BTC Price Consolidation Continues but All Signs Point to a Run Toward New ATH: Bitcoin Price Analysis

Bitcoin’s price has been consolidating for almost 3 months now after making a new all-time high around the $74K mark.

Since then, the asset has failed to produce a new peak, but a new rally might begin soon.

Technical Analysis

By TradingRage

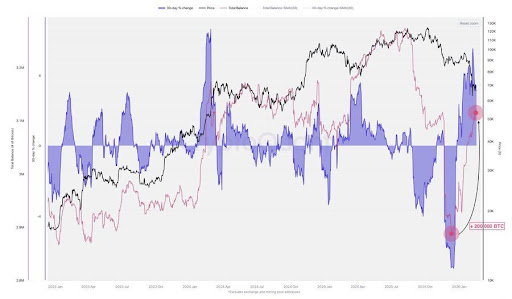

The Daily Chart

Bitcoin’s price action has been choppy on the daily timeframe, as the market has been consolidating inside a descending channel. Yet, the asset is currently testing the higher boundary of the channel and the $68K level.

While it has not been successful in breaking to the upside, the momentum is still bullish, and such a breakout could happen at any time. In this case, the market can rise toward the $75K all-time high and potentially make a new one.

The 4-Hour Chart

The 4-hour chart paints a clear picture of the recent consolidation. The price oscillates around the $68K level in a symmetrical triangle pattern. Considering the price action inside the pattern and the fact that the market has already touched the lower trendline of the triangle three times, a bullish breakout seems probable based on classical price action concepts.

Meanwhile, the RSI is still hovering around the 50% level, failing to point to a potential direction in the short term. Therefore, everything relies on the direction of a breakout from the triangle.

On-Chain Analysis

By TradingRage

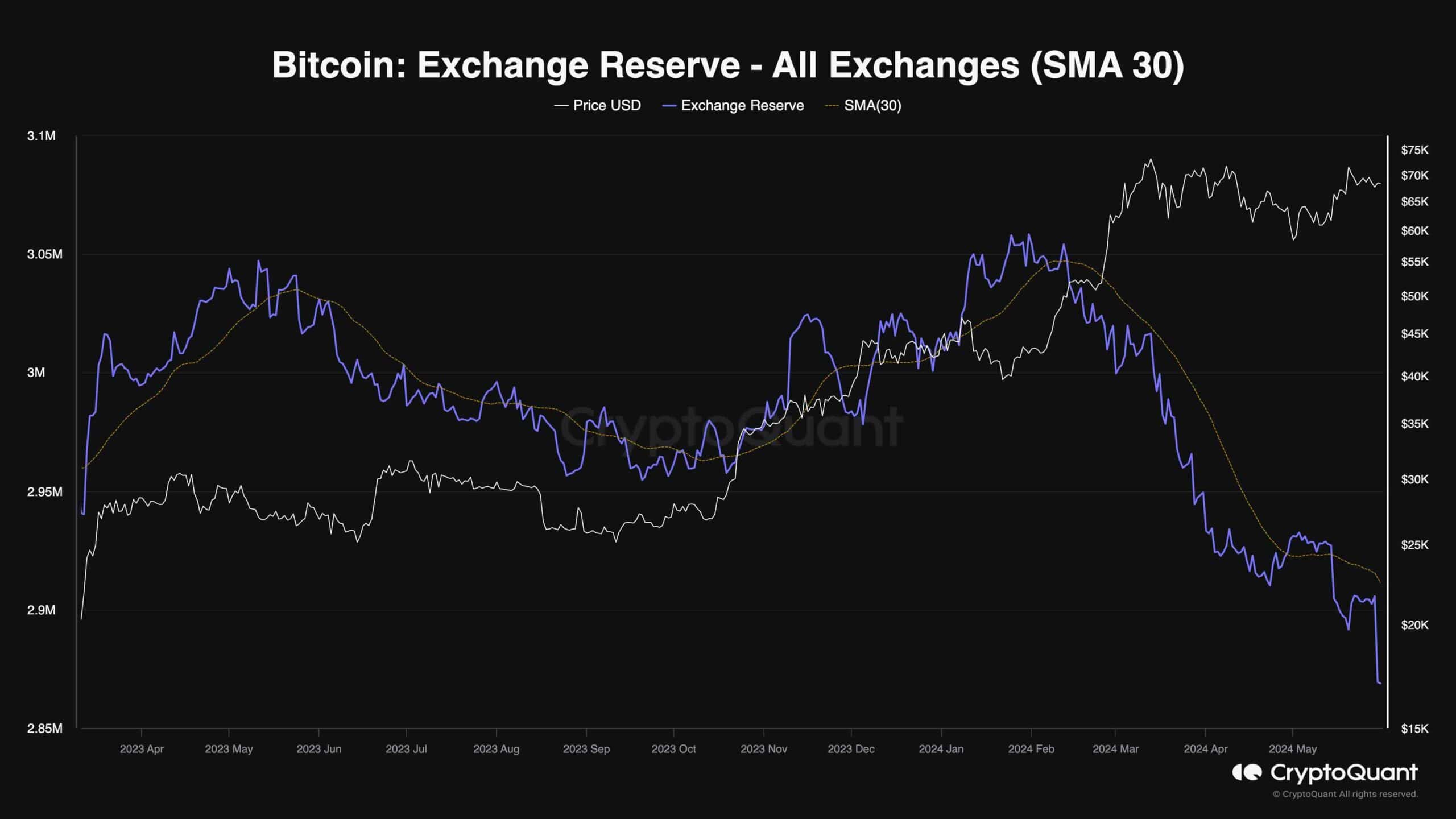

Bitcoin Exchange Reserve

As Bitcoin’s price continues its gradual move toward a new all-time high, investors are also getting more and more optimistic. This chart demonstrates the exchange reserve metric, which measures the total amount of BTC held in exchange wallets. Naturally, a drop in the metric is considered bullish, as it practically reduces supply, while an increase is bearish, as more BTC are ready to be sold.

As the chart demonstrates, the Bitcoin exchange reserve metric has declined steeply since February. This supply shrinkage was one of the contributing factors to the recent rally. The decline has even become sharper in the past few days, as investors expect a rally toward a new all-time high soon. This decrease in exchange reserve might be just what the market needs to do.

The post BTC Price Consolidation Continues but All Signs Point to a Run Toward New ATH: Bitcoin Price Analysis appeared first on CryptoPotato.