Bitcoin Plunges Below $60,000 for the Second Time in 15 Days: Here’s What It Implies!

The post Bitcoin Plunges Below $60,000 for the Second Time in 15 Days: Here’s What It Implies! appeared first on Coinpedia Fintech News

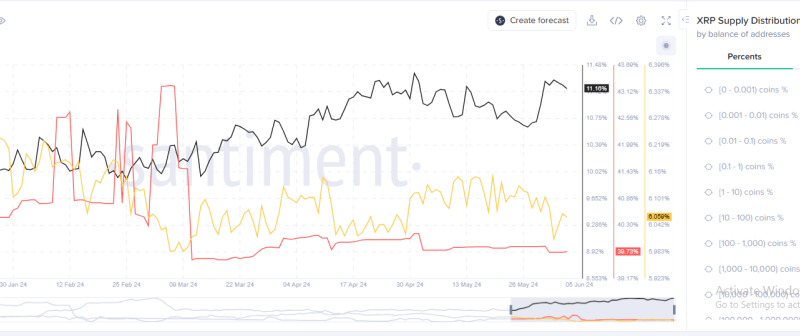

The market sentiments are turning bearish as fresh selling pressure is mounting over the crypto space. The Bitcoin price has formed a fresh daily low below $60,000 for the second time in the past fortnight, which suggests the bears are slowly increasing their hold over the rally. The long-term trade has turned bearish and hence the possibility of achieving fresh lows looms over the BTC price rally.

The BTC price slumped hard while the RSI approached oversold levels, due to which the CME gap has been filled. The liquidity has been grabbed from shorts and longs, as more than $100 million worth of longs have been liquidated in the past few hours. The bulls do not appear to be strong enough to prevent excessive bearish pressure and hence an extended drain close to $59,000 could be fast approaching.

In the higher time frame, the BTC price underwent a parabolic recovery to mark a new ATH at $73,750 in the first few weeks of 2024. This was followed by a decent pullback, while the lower support was tightly held at $60,000. Currently, the price is flipping in and out of $60,000 and also trying to hold the lower support of the cup & handle pattern. If the price fails to hold the support, then the price is expected to maintain a steep bearish trend throughout the week and mark fresh monthly lows close to $57,000.

The volume is slashing hard while the RSI is maintaining a strong descending trend, which validates the bearish trend. However, a drop toward new lows may attract fresh liquidity, which may trigger a fresh upswing and raise the price above $70,000 in no time. However, no major price action is expected to occur in July, as the bulls could be busy defending the lower support and preventing testing lower support close to $56,000.