Bitcoin ETFs record best day with no outflows netting $887 million

Quick Take

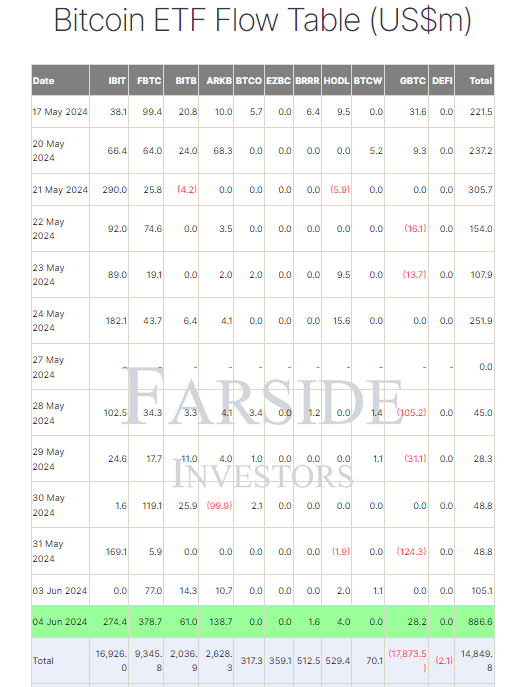

Farside data shows that on June 4, Bitcoin exchange-traded funds (ETFs) saw significant inflows, with a total of $886.6 million. This makes it the second-largest day of inflows since launch, trailing only March 12, which saw over $1 billion in inflows. Notably, this is the largest inflow ever for a day when no US ETF recorded an outflow, including GBTC.

Leading the charge was Fidelity’s FBTC, which recorded an inflow of $378.7 million, marking its biggest single-day inflow since March 7. This boost brought Fidelity’s total net inflow to $9.3 billion. BlackRock’s IBIT was another major contributor, with an inflow of $274.4 million, raising its total net inflow to an impressive $17 billion. Bitwise’s BITB saw a $61 million inflow, taking its total to $2 billion, while Ark’s ARKB reported a $138.7 million inflow, pushing its total to $2.6 billion. Grayscale’s GBTC saw a $28.2 million inflow, which still reflects a total net outflow of $17.9 billion. In total, ETFs have attracted a combined inflow of $15 billion, according to Farside data.

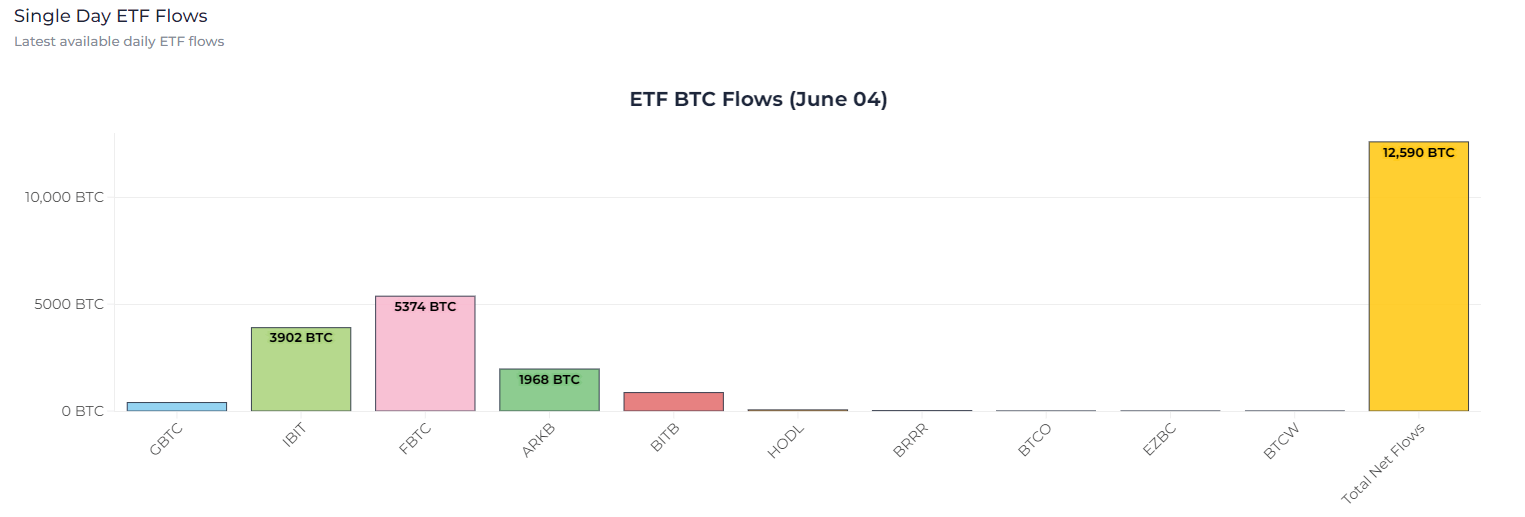

According to Heyapollo data, the $886.6 million inflow is equivalent to 12,590 Bitcoin, with FBTC alone accounting for 5,374 BTC.

US Bitcoin ETFs have now experienced 16 consecutive trading days of inflows. Just one more day of inflows will tie the current record for consecutive inflow days.

The post Bitcoin ETFs record best day with no outflows netting $887 million appeared first on CryptoSlate.