Why The 4-Year Crypto Cycle Is A Thing Of The Past: Top-Analyst

The long-held belief in the crypto market’s predictable four-year cycle, characterized by distinct phases of accumulation, uptrend, distribution, and downtrend, is being questioned by top-analyst Jordan Fish, better known as Cobie. He articulated an argument that challenges this traditional view, suggesting that the concept of a cyclic market may no longer hold true.

Cobie ignited a debate on X (formerly Twitter) with his assertion, “Unironically [the bull run] has not even started yet.” This statement was met with incredulity by some, such as Maher Abdelsala, who remarked, “Brother people think you are serious lol.” Cobie clarified his stance, stating, “I am serious! Increasingly I like the argument that this is not even a ‘cycle’, really, but it’s more like 2019 with leverage and ETFs.”

The End Of The Traditional Crypto Cycle?

Cobie’s perspective hinges on the notion that the structural dynamics of the crypto market have fundamentally changed. He draws parallels to the market conditions of 2019, but with significant differences influenced by the proliferation of leverage and the introduction of spot Bitcoin and Ethereum Exchange-Traded Funds (ETFs). “Was 2019 a new ‘cycle’ or was it part of the bear market?” Cobie pondered. “Floated this idea to a few people in March but everyone told me I was an idiot, which I am, but still it was quite rude to say that to my face.”

The introduction of ETFs and the increased use of leverage have brought new complexities to the market. These instruments have changed how capital flows into and out of the crypto ecosystem, creating a less predictable and more fragmented market landscape. Cobie emphasized, “Of course if we’re in 2019-looking-2024, it doesn’t mean 2020 plays out the same way, because structurally so much is different now with ETFs and high FDVs and shit, probably too difficult to pattern match too much stuff about the future.”

Cobie’s analysis suggests that the current market exhibits a high degree of dispersion, where various assets behave differently rather than moving in unison as seen in previous cycles. This dispersion makes it challenging to identify a single driving force or pattern that governs the entire market. “I think this cycle is so unlike any other cycle it’s probably better to just stop thinking of cycles altogether,” Cobie stated. “It’s clear there is no one single thread pulling everything forward like it did before.”

This view is reinforced by the performance of certain cryptocurrencies. For instance, Chainlink (LINK) and Dogecoin (DOGE) are cited by Cobie as examples where the traditional hype and subsequent price appreciation may no longer apply. He explained, “I think there’s a very strong likelihood stuff like that could potentially never make new highs again and LINK could just keep existing as a wildly successful oracle without the price appreciation.”

The Echo Bubble Phenomenon

In the context of market maturity, Cobie referenced the concept of the “echo bubble,” popularized by the renowned trader GCR (Global Coin Research). The echo bubble theory posits that a smaller bubble follows the burst of a larger one, as observed in 2019 following the massive rally in 2017. Cobie expressed surprise at GCR’s recent market behavior, noting, “I actually found it pretty weird GCR kept talking about the echo bubble when he was bullish at the picobottom but then when shit started getting silly he just bought the dogwithhat NFT and broke his hiatus to come and tell people not to sell.”

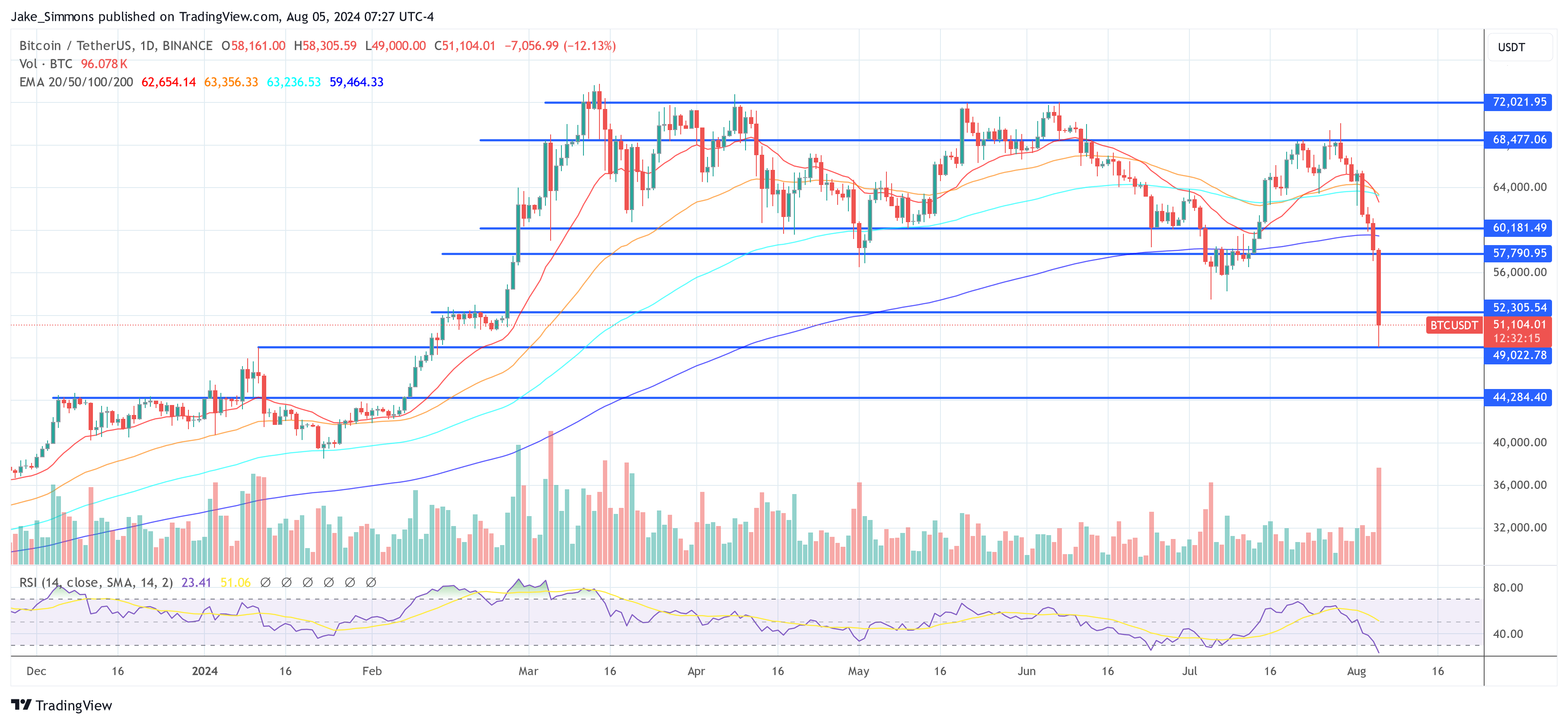

Overall, Cobie believes that the market is currently in a “multi-month/quarter cool-off reaccumulation period” for Bitcoin. He expects Bitcoin to trade within a range of $45,000 to $70,000, with a possibility of a brief breakout to new highs. However, he is pessimistic about the future of many altcoins, particularly those that have survived multiple market cycles. “I def think all the sudden memecoin theses marked an intermediary top for overall risk appetite, and everyone has been conditioned to max long as soon as they think we’re ready to go for it again.”

He anticipates that many of these older altcoins will “slowly bleed away and become irrelevant” as speculative investments. This outlook suggests that the market’s risk-on paradigm, characterized by rapid and extensive price increases, may not resume anytime soon. He concludes, “So long story short I think we need a lot more time before the (real) risk on paradigm starts again and I expect more downside to come before it happens.”

At press time, Bitcoin traded at $51,104.