Hash rate fluctuations in 2024 highlight Bitcoin’s miner resilience and market forces

Onchain Highlights

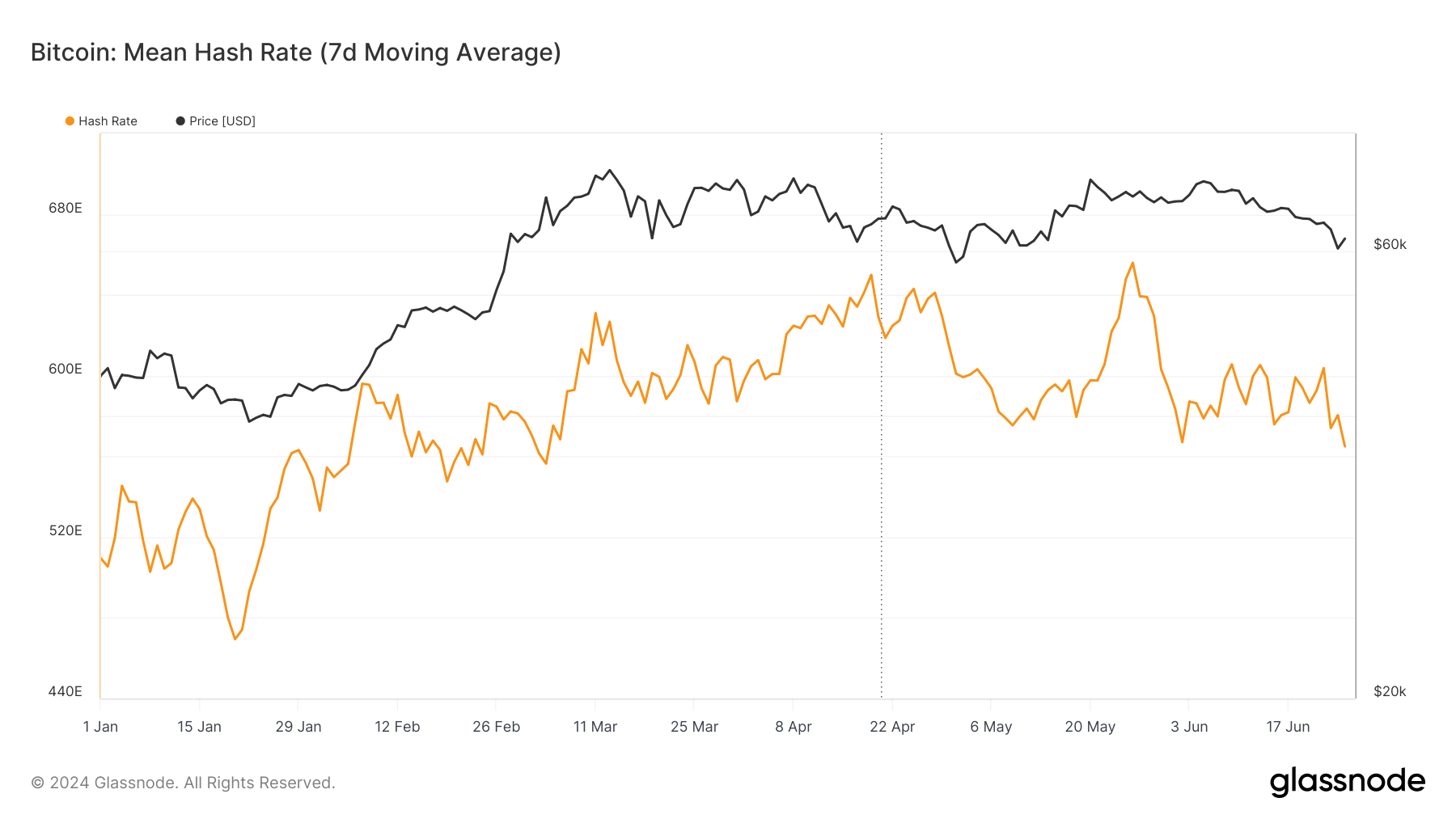

DEFINITION: The mean hash rate is the average estimated number of hashes per second produced by the network’s miners.

Bitcoin’s mean hash rate, represented by the 7-day moving average, has exhibited notable fluctuations throughout the first half of 2024. The hash rate peaked above 650 EH/s in mid-April, coinciding with the latest halving event, before showing a declining trend into June. Despite these changes, the mean hash rate has remained robust, reflecting sustained miner engagement.

