Bitcoin market cap nears 10% of gold as institutional interest soars – Incrementum report

Quick Take

A report compiled by wealth management firm Incrementum, shared by Tuur Demeester, a researcher at Adamant Research sheds light on the growing institutional interest in Bitcoin. The research, titled “The New Gold Playbook,” highlights the increasing resemblance of Bitcoin to gold, supported by various charts.

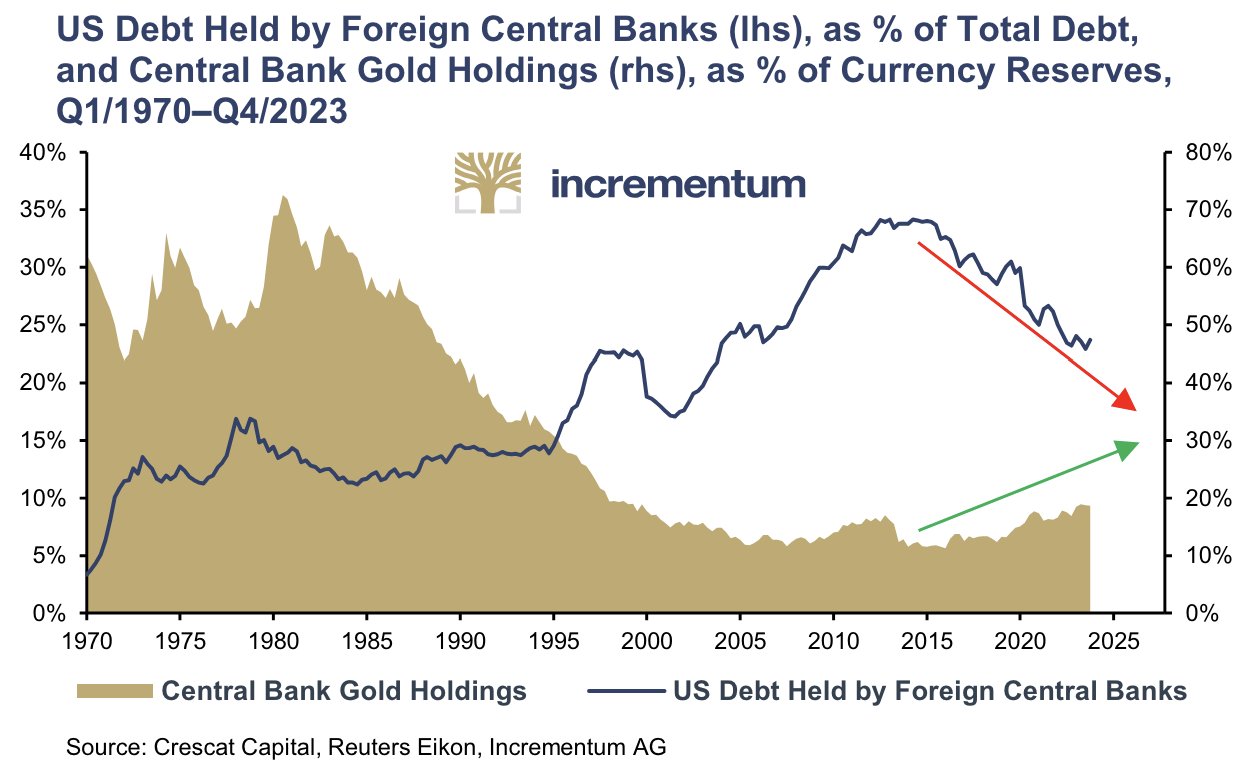

Incrementum’s data show that central bank gold holdings have risen, and US debt held by foreign central banks has decreased.

