Top analyst explains why most altcoins fail and lose 99 percent of their value

The post Top analyst explains why most altcoins fail and lose 99 percent of their value appeared first on Coinpedia Fintech News

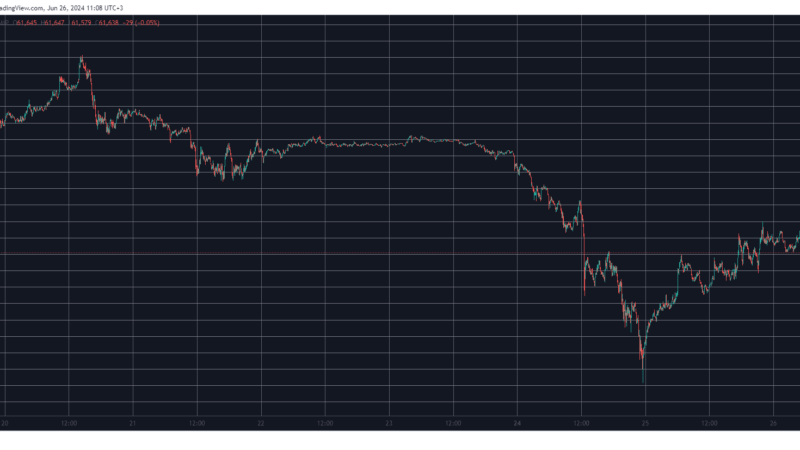

Analyst Lark Davis recently explained that assessing altcoins starts with understanding their simplicity. In a new analysis video, he said that while some altcoins have easy-to-digest summaries, most do not. The more novel a token, the harder it is to package and assess, leading to higher risks. These altcoins can surge in bull markets but can also crash dramatically when market sentiment shifts, sometimes losing up to 99% of their value.

He said that it’s important to categorize altcoins to identify the promising ones. The term “altcoin” is broad, so breaking it into subcategories makes sense.

Debate Over Ethereum

Starting with Ethereum (ETH), there’s debate over whether it is still considered an altcoin. Bitcoin maximalists argue it is, others believe it’s too significant to be classified as an altcoin, suggesting it is its own asset class, especially with the advent of spot Ethereum ETFs.

Emerging Projects

Beyond Ethereum, major alternative layer-one blockchains like Solana, Avalanche, and Cardano dominate the top ranks, often appearing within the top 10 to 15 cryptocurrencies by market cap. Newcomers such as Tonchain are also making notable progress. He said that these projects are typically volatile but offer long-term growth potential.

Expansion of Ethereum Layer-2

Additionally, the Ethereum layer-2 ecosystem is expanding with networks like Arbitrum and Base, and even layer-3 solutions built on these layer-2 platforms, such as Orbit chains and Arbitrum’s Degen on Base. This complexity adds to the diversity of the altcoin market.

Utility projects form another crucial category, including oracles, AI coins, real-world asset coins, decentralized exchange tokens, and gaming tokens. These altcoins vary significantly in market cap and utility, often experiencing extreme price swings over short periods.

Meme Coins

At the most volatile and risky end of the spectrum lies a continuous influx of new meme coins. While many of these are highly speculative and short-lived, a few manage to establish themselves as long-term assets. Dogecoin, the original meme coin launched in 2013, is a prime example. It has become a staple in the cryptocurrency landscape, proving that even meme coins can achieve lasting success.