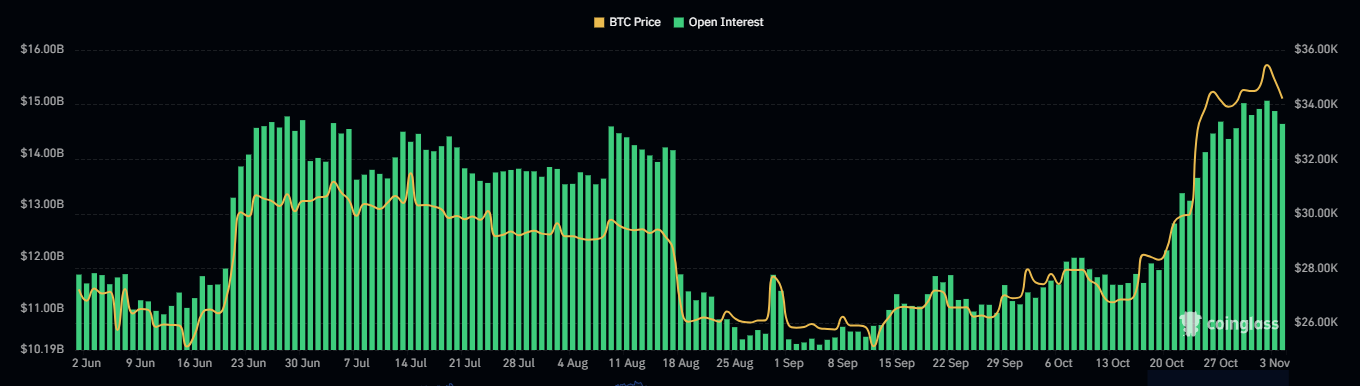

It would appear that today’s liquidation squeeze has been unable to put off speculators, as the Bitcoin open interest (a measure of the total amount of contracts open on the futures market) is still at high values.

As such, it’s possible that Bitcoin will see more volatility in the near future and with it, another liquidation squeeze.

Bitcoin Price

Following its drop of more than 3%, Bitcoin is now trading around the $34,200 level.