Terraform Labs’ $4.5 Billion SEC Settlement Spurs LFG’s Crypto Transfer

The post Terraform Labs’ $4.5 Billion SEC Settlement Spurs LFG’s Crypto Transfer appeared first on Coinpedia Fintech News

The Luna Foundation Guard (LFG), associated with Terraform Labs (TFL), recently transferred its crypto holdings to a direct custody solution following a significant settlement with the U.S. SEC.

This move has raised questions about the foundation’s financial strategies.

Background and Settlement with the SEC

Notably, this activity comes shortly after Terraform Labs and its co-founder Do Kwon settled a civil fraud case with the SEC. The resolution required both of them to pay a staggering $4.5 billion in penalties. This settlement has prompted LFG to safeguard its crypto assets proactively.

LFG’s Crypto Shift: Just a Security Issue or a Backup Strategy

In a post on the X platform dated June 25, The Luna Foundation Guard reportedly moved a significant amount of cryptocurrency, including Bitcoin, to a direct custody solution. This decision aims to enhance the security of funds held in LFG wallets. This transfer involved substantial amounts of cryptocurrency, including 1.974 million AVAX valued at $71.19 million and 39,499 BNB worth approximately $23.5 million.

To maintain transparency and trust, LFG has established a Reserves Dashboard. This dashboard provides real-time tracking of the funds held in LFG-linked wallets, ensuring continued transparency and traceability.

Current Market Snapshot

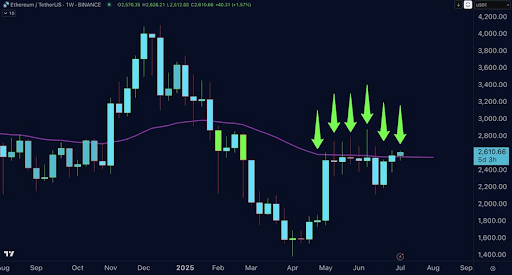

The crypto market has reacted negatively to these developments. Prices of assets held by Terraform Labs have dropped significantly due to concerns over potential sell-offs and overall market sentiment. For instance, AVAX has seen a 34% decline in a month, while LUNA and USTC have fallen by over 30% and 20%, respectively.

As of now, the total reserve balance stands at $124.36 million, with Bitcoin holdings valued at $19.13 million, Avalanche (AVAX) worth $49.71 million, and BNB worth $32.87 million.

Impact on Terraform Labs’ Operations

In response to the SEC settlement, TFL CEO Chris Amani has initiated the sale of major projects like Pulsar Finance and Station Wallet while committing to continue operating its remaining products. This has coincided with significant drops in AVAX, LUNA, and USTC prices amid market uncertainties and concerns over potential selloffs.