After BTC ETF, 21Shares Now Integrates Chainlink for Its ETH ETF!

The post After BTC ETF, 21Shares Now Integrates Chainlink for Its ETH ETF! appeared first on Coinpedia Fintech News

One of the world’s largest issuers of crypto exchange traded funds (ETPs), 21Shares, has integrated Chainlink’s Proof of Reserve (PoR) on Ethereum to make their Core Ethereum ETF (CETH) transparent. This step will enhance investors’ trust in the firm.

21Shares integrating Chainlink

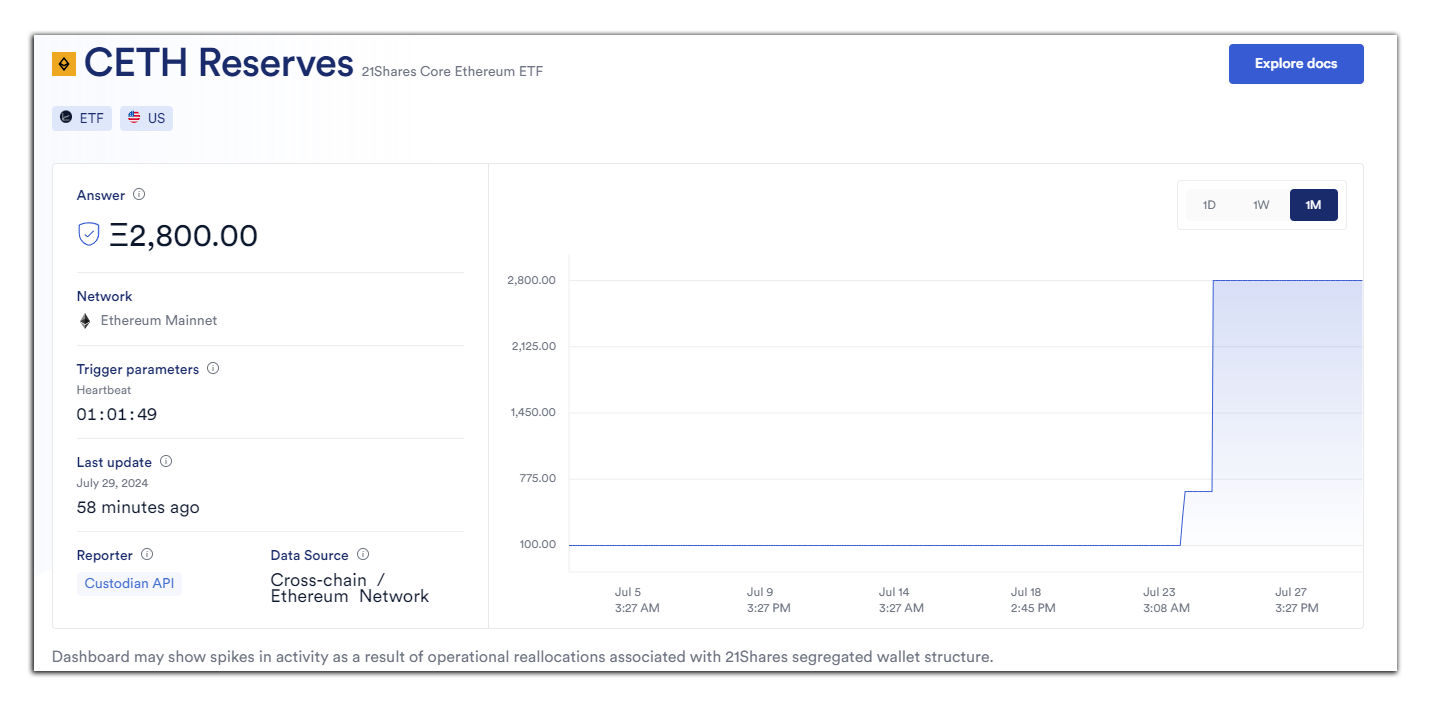

In a press release, 21Shares US LLC, shared the information about this integration. They have integrated the Industry standard “Chainlink Proof of Reserve” on Ethereum mainnet to enhance the transparency of their Ethereum reserve. This will provide assurance to the investors that CETH is actually backed by physical Ethereum holdings. The data about 21Shares’ ETH reserve is available through a Chainlink feed that pulls this information directly from Coinbase custody.

President of ETFStore, Nate Geraci, shares a screenshot of the CETH reserve saying this offers transparency into the ether backing ETF.

Why Chainlink?

In the press release, 21Shares has clearly shared the reason behind choosing Chainlink’s Proof of Reserve. They have mentioned that chainlink was chosen as the firm’s preferred decentralized computing platform due to its proven history enabling over 12 trillion in total value for on-chain markets. This integration will ensure full transparency while enabling security, maintaining asset integrity and building trust among the investors. The Proof of Reserve feed by chainlink eliminates the need of a middle point to provide external data to blockchains. This keeps the system fully decentralized and there is no scope of failure of data updation. The automated onchain verification keeps the onchain data up-to-date. According to the CETH reserve data, 21Shares currently holds 2,800 ETH in their reserve.

Chainlink for Bitcoin ETF

21Shares is already using Chainlink PoR for their ARK Bitcoin ETF (ARKB). In February 2024, they performed this integration. ARKB is a leading Bitcoin spot exchange traded product that currently holds $3.2 billion worth of assets.

High Volatility Risks

In a twitter post, 21Shares US has shared a lot of details about this integration. They have also mentioned that the Fund is not a fund registered under the Investment Company Act of 1940.

They emphasized that the fund has no similarities with other exchange traded products or ETFs. The fund is not suitable for all the investors as trusts that focus on a single asset often face high volatility and there is a chance of losing whole funds. Their twitter post contains a link to 139 pages long ETH ETF Prospectus for 21Shares CETF.

Also Read : Bitcoin in Hong Kong’s Financial Strategy: A Game-Changer for Digital Finance