How ETFs affected BTC futures trading in the U.S.

The launch of the spot Bitcoin ETFs in the U.S. marked a watershed moment in the crypto industry. While the impact it could have on the global Bitcoin market, like legitimizing it as an asset class or creating more demand, has been analyzed at length, few have focused on its effects on other regulated investment products like futures.

As a spot Bitcoin ETF offers a more direct investment road to cryptocurrencies, it’s important to examine how it influences the Bitcoin futures market. The relationship between these two investment vehicles shows investor sentiment and market trends, and the impact regulation has on crypto trading.

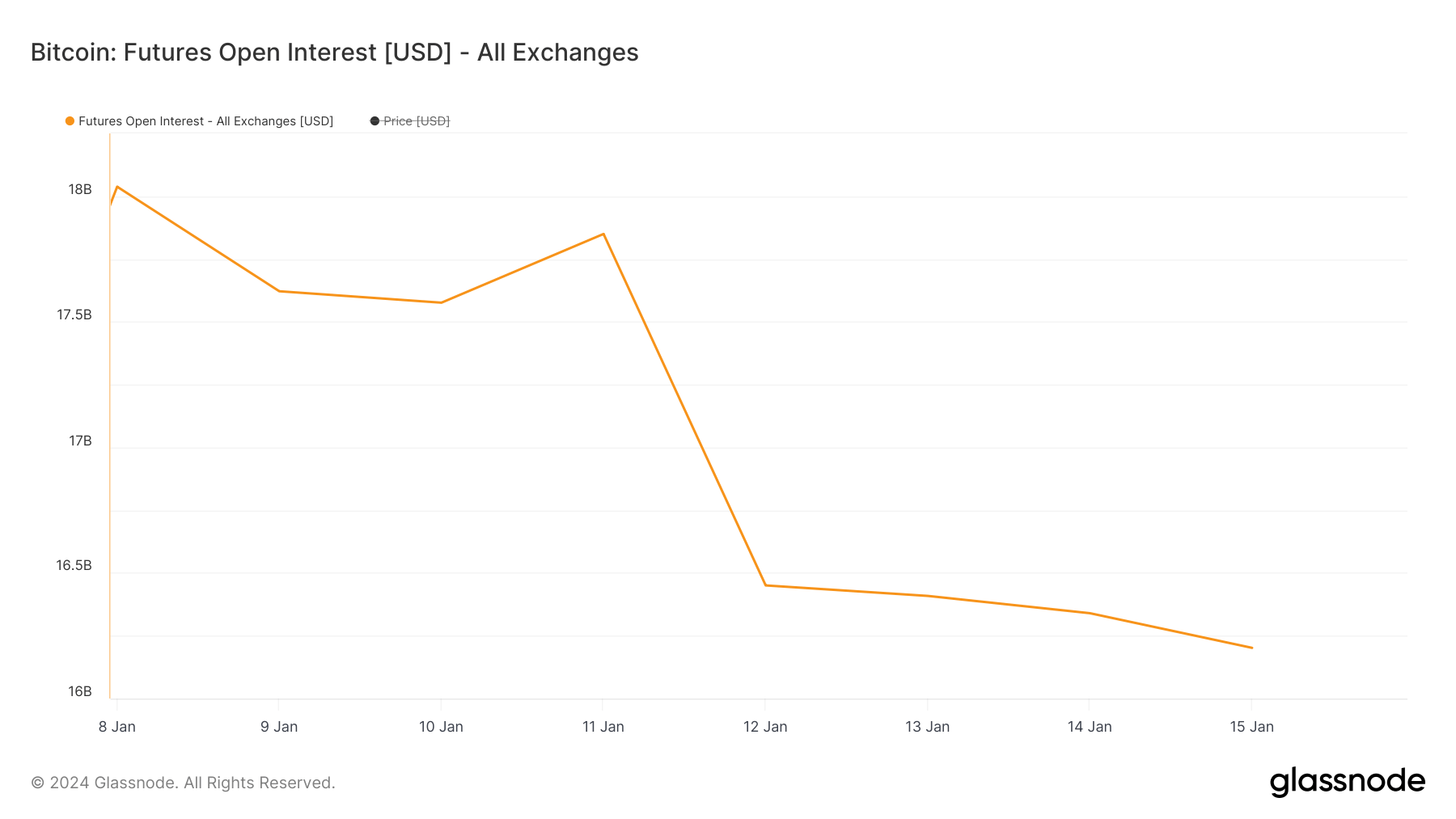

From Jan. 9 to Jan. 15, there was a noticeable decline in the total open interest across all exchanges, decreasing from $17.621 billion to $16.201 billion. This 8.05% drop suggests a reduction in the number of open futures contracts, hinting at either a diminished interest in futures trading or a possible reallocation of investments to other vehicles, such as the spot ETFs, which began trading on Jan. 11.

Most exchanges offering futures and other derivatives saw similar drops in open interest. However, CME stands as an outlier, the exchange that suffered the most significant decrease in open interest and trading volume.

