Coinbase sell pressure increases as Bitcoin dips below $61k, over $100 million liquidated

Quick Take

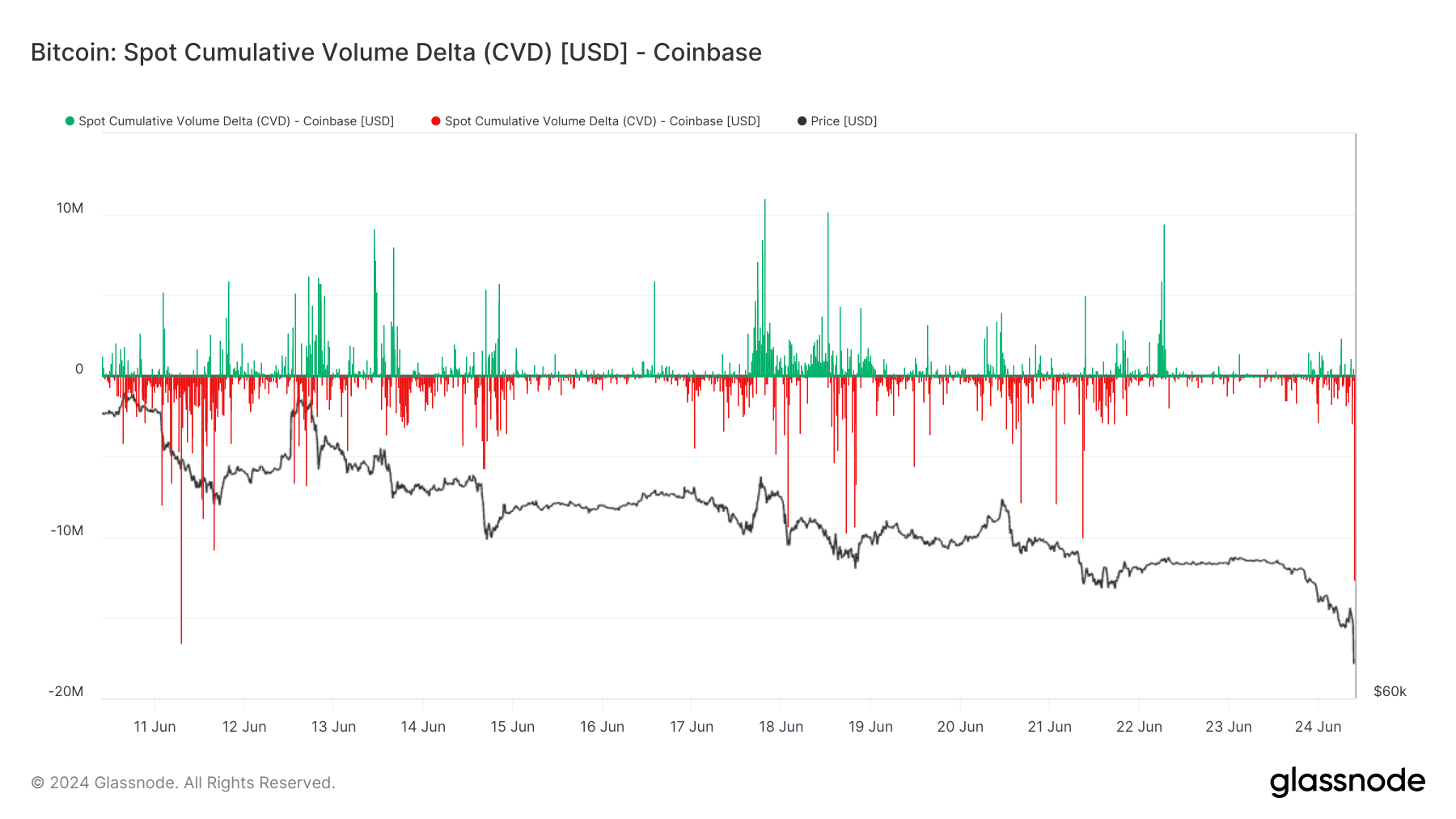

On June 24, Bitcoin experienced a significant downturn, dropping approximately 3% to just below $60,600, marking its lowest price since May 10.

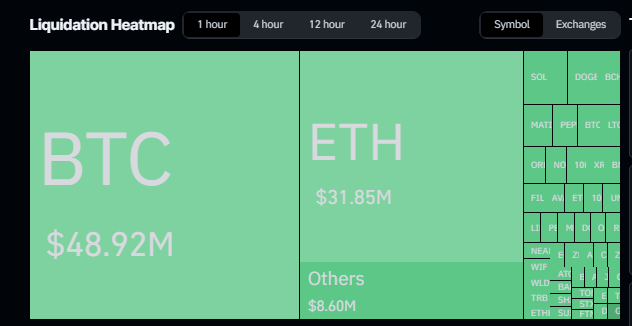

This decline has been accompanied by substantial liquidations in the digital assets market. Coinglass data reveals that in the past 24 hours, $280 million of positions were liquidated, with $260 million being long positions.

In the past hour alone, the market saw over $107 million in liquidations, with $103 million attributed to long positions. Bitcoin saw roughly half of these liquidations, with approximately $50 million liquidated, primarily from long positions, according to data from Coinglass.

According to Glassnode data, there has been nearly $15 million in spot sell pressure on a 10-minute resolution from Coinbase, the largest since June 11. This pattern suggests that a significant portion of the selling pressure originates from Coinbase each time Bitcoin dips. This recurring trend indicates that large-scale sell-offs on this platform may be a critical factor driving Bitcoin’s recent price drops.

The post Coinbase sell pressure increases as Bitcoin dips below $61k, over $100 million liquidated appeared first on CryptoSlate.