Bitcoin above $44k spurs market confidence with spike in unrealized profits

As Bitcoin’s price breached the $44,000 mark on Feb. 7, a significant milestone was achieved, signaling a robust recovery to levels seen before the launch of spot Bitcoin ETFs. This price recovery marks a notable comeback and brings a renewed sense of confidence among investors, as evidenced by the accompanying spike in unrealized profits across the Bitcoin market.

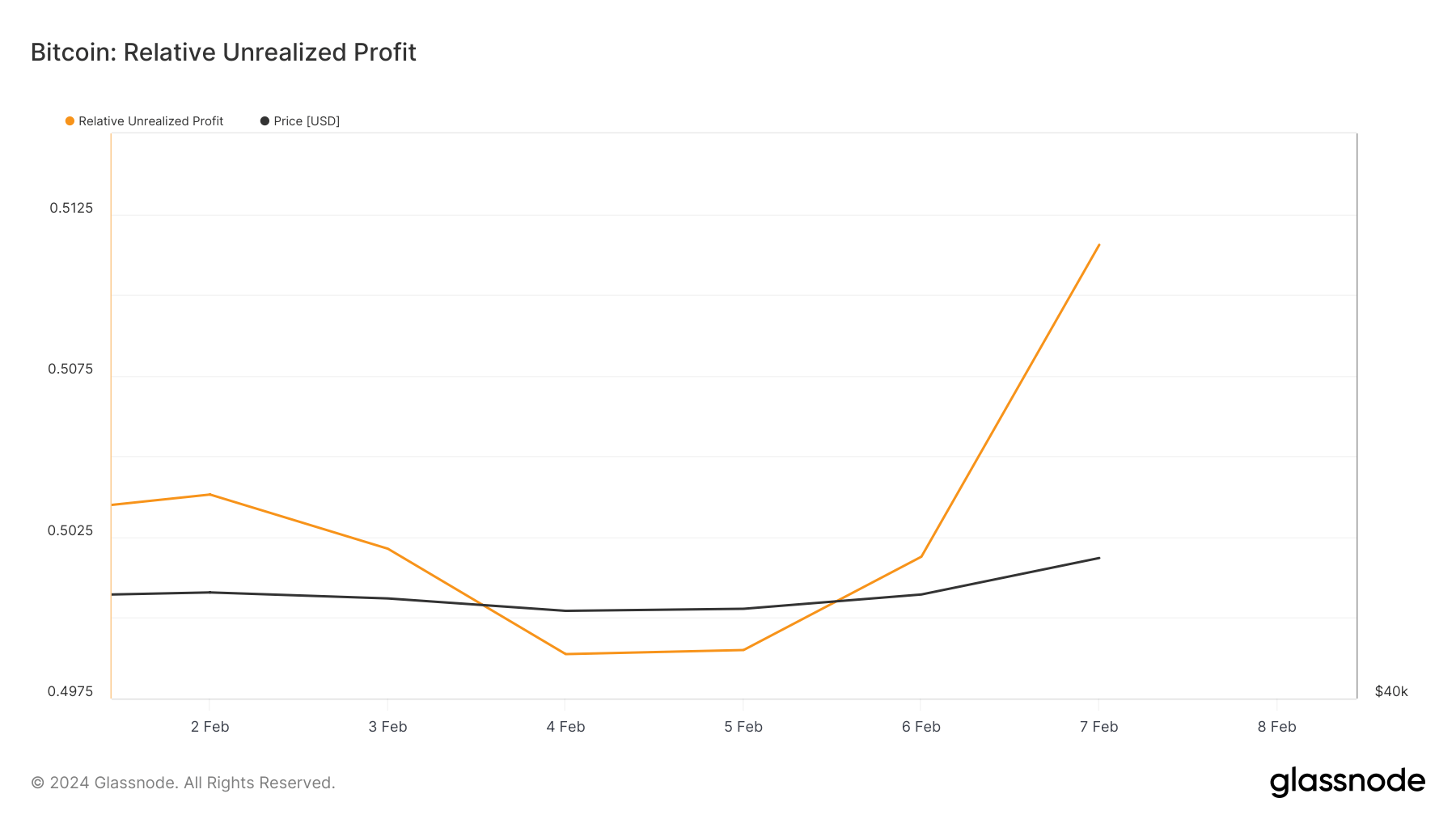

The relative unrealized profit, an indicator measuring the overall proportion of the market holding Bitcoin at an unrealized profit, witnessed an increase from 0.499 to 0.511 in the short span from Feb. 5 to Feb. 7. Although this rise might appear minimal, it represents a significant shift in market sentiment within such a brief timeframe. This metric is a gauge for the level of optimism pervading the market, suggesting that a more substantial segment of investors are now sitting in profitable positions without the immediate intention to sell.

