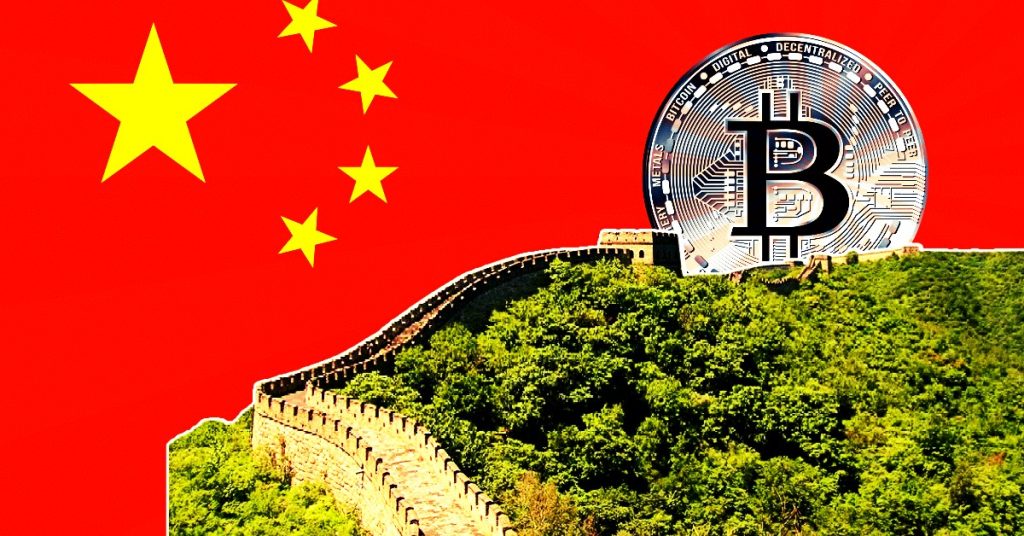

China Might Unban Crypto in Upcoming 3 Months: Experts Predict

The post China Might Unban Crypto in Upcoming 3 Months: Experts Predict appeared first on Coinpedia Fintech News

China, known for its strict stance against cryptocurrencies, is reportedly considering lifting its ban on Bitcoin in the upcoming months. This development comes as Hong Kong, a Chinese Special Administrative Region, makes significant moves towards embracing Bitcoin by approving Bitcoin exchange-traded funds.

The Chinese Ban on Cryptocurrencies

China’s ban on cryptocurrencies began in September 2017 when the government imposed strict regulations on Initial Coin Offerings (ICOs), leading to the shutdown of cryptocurrency exchanges. The ban aimed to curb financial risks and illicit activities associated with cryptocurrencies.

It included prohibitions on mining, trading, and ICOs. The government also cited environmental concerns related to Bitcoin mining as one of the reasons behind the ban.

In 2021, China escalated its crackdown on cryptocurrency mining, leading to the shutdown of large-scale mining operations across the country. This move resulted in a significant exodus of mining operations to other countries with more favourable regulatory environments. The aftereffects of the ban were substantial, with a dramatic drop in Bitcoin’s hash rate and a shift in the global mining landscape.

After effects of the Ban

China’s ban on cryptocurrencies caused a ripple effect across the industry. The clampdown on mining led to a notable decrease in Bitcoin’s hash rate, as miners relocated to countries with more lenient regulations. This shift also impacted Bitcoin’s price, causing temporary market volatility.

The ban’s effects on the broader cryptocurrency ecosystem were also notable, with Chinese crypto exchanges and other crypto-related businesses relocating to more favourable jurisdictions. This migration of talent and capital affected China’s position in the global cryptocurrency industry.

Hong Kong’s Bitcoin ETF Approval: A Turning Point?

The recent approval of spot Bitcoin and Ether ETFs in Hong Kong may signal a change in China’s stance on cryptocurrencies. The Hong Kong Securities and Futures Commission approved these ETFs, which are set to begin trading on April 30, 2024.

This move makes Hong Kong the first Asian financial hub to embrace cryptocurrencies as mainstream investment tools.

The approval of Bitcoin ETFs in Hong Kong has several implications for China. As a Special Administrative Region, Hong Kong has a separate legal and financial system, allowing it to make independent decisions regarding financial products.

However, Hong Kong’s moves towards becoming a global digital asset hub may encourage mainland China to reconsider its ban on cryptocurrencies.

Influence of Hong Kong’s Crypto-Friendly Stance on China

With Hong Kong’s Bitcoin ETFs gaining popularity, China might see an opportunity to reengage with the cryptocurrency market.

The success of these ETFs could demonstrate the potential for regulated and compliant cryptocurrency investment, alleviating some of China’s concerns about financial stability and illicit activities.

Additionally, the success of the US’s spot Bitcoin ETFs, which have drawn significant net inflows, may further influence China’s decision to unban Bitcoin.

These developments suggest that China could benefit from embracing cryptocurrencies in a regulated manner, potentially boosting its position in the global financial market.