Federal Reserve balance sheet rises amidst looming rate cut speculation

Quick Take

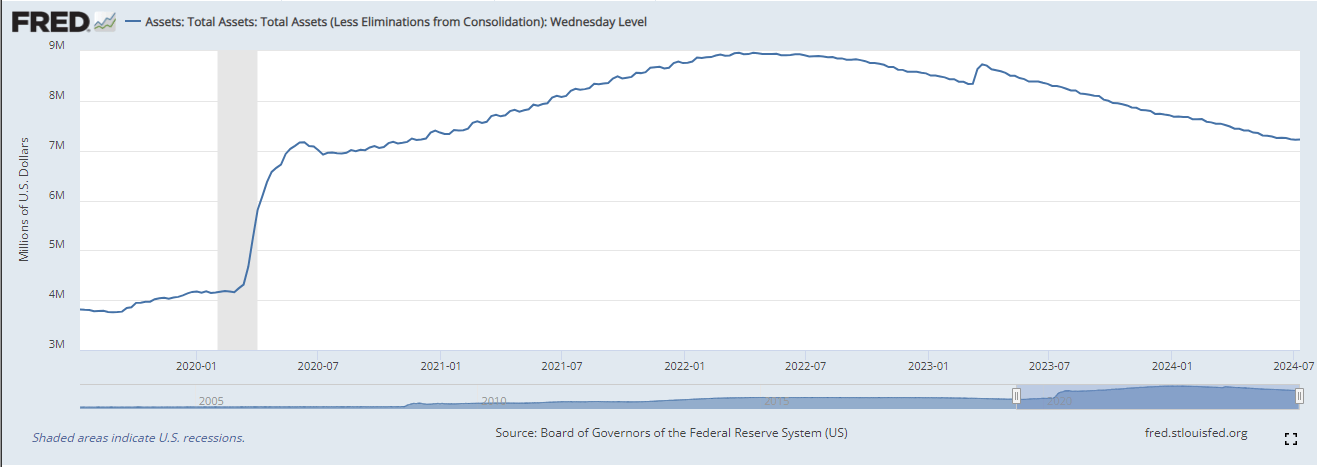

Data from FRED shows that the Federal Reserve’s balance sheet has increased by $2.6 billion to $7.2 trillion. Despite the Fed’s ongoing quantitative tightening, there have been intermittent periods of stagnation or growth in the balance sheet. However, the long-term trend remains downward.

The balance sheet peaked at $9.0 trillion in the second quarter of 2022, indicating a roughly 22% reduction over the past two years. Pre-pandemic, the balance sheet stood at $4.2 trillion, reflecting an over 50% increase since then.

As the end of the rate-hiking cycle approaches, speculation about the Federal Reserve’s first rate cut is mounting. This speculation has intensified following the Consumer Price Index (CPI) inflation print on July 11, which recorded a deflationary headline rate month-over-month at -0.1%. The decrease in CPI inflation suggests a cooling economy, potentially prompting the Fed to consider a rate cut. The balance sheet and inflation trends will be crucial in shaping the Fed’s monetary policy decisions in the coming months.

The post Federal Reserve balance sheet rises amidst looming rate cut speculation appeared first on CryptoSlate.