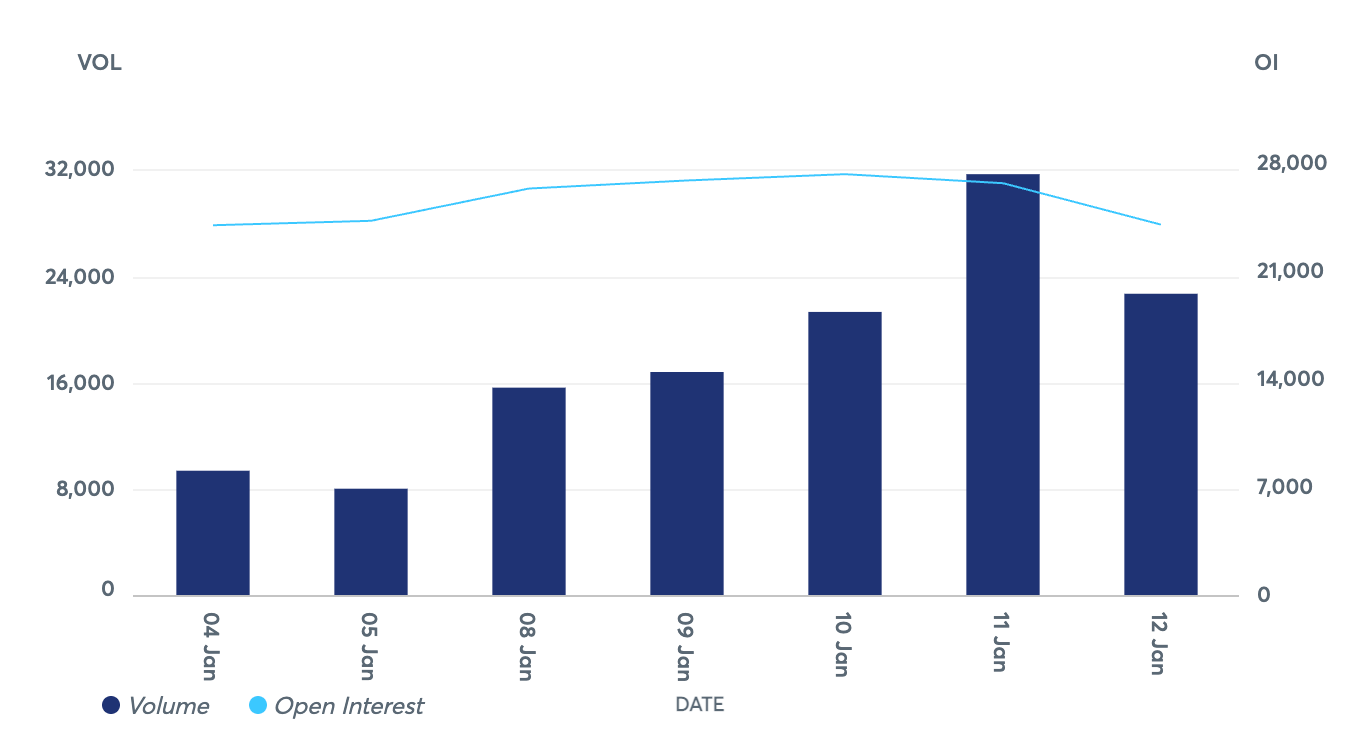

Beginning at 26,846 BTC on Jan. 9, open interest on CME Bitcoin futures increased slightly to 27,252 BTC on Jan. 10, a modest increase of 1.51%, before entering a decline. By Jan. 12, the open interest had fallen to 23,992 BTC, marking a significant reduction of 10.64% from its highest point on Jan. 10.

This decrease in open interest, particularly notable between Jan. 11 and Jan. 12, coincides with a considerable drop in Bitcoin’s price during the first day of spot Bitcoin ETF trading. This suggests a correlation between the declining market confidence in Bitcoin’s future price and the reduced interest in futures contracts.

The trading volume of CME Bitcoin futures showed even more volatility. After an initial volume of 16,821 BTC on Jan. 9, it peaked on Jan. 11 with 31,681 BTC, a substantial increase of 88.33%. However, this peak was short-lived; following the sharp decline in Bitcoin’s price, the futures trading volume fell to 22,699 BTC by Jan. 12, a decrease of 28.34% from the previous day’s peak.

Bitcoin also exhibited significant volatility last week. Starting at $46,088 on Jan.9, the price fluctuated slightly before experiencing its most significant drop between Jan. 11 and Jan. 12, falling from $46,393 to $42,897, a decrease of 7.54%.

The notable drop in open interest and volume on CME shows the potential the spot Bitcoin ETF has to influence established markets like Bitcoin futures or GBTC.

Within the first two days of trading, spot Bitcoin ETFs saw $1.4 billion in inflows. These two days saw extremely high trading activity, totaling approximately 500,000 traders and amassing around $3.6 billion in volume. Amidst this influx, the Grayscale Bitcoin Trust (GBTC) encountered notable outflows, amounting to $579 million. When these outflows are factored in, the net inflows for all spot Bitcoin ETFs are $819 million. However, these figures might not reflect the actual volume and inflows on Jan. 11 and Jan. 12, as some transactions are still pending final accounting settlement.

Some analysts speculate that the outflows from GBTC could react to the approval of the spot Bitcoin ETF, as Grayscale’s 1.50% fee is being weighed against more cost-effective alternatives like BlackRock’s ETF, which charges a 0.25% fee. In such a short time, the amount of outflows could indicate a growing sensitivity among investors to ETF fee structures.

This sensitivity to cost could also be one of the most significant factors influencing Bitcoin futures. Spot ETFs may offer a more cost-effective way of investing in Bitcoin, as futures contracts often involve premium costs and rollover expenses. For larger institutional investors, these costs can be significant over time, especially given the highly competitive fees among the 11 listed ETFs.

For traditional investors or institutions, an ETF represents a familiar structure akin to investing in stocks or other commodities, making it a more attractive option than futures contracts. If the shift toward the spot Bitcoin ETF continues, it will show a growing preference for simpler, more direct investment methods in Bitcoin. It would indicate that investors are seeking ways to incorporate Bitcoin into their portfolios in a manner that aligns more closely with traditional investment practices.

The post How ETFs affected BTC futures trading in the U.S. appeared first on CryptoSlate.