Bitcoin basis trade unwind reflected in shifting futures market and lack of inflows

Quick Take

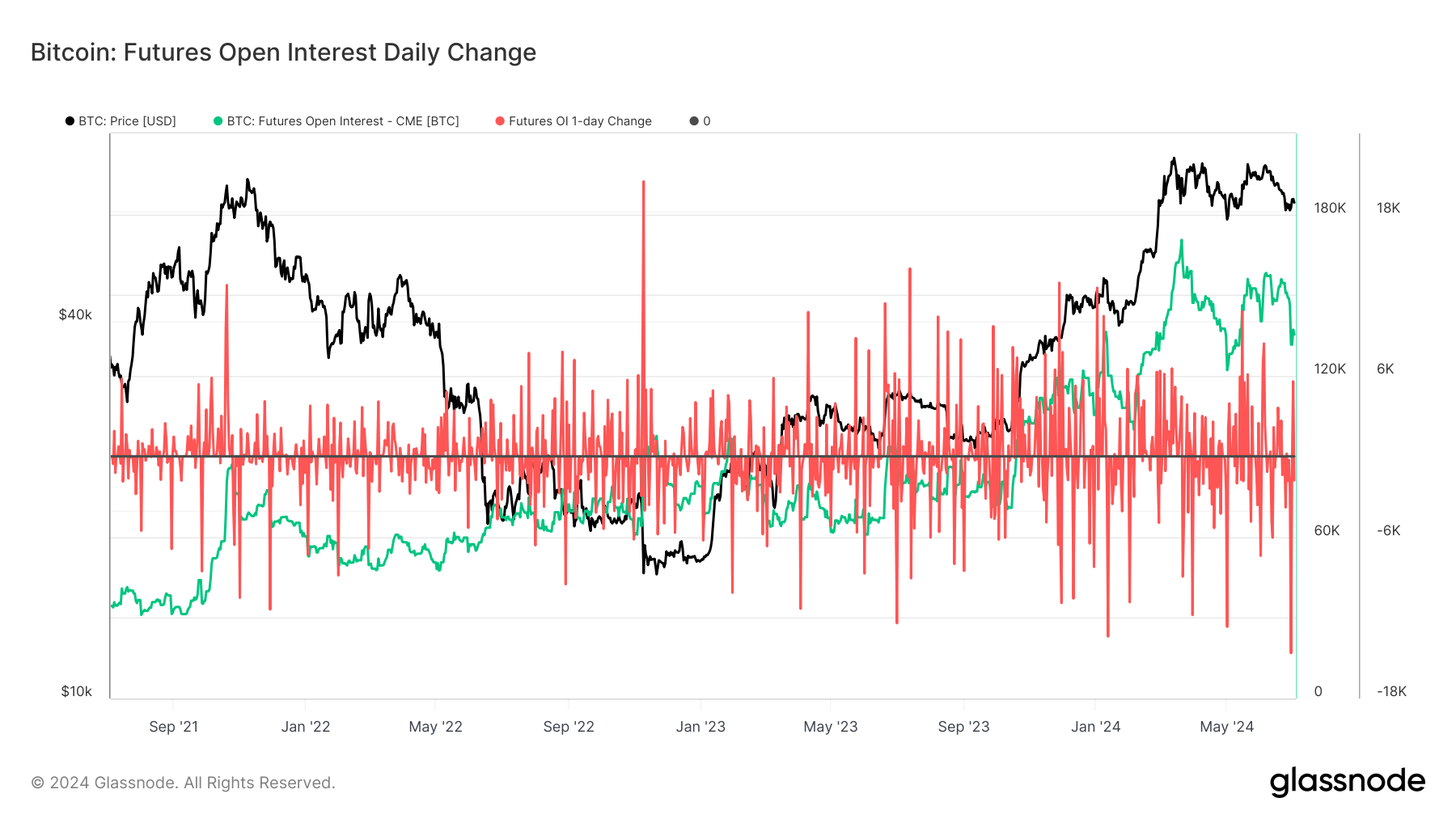

Glassnode data reveals that Bitcoin futures open interest on CME is currently around 135,000 BTC, reflecting a significant decline of approximately 40,000 BTC from its all-time high in March, which coincided with Bitcoin’s price peak. Notably, June 28 witnessed the largest single-day drop in open interest on the CME, with a decrease of around 14,620 BTC.

