Examining the Impact of Wall Street’s First Bitcoin Futures ETF

The post Examining the Impact of Wall Street’s First Bitcoin Futures ETF appeared first on Coinpedia Fintech News

The cryptocurrency space often paints itself as a guard of decentralization, immune to the traditional market’s machinations. However, historical data, such as the one shown in a recent tweet from Whalewire, suggests otherwise. As we cast our analytical gaze back to December 2017, we unravel the tale of Bitcoin’s tumultuous journey following the launch of the first Bitcoin futures ETF by Wall Street.

In December 2017, the cryptocurrency ecosystem braced for a paradigm shift by introducing the first Bitcoin futures ETF. This financial instrument was anticipated to bridge the gap between conventional finance and the crypto market. But the aftermath was far from what the crypto experts had hoped.

Market Manipulation Allegations

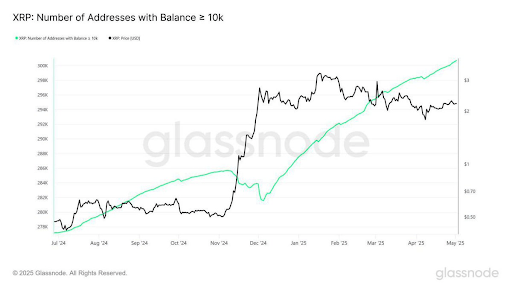

The chart accompanying Whalewire’s tweet reveals a stark downtrend in Bitcoin’s price after the ETF’s introduction. Accusations abound: Wall Street utilized the futures market to manipulate prices, catalyzing a protracted bear market that lasted years. Such events have seeded distrust towards mainstream financial entities among crypto enthusiasts.

Now, one must differentiate between a spot ETF and a futures ETF. A spot ETF directly holds Bitcoin, mirroring the real-time price fluctuations. In contrast, a futures ETF deals with contracts predicting Bitcoin’s future price, which may involve elements of leverage and contract expiration, further complicating the price dynamics.

The tweet and the graph suggest that spot markets are susceptible to manipulation tactics like spoofing, where traders place deceptive orders or wash trading, where one trades with themselves to feign market activity. These deceptions can distort the true supply and demand, leading to skewed price perceptions.

As we advance, the crypto community remains wary of traditional financial entities introducing novel financial products. The question lingers: Can the ethos of decentralization withstand the strategies of seasoned financial players?

The historical perspective of Bitcoin’s price about Wall Street’s involvement provides a cautionary tale. It is a narrative of power dynamics, market psychology, and the constant tug-of-war between decentralization and established financial structures.