Solana Breaks Down Below the Crucial Support: Is It All Over for the SOL Price Rally?

The post Solana Breaks Down Below the Crucial Support: Is It All Over for the SOL Price Rally? appeared first on Coinpedia Fintech News

The FOMC minutes and fresh CPI data are about to create ripples across the markets, and Solana’s price appears to be deprived of the impact. The price was hovering under bearish impact for a certain period, and their influence is believed to have escalated if the SOL price fails to regain a certain price zone.

The latest drop in the BTC price, close to $66,000, circulated bearish waves across the entire market, including Solana. The price marked the lows at $145 for the first time in the past 25 days, signalling the growing selling pressure over the token. Meanwhile, the optimistic start to the day offered the possibility of a rebound, but the technicals point to a continuation of a bearish trend, which may cause acute harm to the token.

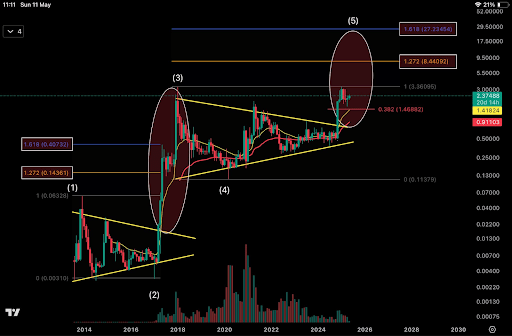

The SOL price roared and kept inflating since the price triggered a minor bull run during the last quarter of 2023. However, the rejection from the yearly highs above $200 seems to have initiated a fresh descending trend. The price has been forming constant lower lows and highs, signifying the growing strength of the bears, which may eventually lead the rally towards crucial support. Below are the observations from the daily chart of the SOL price rally,

- The SOL price has broken below the support of an expanding wedge. Although the price has displayed a similar action before, this time the recovery is not quick. Hence, it may not be a fake breakdown, as it happened before.

- Ever since the price soared above the trend reversal zone between $155 and $159, they have been offering a strong base during every bearish encounter. However, the recent pullback caused the price to break the zone after holding for a few days

- The price has dropped below the average bands of the Gaussian Channel and failed to recover. Previously, when this happened, the price dropped to lower support and despite a rebound, the channel turned bearish.

- Lastly, the MACD is displaying growing selling pressure over the token as the levels are slowly heading to negative levels.

Collectively, the Solana (SOL) price rally currently appears to be stuck in a bearish trend and hence is expected to form new monthly lows below $140. If the bulls fail to defend the support, then an extended pullback could compel the price to test one of the important supports at $133, which may trigger FUD among the market participants. However, a rebound from any levels above $142 to above $155 may invalidate the bearish scenario, reviving the possibility of a bullish trend.