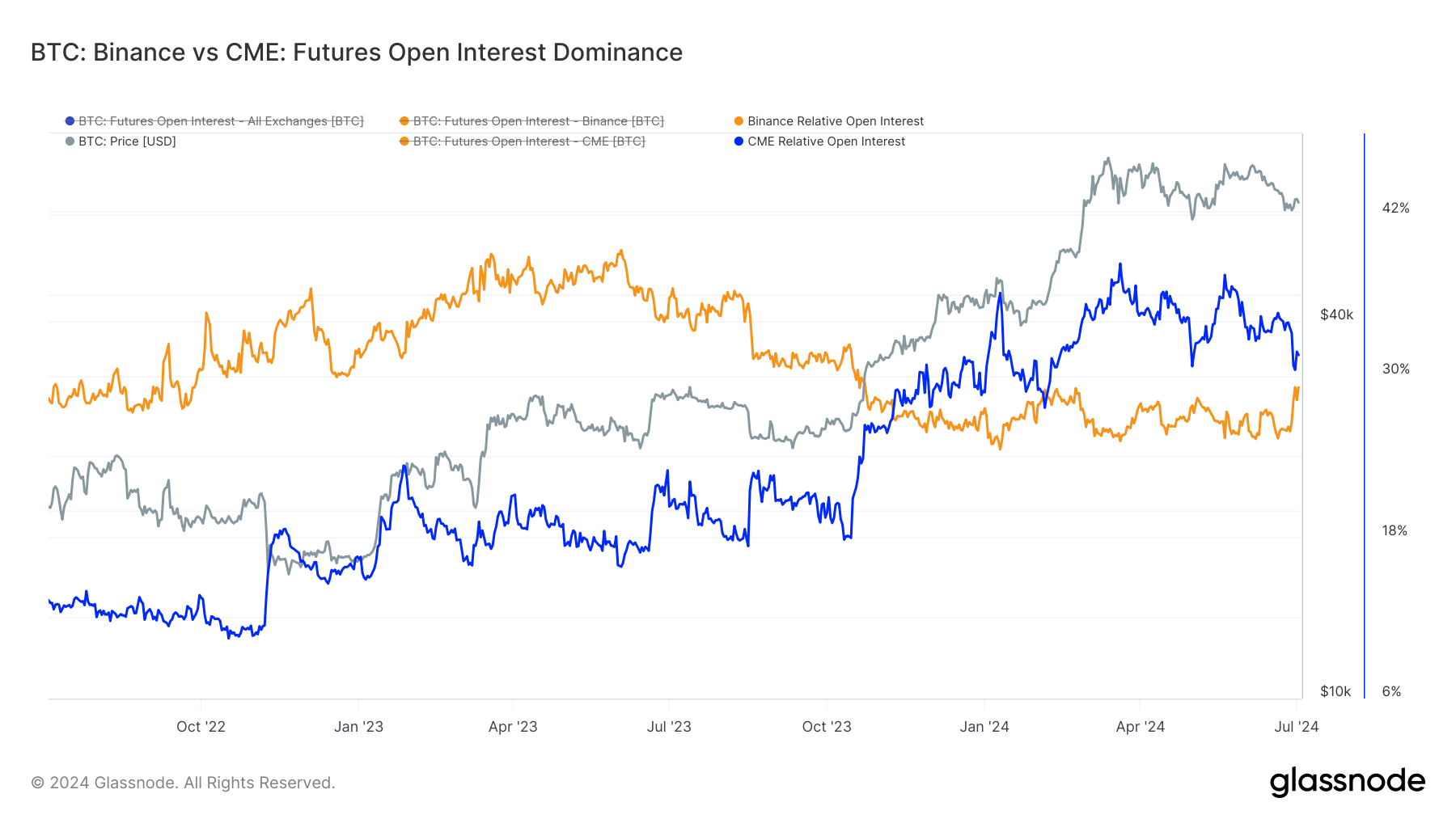

In contrast, Binance’s open interest is experiencing a dramatic increase, edging closer to reclaiming its position as the leading futures exchange, a title it lost in October 2023. Presently, CME holds just over 30% dominance in the market, while Binance is just under 30%, according to Glassnode data.

This shift could be indicative of a basis trade strategy being unwound. Typically, this strategy involves holding long positions in spot ETFs and short positions in futures. The closure of futures contracts on the CME, without corresponding significant inflows into the ETFs, suggests that traders might be closing these basis trades.

The current BTC futures price is $60,400, while the spot price is $60,259, providing a slight arbitrage opportunity. However, the high funding rate of 10% significantly increases the cost of maintaining a long position in futures, potentially eroding the profitability of the basis trade. While falling BTC prices below $60,000 do not directly impact the trade, they contribute to market sentiment and risk, further diminishing the attractiveness of this arbitrage strategy.

The post Bitcoin basis trade unwind reflected in shifting futures market and lack of inflows appeared first on CryptoSlate.