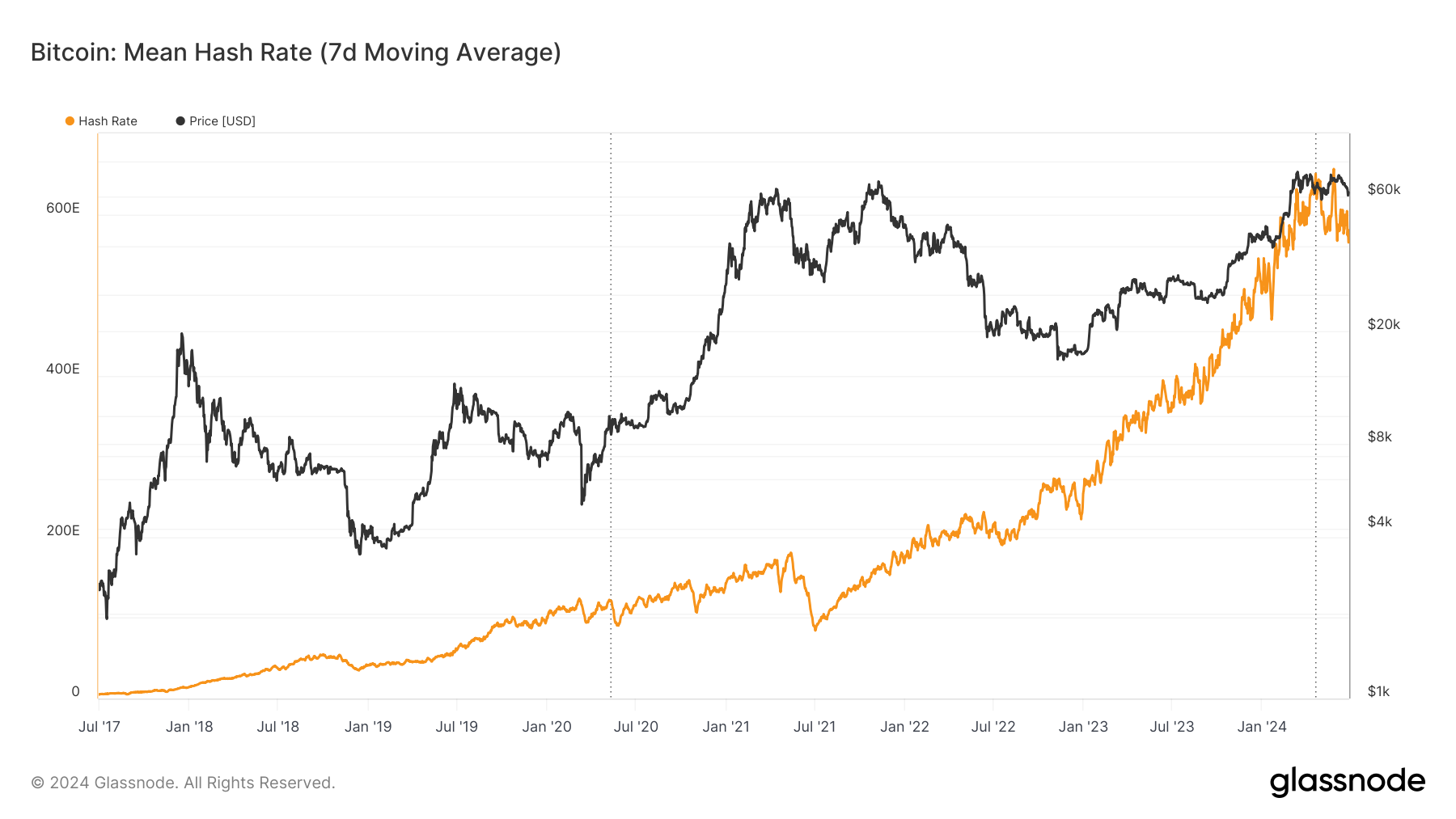

Comparing this year’s data with previous years, the long-term trend illustrates significant growth in network security and computational power. From a low of around 150 EH/s in early 2021 to recent highs, the increasing hash rate highlights the network’s resilience and growing miner participation. However, the recent decline may signal market recalibration post-halving, often observed as miners adjust operations.

The price of Bitcoin has similarly mirrored these hash rate trends, peaking near the halving before stabilizing. This correlation between hash rate and price movements suggests a complex interplay where miner activity influences market conditions and vice versa, marking an essential metric for assessing the health and security of the Bitcoin network.

The post Hash rate fluctuations in 2024 highlight Bitcoin’s miner resilience and market forces appeared first on CryptoSlate.