Further broadening the market perspective, net unrealized profit/loss (NUPL), which differentiates between unrealized profit and loss across all Bitcoin holders, increased from 0.474 to 0.492. A positive uptrend shows the prevailing profitability within the network, reinforcing the bullish sentiment that the market as a whole is benefiting from the price resurgence.

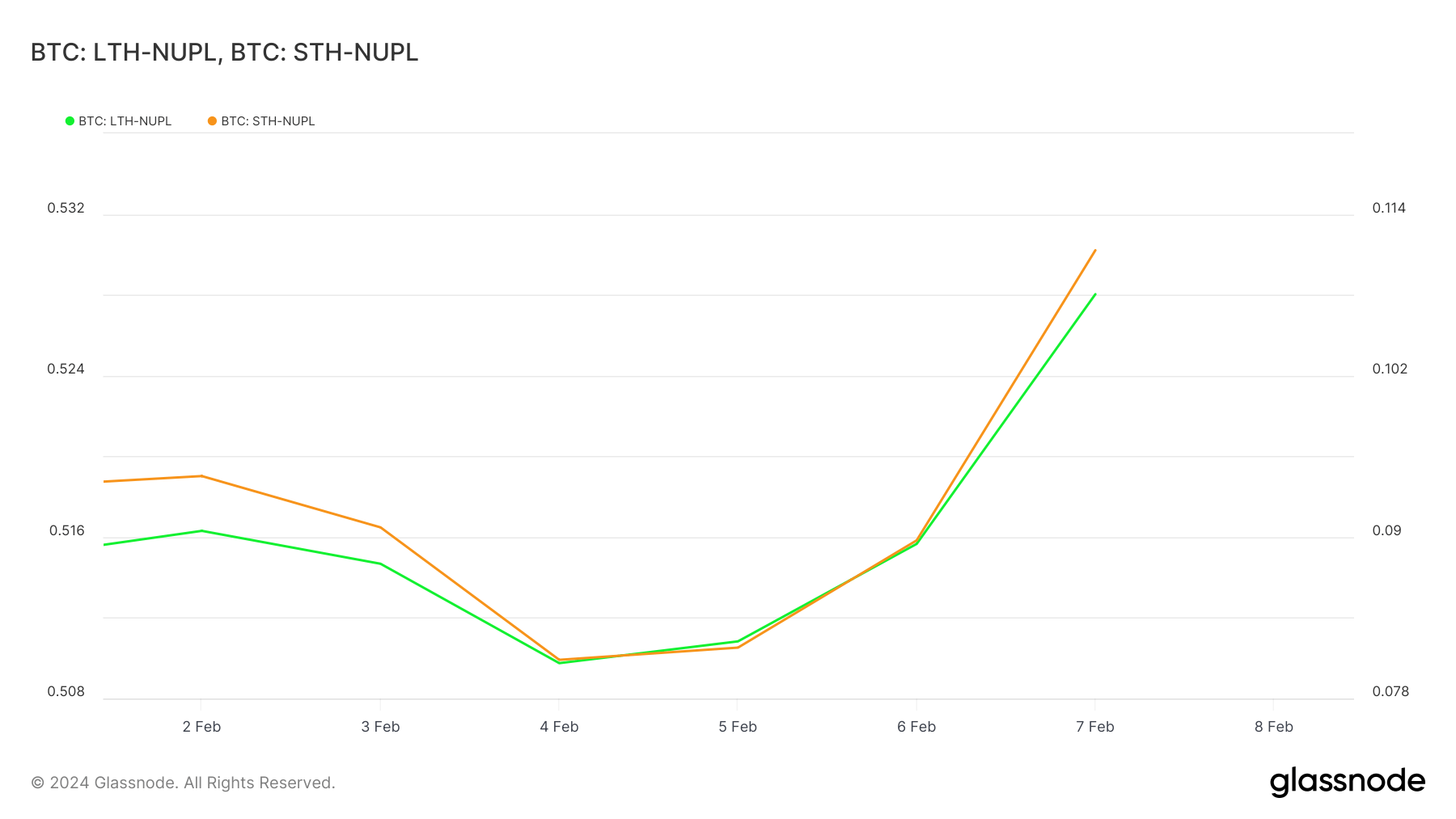

To dive even deeper into how much unrealized gains each market segment is sitting on, we can look at data for long-term and short-term holders. The consistent increase in LTH NUPL from 0.510 to 0.528, alongside a more pronounced rise in STH NUPL from 0.081 to 0.111, reveals that both investor classes are experiencing growing profitability, with short-term holders seeing a significant boost in unrealized gains. This divergence may indicate that short-term traders are more reactive to recent price movements, while long-term holders remain steadily in profit.

