XRP ETF Is Trending On X, Here’s Why

As anticipation builds around the potential approval of the first spot Bitcoin ETFs in the US by the Securities and Exchange Commission, the keyword “XRP ETF” is currently trending on X (formerly Twitter). Numerous XRP community members have posted supposed proof that an ETF in the US is on its way and could soon become a reality. However, a closer examination reveals a more nuanced reality.

Why is $XRP ETF trending?

— XRPcryptowolf (@XRPcryptowolf) January 7, 2024

XRP ETF Is Trending

Good Morning Crypto recently stated, “JUST IN: Fidelity Unveils XRP ETP !?! With Grayscale & Fidelity offering XRP products, 2024 could be the breakout year for XRP as it inches closer to all-time highs.” Similarly, XRP CAPTAIN announced, “BREAKING: Spot XRP ETF is for real,” while CryptoGeek claimed, “BREAKING: XRP ETF CITED TO BE RELEASED IN A ‘MATTER OF WEEKS’ FOLLOWING BITCOIN ETF APPROVAL BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION.”

BREAKING

SPOT #XRP ETF Is For Real

pic.twitter.com/Up2sA9jbDK

— XRP CAPTAIN (@UniverseTwenty) January 7, 2024

The root of these claims lies in an XRP ETP from 21Shares (formerly Amun), which is available on Fidelity Investments’ platform. This development has generated significant excitement within the XRP community. However, the narrative around a US-launched ETF is misleading.

The buzz partly stems from Grayscale’s recent decision to reincorporate XRP into its Grayscale Digital Large Cap (GDLC) fund, following Judge Analisa Torres’ July 2023 ruling that classified XRP as a non-security. This ruling reversed Grayscale’s previous removal of XRP in January 2020 amid legal controversies over its security status. This move by Grayscale has fueled speculation about an upcoming ETF from the firm.

But contrary to circulating claims, Fidelity has not launched an XRP ETP. Fidelity’s platform only showcases the XRP ETP launched by Swiss financial institution Amun AG in April 2019. This product, initially called AXRP and later rebranded to 21Shares, is available on the SIX Swiss Exchange. Moreover, it is not a US-registered ETP.

Meanwhile, it is backed by physical XRP and managed by Coinbase Custody. Remarkably, the product is 100% backed by physical XRP and records $49,325 million in assets under management (AUM).

Why A XRP ETF Won’t Happen Anytime Soon

Regarding the possibility of an XRP ETF in the US, Bloomberg ETF expert James Seyffart offered a sobering perspective a few months back in response to rumors about a fake BlackRock XRP ETF which initiated a 15% pump that was quickly erased. In an interview, he stated: “I don’t think that XRP is ever going to get through the SEC’s doors, essentially not anytime soon, even after that loss [Ripple vs. SEC].

He added, “First of all, CME would have to list XRP futures before a futures ETF would launch, and I can’t imagine them allowing them a spot XRP ETF anytime soon. But again, like I said, three weeks ago I said I didn’t think Ethereum futures ETFs would be coming anytime soon unless there’s a huge change in the SEC, so theoretically it could be. But the SEC has said in that Terra case and multiple other cases that they believe Judge Torres got it wrong.”

In summary, while the XRP community’s excitement is palpable, the reality of an ETF in the US remains distant, with regulatory hurdles and the SEC’s stance posing significant challenges.

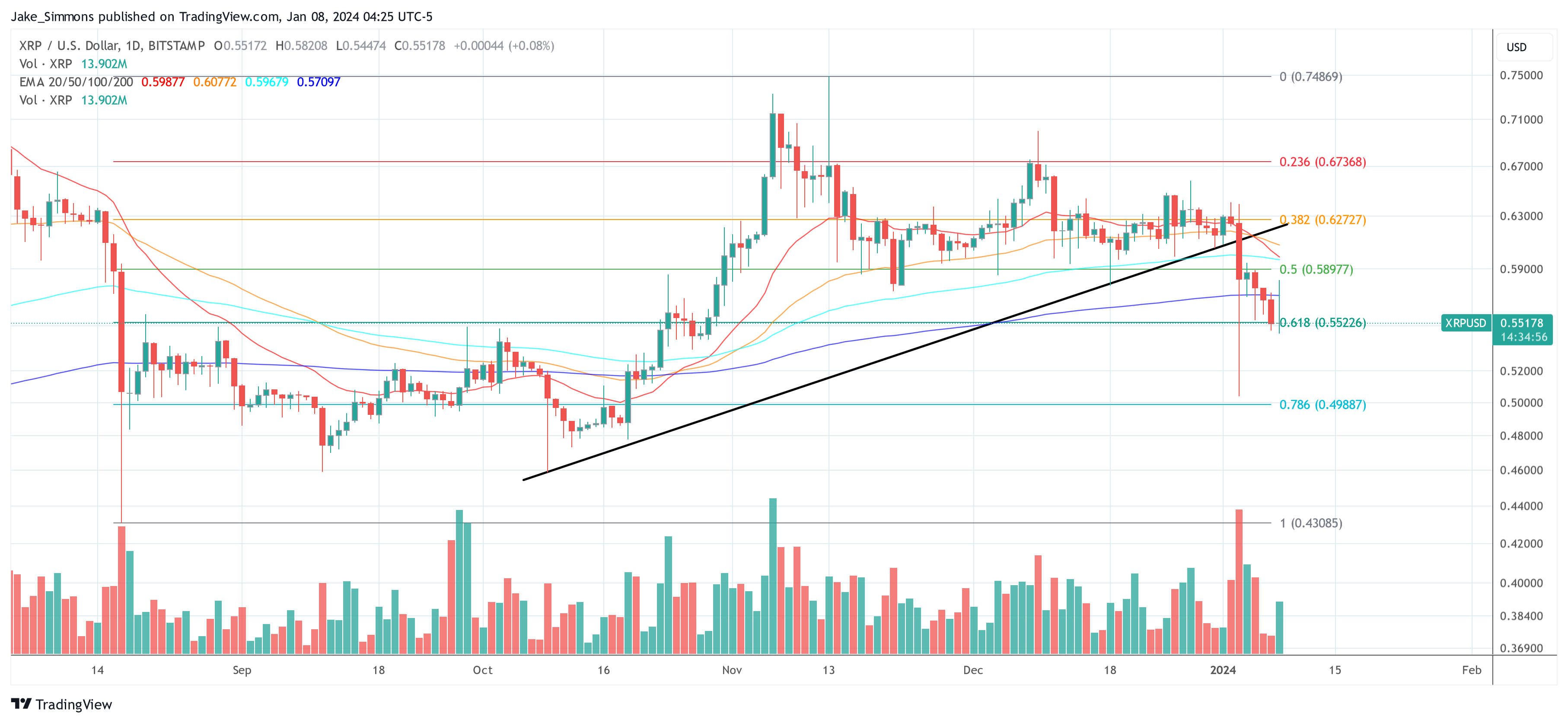

At press time, XRP traded at $0.55178.