AMM on XRPLedger: A Boost for Ripple and XRP, Say Crypto Experts!

The post AMM on XRPLedger: A Boost for Ripple and XRP, Say Crypto Experts! appeared first on Coinpedia Fintech News

The XRPLedger is introducing Automated Market Makers (AMMs), offering XRP holders chances for passive income by providing liquidity to pools. They earn a share of earnings and get pool tokens based on their deposits, with the ability to vote on trading charges. Stedas, a crypto influencer, offers a guide on earning passive income through this.

Here’s what it means for you!

Understanding the Mechanism Behind

The XLS-30 AMM Amendment proposes introducing automated market maker (AMM) functionality to the XRPL, simplifying AMM deployment without custom code. Benefits include increased liquidity, improved price discovery, and reduced fees.

However, there are potential market volatility and centralization risks. The amendment is in a voting process for integration into the XRPL Mainnet, expected in Q1 2024. AMMs work by holding asset pools and adjusting exchange rates based on balances.

Added Features

LP Tokens represent shares of these pools. Anyone can create or deposit assets into an AMM. Meanwhile, the XLS-30D Amendment introduced new transaction types, voting on fees, and a continuous auction mechanism. It integrates AMM functionality into the XRPL, addressing impermanent loss by distributing fees. The AMM interacts with XRPL’s limit order book-based DeX, allowing users access to all liquidity.

Chances of Passive Income?

Meanwhile, the SEC v. Ripple lawsuit’s upcoming deadline on March 22 may affect XRP’s price due to Ripple’s significant holdings. However, the introduction of AMMs is anticipated to have a positive impact on both XRP and Ripple, with the activation set to occur by March 22.

Coinpedia earlier reported Ripple’s CTO, David Schwartz eagerness to utilize AMMs for institutional payments, benefiting from the liquidity they provide on the DEX to facilitate smoother transactions.

Amid discussions about earning passive income through the XRP Ledger AMM, Schwartz explained that it requires trading XRP for claims against AMM pools, not just holding. This aims to address myths about DeFi and to promote realistic expectations. Schwartz also emphasized individual control over assets, rejecting calls for burning excess XRP from escrow as it should remain the owner’s decision.

In an X post, crypto expert, WrathofKahneman says it’s okay to call earning through the XRPL AMM passive income because it involves letting the machine trade XRP. They compare it to real estate investments and rentals, which are also seen as passive income. However, they stress that participants shouldn’t expect guaranteed profits from it.

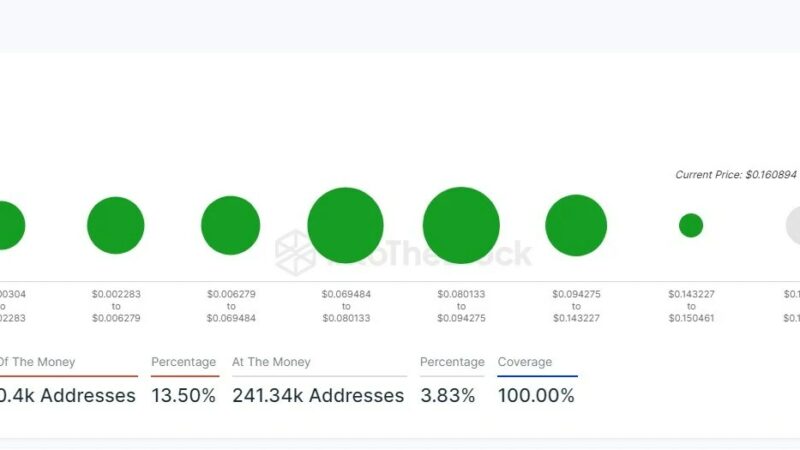

XRP Price Snapshot

Remarkably, XRP’s price has remained steady and managed to sustain above the critical $0.60 level. However, technical indicators suggest a potential correction in the near term, with the altcoin likely to test support levels around $0.5553. In a bullish scenario, XRP is likely to reclaim the $0.6293 level, signaling further upward momentum with the next significant resistance level at the 2024 peak of $0.6685.

Do you think AMMs present an exciting opportunity for XRP holders to get guaranteed profits?