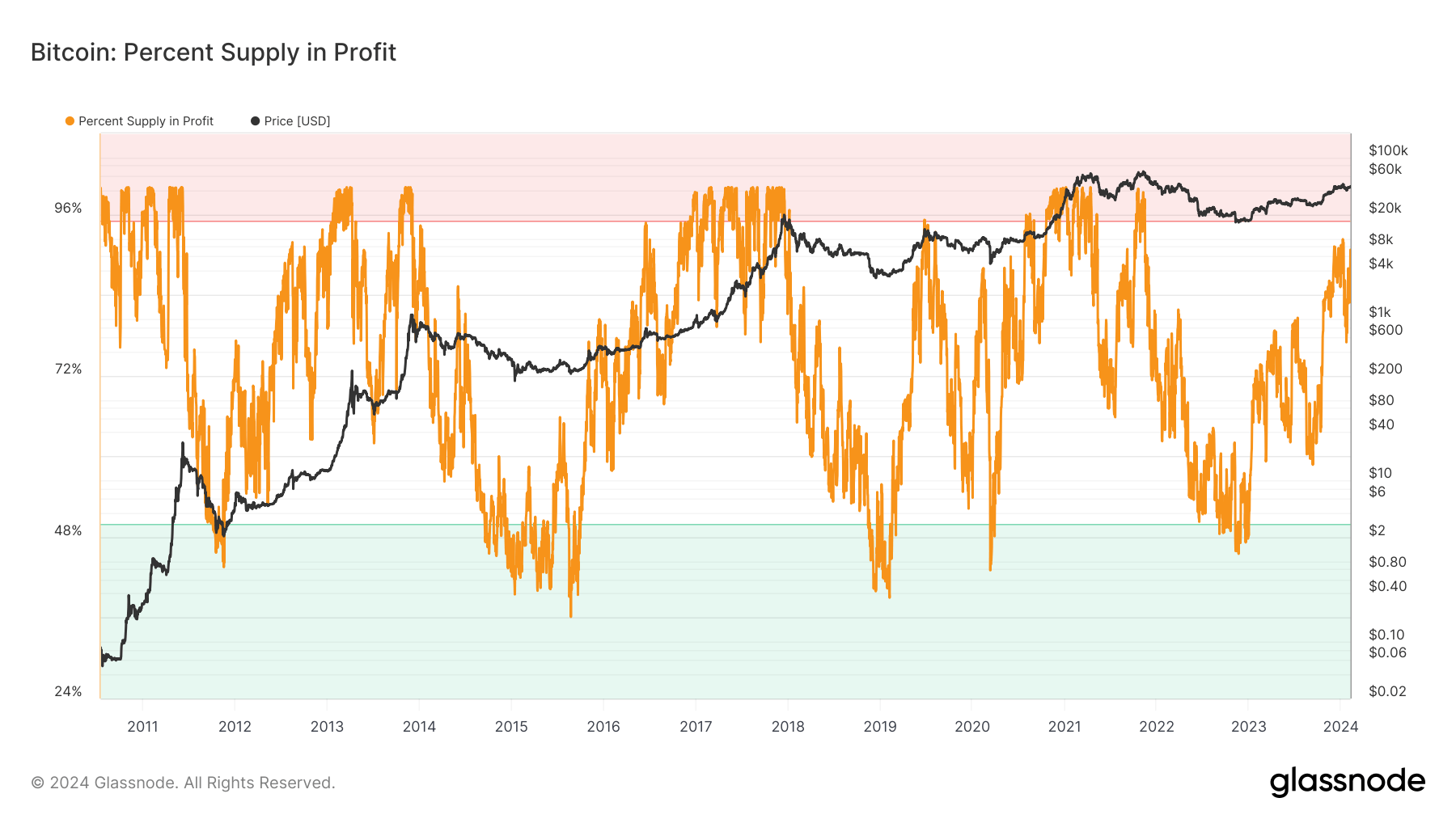

The percent of UTXOs and the supply in profit metrics quantify the share of existing Bitcoin held at a profit. The notable increase in both metrics, with UTXOs in profit rising from 86.83% to 94.60% and supply in profit from 83.49% to 90.7%, underscores a widespread return to profitability across the market. This trend is significant for assessing the likelihood of selling pressure, as higher percentages typically reduce the immediate incentive to sell at a profit. However, prolonged periods over 90% of the supply was in profit have always ended in a significant selloff, as most of the market is eventually pushed to take profits.

The post Bitcoin above $44k spurs market confidence with spike in unrealized profits appeared first on CryptoSlate.