Bitcoin Price Prediction: Support Levels Drop as Price Struggles To Stabilize Above 66K

The post Bitcoin Price Prediction: Support Levels Drop as Price Struggles To Stabilize Above 66K appeared first on Coinpedia Fintech News

Analyst Josh of Crypto World took to his latest video and discussed the current state of Bitcoin, saying that it is currently finding support at a critical level. He said that Bitcoin is showing new signals in the short term, indicating potential developments worth watching.

Before analyzing the Bitcoin charts, he revisited recent Bitcoin news. Specifically, he looked at a major net outflow of over $150 million from Bitcoin ETFs the previous day. This outflow, he explained, represents selling pressure as these ETFs offload Bitcoin into the market. He warned that such outflows typically hinder bullish price actions, suggesting instead that while short-term bullish movements are possible, a more bearish sentiment might prevail amidst these outflows.

Taking a look at the Bitcoin charts, he first examined the 4-day chart, remarking that there have been no major changes recently. Moving to the daily chart, he pointed out an interesting development: a slight drop in the DXY, which, if it continues, could signal a bullish indicator for Bitcoin. However, he cautioned that this drop in the DXY is currently a short-term pullback, and more sustained decline is needed to bolster Bitcoin’s prospects.

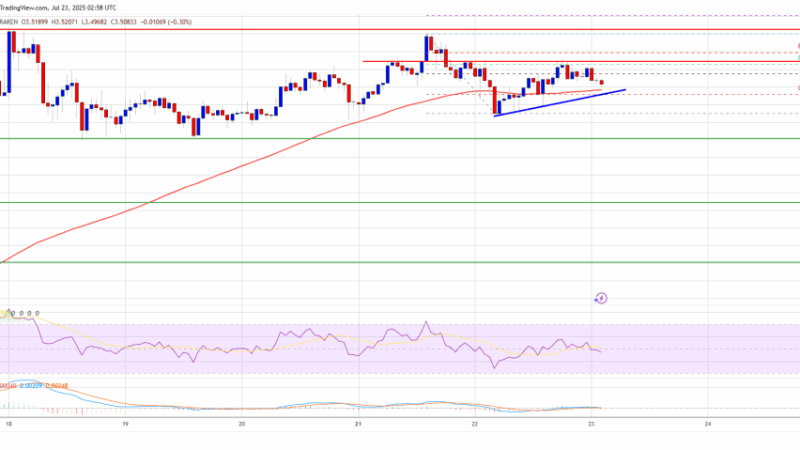

He looked at recent weeks and pointed out his consistent warnings about potential bearish actions in Bitcoin’s price. He reaffirmed his stance that the short-term outlook for Bitcoin has been bearish since it broke below a critical support level around $67,000, a point he had flagged previously. Currently, Bitcoin has found support in the range of $63,000 to $64,000, where recent price bounces have occurred.

Looking ahead, he suggested that Bitcoin may enter a phase of short-term consolidation, potentially lasting one to two weeks. Such consolidation could involve choppy price movements within the current support and resistance zones. He attributed this outlook partly to a new bullish divergence observed. He noted that weekdays typically see higher volatility compared to weekends, where market activity tends to calm down.