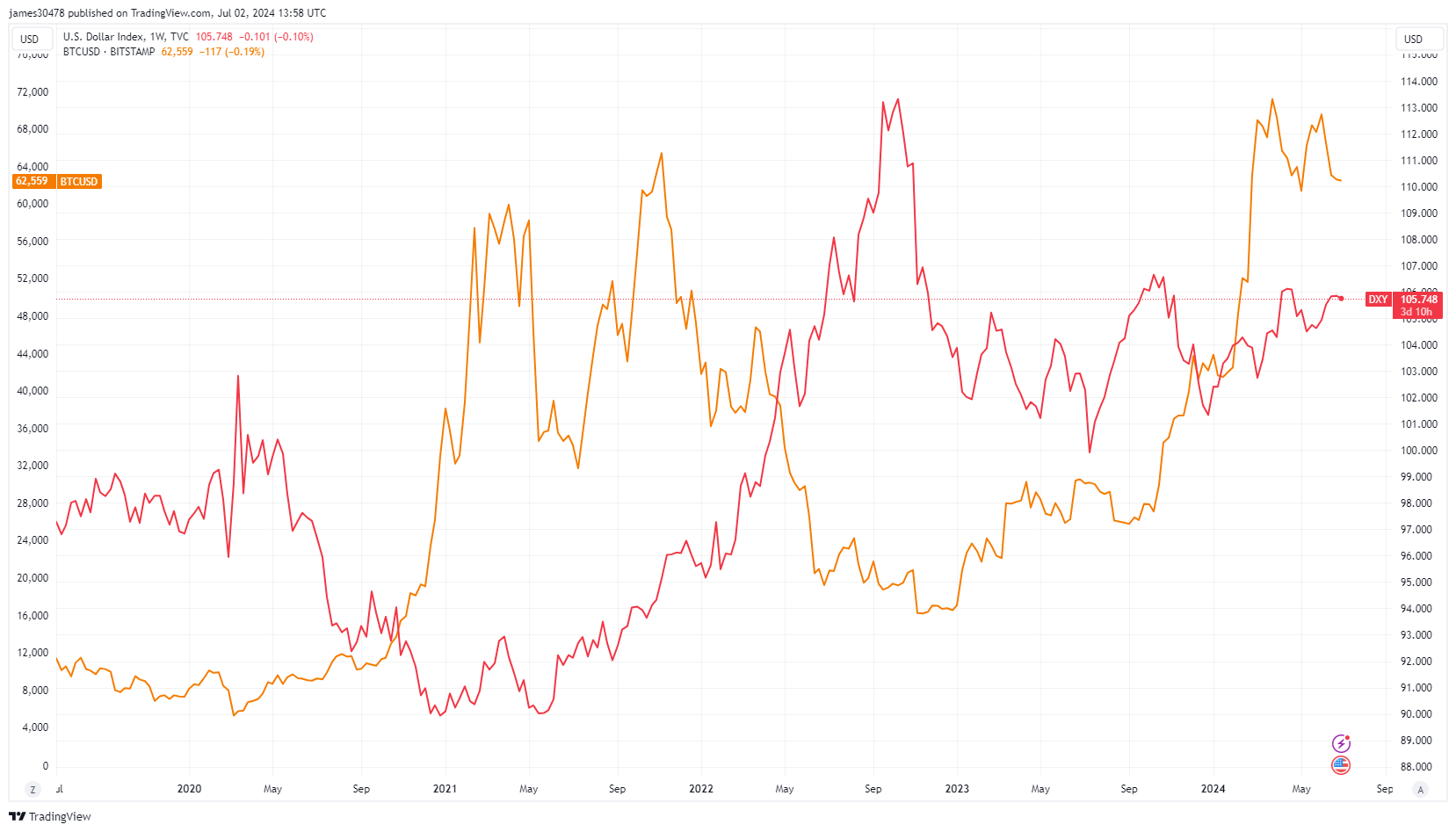

Bitcoin remains resilient amid DXY’s strength

Quick Take

The DXY index, a measure of the US dollar’s value relative to a basket of six major currencies, includes the Euro, Japanese Yen, Canadian Dollar, British Pound, Swedish Krona, and Swiss Franc. Notably, the Euro constitutes 57.6% of the index’s weighting, followed by the Yen at 13.6%, the Pound at 11.9%, the Canadian Dollar at 9.1%, the Krona at 4.2%, and the Franc at 3.6%, according to Investopedia.

Interestingly, there is typically an inverse relationship between the DXY and Bitcoin (BTC). Despite the DXY’s high value, BTC is trading just $10,000 below its all-time high in 2024, highlighting BTC’s resilience and strength in the market.

The DXY index is influenced by many factors, such as positive US economic indicators, higher interest rates compared to other countries, lower inflation rates, and increased investor demand for dollar-denominated assets, reflecting the dollar’s strength and attractiveness as a safe-haven and global reserve currency, especially during economic uncertainties. A value above 100 indicates a strong dollar, while a value below 100 suggests weakness.

Currently, the DXY index is trading around 106, reflecting a robust dollar. This level is significant, as the index has closed above 106 for only 34 trading days in the past year.

The post Bitcoin remains resilient amid DXY’s strength appeared first on CryptoSlate.