HODLing to Wealth: Unlocking Up to 14% APY on Crypto Savings with EMCD’s Coinhold Wallet

The post HODLing to Wealth: Unlocking Up to 14% APY on Crypto Savings with EMCD’s Coinhold Wallet appeared first on Coinpedia Fintech News

As the crypto market rides the wave of a major bull run, thanks to Wall Street’s warm embrace of digital currency spot exchange-traded funds (ETFs), the concept of holding onto digital assets the long term has never been more appealing. This optimism surge perfectly aligns with the quest for secure methods to boost crypto holdings, hand in glove with the HODL strategy that advocates holding onto cryptocurrencies as a long-haul investment.

The HODL Wave: A Reflection of Investor Behavior

By analyzing on-chain behavior, particularly the Bitcoin HODL Wave chart, which tracks the percentage of existing Bitcoins that have not been moved from one wallet to another for at least one year, we see that the 1 Year+ HODL Wave is currently at 68.19%, indicating that the majority of all Bitcoin has not moved for at least a year.

In other words, there appears to be a growing trend in the current crypto market with investors showing an increasing amount of interest in long-term holdings.

Market Sentiment and the NUPL Perspective

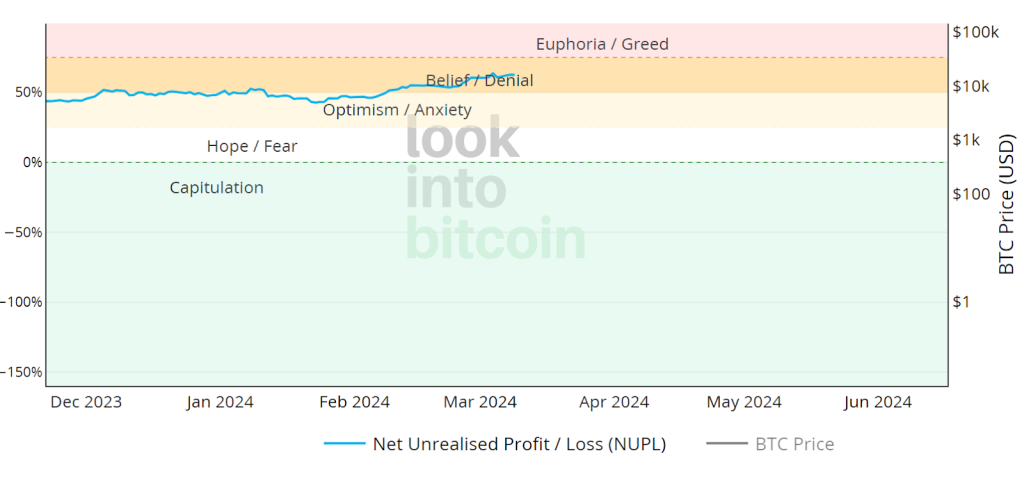

This steadfastness among Bitcoin holders is further mirrored in the current market sentiment, captured by a 62.49% Net Unrealized Profit/Loss (NUPL).

Such an optimistic sentiment, placed firmly in the ‘Belief/Denial’ zone, could mean that investors are in significant profit and may believe the market will continue to rise, potentially ignoring signs of a reversal. This may also indicate that while holders are enjoying gains, they are also cautiously optimistic, potentially seeking secure methods to grow their assets further.

EMCD Coinhold Wallet: A Secure Solution for Long-term Crypto Savings

The EMCD Coinhold Wallet, an extension of the EMCD ecosystem, has captured the attention of the crypto community by offering a high-yield fixed APY of up to 14%, a rate that starkly contrasts the modest yields of traditional banking savings accounts and its rivals in the crypto industry.

With roots deeply entrenched in the mining sector, EMCD is a Hong Kong-based entity that stands out as one of the top 7 Bitcoin mining pools on a global scale. Since its debut in 2018, EMCD has emerged as a powerhouse in the crypto universe with their high-performance mining services and dependable digital asset transfer mechanisms.

Savings mechanisms like the one offered by EMCD Coinhold Wallet with a high annual percentage yield (APY) of up to 14% on cryptocurrency holdings are growing in popularity among crypto-savers. EMCD helps holders of Bitcoin and stablecoins like USDT and USDC as well as a range of other popular digital assets get more value out of their savings, boosting the advantages of the HODL strategy in a secure and user-friendly platform.

Meanwhile, the security of investments is not an afterthought for EMCD. Adhering to rigorous AML and CTF standards, the platform fortifies user confidence through bank-grade security measures and dependable wallet storage, complemented by two-factor authentication and oversight by Chief Information Security Office (CISO).

In addition to the standout fixed APY, EMCD also offers a flexible APY option, capped at 10%, with the allure of daily compounded interest, presenting substantial growth opportunities for investments. The EMCD user base, now over 200,000 strong, enjoys the liberty to withdraw crypto at any time, ensuring liquidity alongside attractive yields.

The way EMCD has been expanding is also quite impressive. The doubling of its team and hash rate within a mere six months stands testament to its commitment to progress and efficiency.

With a straightforward investment process and a modest minimum investment requirement of $100, EMCD positions itself as an accessible and straightforward choice for both crypto veterans and newcomers.

Conclusion

Amidst this backdrop of profit and optimism, as was as the heightened interest in long-term holding, the search for higher yields amidst a low-interest environment, and the meticulous attention to security reflect a maturing market, EMCD’s offerings seem to echo the community’s sentiment and confidence in the future of cryptocurrency savings.

As a service that caters to the ‘hodl’ culture, EMCD Coinhold Wallet offers holders a chance to capitalize on their crypto holdings. With the EMCD Coinhold Wallet in their corner, they can have smart, long-term game plans and maximize their crypto savings while maintaining unwavering faith even when the market shows signs of uncertainty.