‘My Target for Pre-Spot ETF is $47K to $50K’, Says an Analyst- Will Bitcoin Hit New ATH Post ETF?

The post ‘My Target for Pre-Spot ETF is $47K to $50K’, Says an Analyst- Will Bitcoin Hit New ATH Post ETF? appeared first on Coinpedia Fintech News

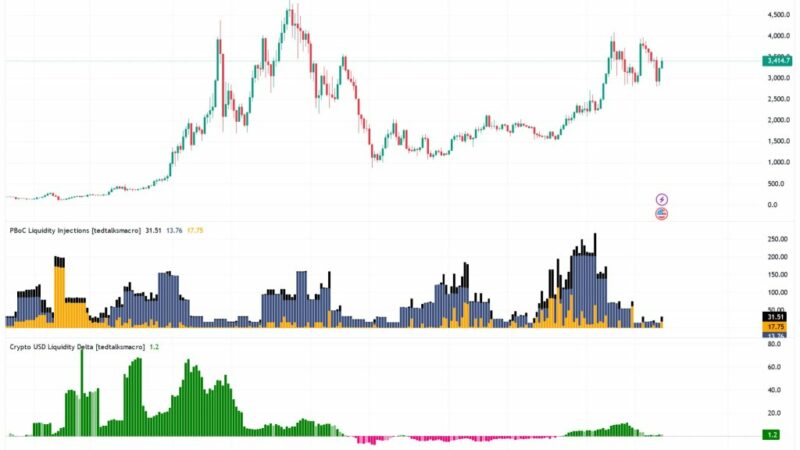

Regardless of the interim bearish action, the Bitcoin price continues to trade under a bullish influence. The recent rebound from the bearish claws validates the claim and also sets a path towards a bullish close for the year. The outcome of the FOMC was up to par, as the price experienced a significant push, compelling it to soar above the prevailing consolidation.

The BTC price, on the other hand, surpassed $42,000 for the second time this week, hinting at the growing strength among the bulls. This surge was attributed to the US Federal Reserve’s decision to maintain unchanged interest rates and a forecast of potential cuts in 2024. Therefore, a popular analyst, Michael van de Poppe, predicts the upcoming price action for the BTC price and says it may hit $50K before the Spot ETF gets approved.

The analyst points towards the current price action, which is hovering between the low and high ranges. Therefore, now that the FOMC fear has faded, the price is expected to maintain a strong uptrend after triggering the current rebound from the interim lows close to $40.500.

“FOMC is done, dovish stance and most likely rate cuts + the high on the interest rates is in.

For Bitcoin, risk-off before FOMC took place. Bounce back upwards and I think, the trend is going to continue going up. MY overall target for this pre-spot ETF run is $47K-50K,”

Therefore, in the coming days, the Bitcoin price is believed to maintain a healthy upswing and close the yearly trade at around $44,500. This move could make the trade more optimistic about the upcoming rally in 2024, which may reach new highs beyond the current ATH. However, sustaining above $42,000 until the end of the year is extremely crucial to setting a rally to a new ATH above $70,000.