KPMG survey reveals significant uptick in institutional adoption of crypto in Canada

The Canadian financial sector witnessed a significant uptick in crypto adoption in 2023, according to a recent survey by KPMG in Canada.

Financial firms offering crypto products and services increased by 22% from 2021, while institutional investors incorporating crypto into their portfolios rose by 26% during the same period.

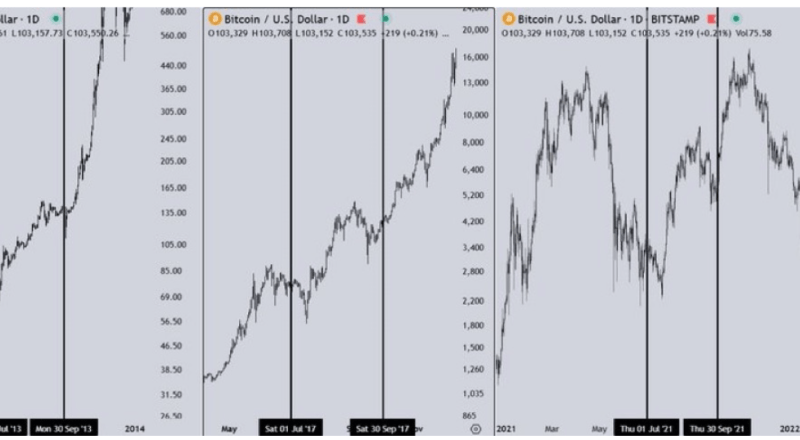

Resurgence

Financial Services: 50% of respondents now provide at least one type of cryptoasset service, increasing from 41% in 2021. Crypto trading, custody, clearing, and settlement services saw substantial growth, with 52% of firms now offering trading services, up from none reported in the previous survey.

Meanwhile, 39% reported either direct or indirect exposure to crypto, marking an increase from 31% in 2021. Notably, direct ownership of digital assets has more than doubled, with 75% of investors now holding these assets compared to 29% two years ago.

Kunal Bhasin, partner and co-leader of KPMG in Canada’s Digital Assets practice, remarked,:

“After the setbacks in previous years, including market instability and high-profile frauds, 2023 has emerged as a year of strong recovery and confidence in cryptoassets. The growing US debt and inflation have driven investors towards cryptocurrencies as a protective hedge and a dependable store of value.”

Kareem Sadek, Emerging Technology Risk leader and co-leader of the practice, cited regulatory advancements as a key driver of the resurgence. He said:

“Canada has established itself as a frontrunner in the crypto market by approving the first Bitcoin and Ethereum ETFs and by supporting innovative strategies like derivatives and Ethereum staking.”

Outlook

The survey also highlighted a shift towards more diversified investment strategies in the financial services sector. The average number of services offered per firm increased to two or three from one to two in 2021.

The expansion is largely driven by rising client demand for crypto services, which now influences 80% of financial services firms — up from 50% two years ago. Institutional investors are diversifying their portfolios further, with one-third now allocating at least 10% to crypto, up from one-fifth in 2021.

The maturation of the market and enhanced custody solutions have encouraged 67% of investors to initiate their first crypto investments, a significant rise from 14% in the previous survey.

According to Sadek, the approval of an Ethereum ETF will continue to drive institutional interest and investment in 2024. He said:

“The recent approval of spot Bitcoin ETFs by the US SEC in January 2024 marked a pivotal moment for the industry, attracting established asset managers to the sector.”

The post KPMG survey reveals significant uptick in institutional adoption of crypto in Canada appeared first on CryptoSlate.