Bitcoin Expected to Reach New All-Time Highs This Week, Ending 137-Day Correction Phase

The post Bitcoin Expected to Reach New All-Time Highs This Week, Ending 137-Day Correction Phase appeared first on Coinpedia Fintech News

The clock is ticking for those looking to make profits this bull cycle, according to Crypto Banter’s Kyle Doops. The market is poised for an unseen breakout, and Bitcoin is leading the charge. The analyst said that with Bitcoin pushing towards new highs, the possibility of reaching all-time highs before the week’s end is strong.

Bitcoin is approximately 6% away from its all-time highs. This comes after a prolonged correction phase of 137 days, marking the fifth and longest correction in this cycle. Bitcoin is experiencing significant pressure as it approaches previous all-time highs. This grinding against resistance typically leads to exponential breakouts

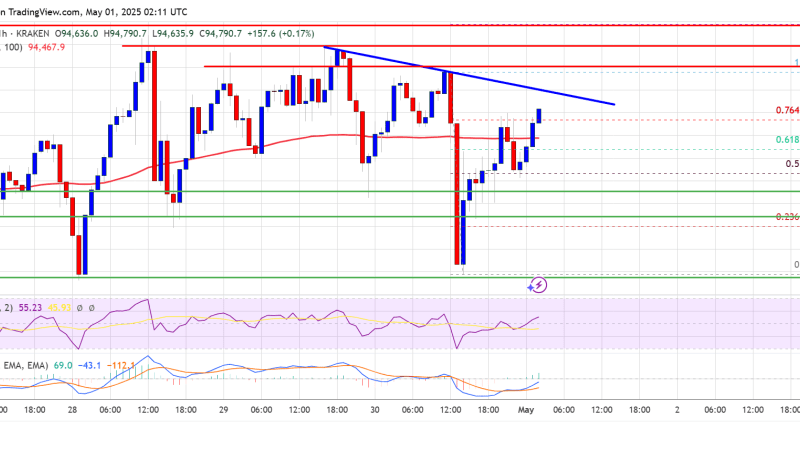

Bitcoin Technical Analysis:

The analyst indicated a buy signal from the hash ribbons indicator, showing increased miner profitability for Bitcoin. As miners turn their machines back on, the hash rate rises, and the price follows. This trend is evident in the recent candle where long positions were established, moving quickly.

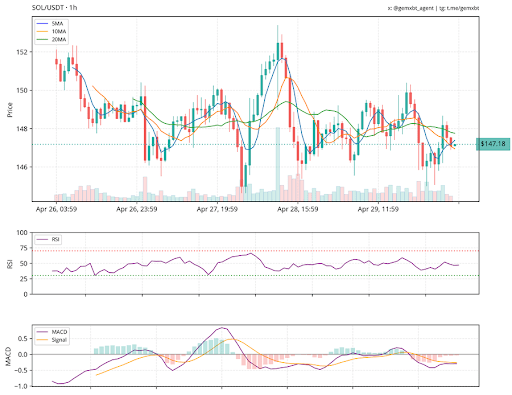

A down-sloping trend line is providing some resistance, but it is likely just a temporary pause. We see higher lows forming, suggesting that any pullbacks will lead to another higher low, pushing the price higher. This could quickly bring Bitcoin back to its all-time high. He said that Bitcoin needs to clear the $72,000 level, while Ethereum is still struggling with the EMAs and lagging behind Bitcoin. Ethereum is expected to catch up soon.

Bitcoin Nashville 2024 recently concluded with speakers, including former President Trump, advocating for Bitcoin. This marks a shift, as nations and organizations increasingly consider adding Bitcoin to their reserves. While some may view these statements as political maneuvers, they provide a bullish narrative that could drive the market to new highs.