Reasons Bitcoin Might Crash to $48,500 Soon

The post Reasons Bitcoin Might Crash to $48,500 Soon appeared first on Coinpedia Fintech News

Amidst the long awaited Mt. Gox repayments and Germany selling its seized BTC, the market is drowning in negative sentiments. The 4 hour RSI chart hit a low of 17.88 as soon as the trading opened in Asian countries and it started to display bad signals. This level of fear and uncertainty is palpable, making traders extremely cautious.

Major Resistance Levels Ahead

The Fibonacci retracement shows resistance at the $56,000 level, and it’s not the only hurdle. There’s significant resistance at $59,000, $61,000, and $63,800 zones, making any recovery seem like an uphill battle.

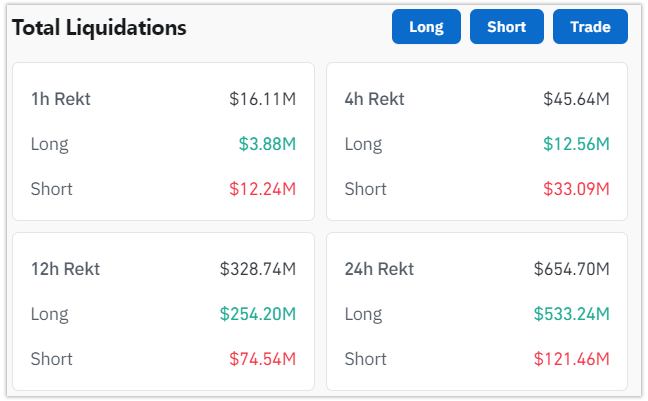

In the last 24 hours, over 230,000 traders have been rekt, with a total liquidation value of $654.70M, according to Coinglass data. The largest single liquidation occurred on Binance, where an ETH USDT long position worth $18.48M was wiped out. BTC alone saw $204.52M in long positions liquidated as the market dropped from $58,625 to $53,779.

Continuous Downward Spiral

BTC has been on a continuous downward spiral since it flashed an Evening Star at its peak price of $63,834. Despite showing signs of minor recoveries along the way, it couldn’t stop the plunge to $53,779 – a steep 15.50% fall. Bitcoin has shown a 4.79% recovery from the ground support of $53,900 to $55,900, but it’s still struggling to break the resistance, facing rejection and falling back to $55,000.

As per the trend, if the price fails to hold at this level then there is a high chance it will tumble down to $48,500. The current support level is an old zone created three years ago in 2021 when BTC soared to $68,000.

This period is marked by ups and downs for bitcoin and its investors and it gets influenced by external factors like the Mt. Gox repayments and the sale of seized BTC by the German government. These external factors have added layers of complexity and anxiety to the market, a perfect storm of uncertainty.

We know that the crypto market is notorious for its volatility, and events like these only add fuel to the fire. Traders need to stay informed and vigilant. With the market in turmoil, it’s crucial to stay informed and ready for whatever comes next. This rollercoaster ride might seem terrifying, but it’s also an opportunity for those who can navigate the waves of the crypto ocean.

There are few things that the investors must understand and follow. Keeping a close eye on the charts, watching for key resistance levels, and preparing for sudden drops will be a saviour. The crypto world is unpredictable for sure but with the right strategies and a keen sense of the market can turn your luck into great favour.