Demeester says:

“Since 2015 that central banks around the world have been decreasing their exposure to the US dollar”

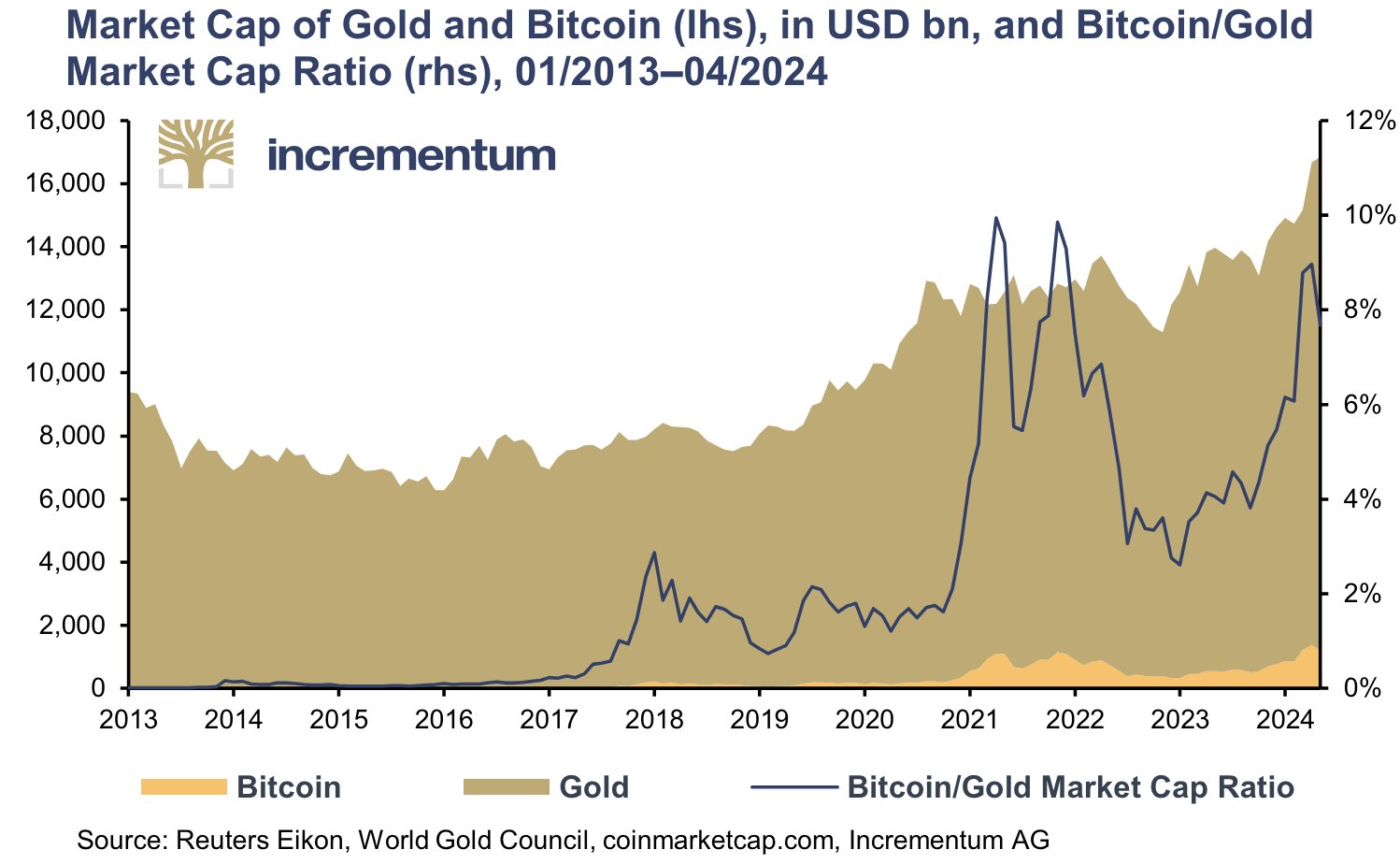

According to the report, Bitcoin’s market capitalization is approaching 10% of gold’s, currently 8.4%. Bitcoin is currently valued at $1.4 trillion compared to gold’s $16 trillion market cap.

A key distinction between the two assets is their supply dynamics. Bitcoin’s supply is fixed, with 94% of its total 21 million coins already mined, translating to a circulating supply of 19.7 million. In contrast, gold’s supply continues to grow steadily and is projected to reach 250,000 tonnes by 2030, according to the Incrementum report.

Incrementum also manages a crypto gold fund characterized by its focus on non-inflatable assets. These trends are key indicators of future Bitcoin adoption as more investors seek alternatives to traditional assets.

The post Bitcoin market cap nears 10% of gold as institutional interest soars – Incrementum report appeared first on CryptoSlate.