Arbitrum Orbit Chain Users To Pay Gas Fees Using USDC: Why Is ARB Down 80%?

Users of Arbitrum orbit chains, layer-3 solutions for Ethereum built on top of the platform’s technology stacks, can now pay gas fees using USDC. The move comes even as ARB, the native token of the Ethereum layer-2, continues to post lower lows, pushing losses to nearly 80% since January 2024 highs.

Arbitrum Orbit Chains Support USDC For Paying Gas Fees

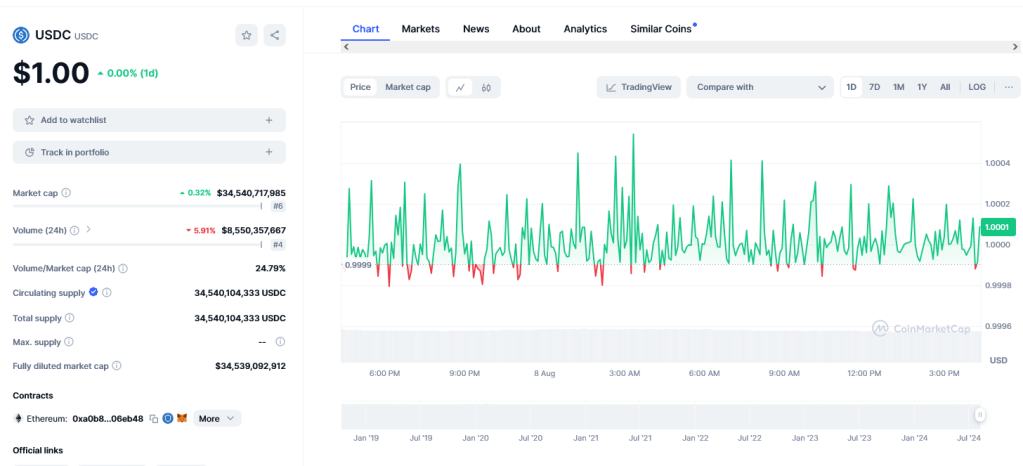

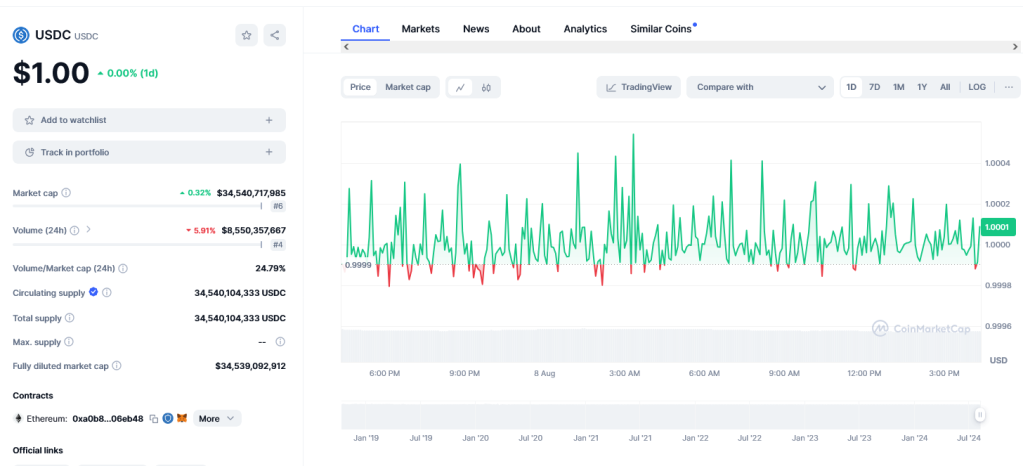

In a press release, the decision to integrate bridged USDC aims to reduce gas fees and attract more developers. As of August 8, USDC is one of the top stablecoins by market cap. CoinMarketCap data shows that Circle, the stablecoin issuer, has minted over $34.5 billion of the token, mainly on Ethereum and its layer-2s.

It should be noted that USDC is also supported in other ecosystems, including Solana and the BNB Chain. Currently, over $1.6 billion USDC has been bridged to Arbitrum.

By allowing users to pay gas fees using USDC, Arbitrum said they would be saved from the pain of enduring volatility typical in ETH. Depending on demand, gas fees tend to fluctuate, rising by several folds when there is congestion in the mainnet.

This volatility tends to impact user experience significantly. As such, some users opt for alternative platforms like Solana or Avalanche, where gas fees are relatively low.

Since USDC is pegged to the greenback, it is stable. Accordingly, regardless of the decentralized app they use on Arbitrum’s orbit chains, users can predict gas fees, making it easier to budget and, more importantly, manage finances.

Pushing Adoption, ARB Down 80% In 8 Months

In the press release, Arbitrum added that this integration will free orbit chain users from holding multiple tokens, further enhancing user experience.

Circle also announced a grant program for projects looking to be built on Arbitrum. This may spur the adoption of USDC on the orbit chain.

Despite the integration, ARB, the native token of Arbitrum, remains under intense selling pressure. As of August 8, the downtrend remains, and ARB is down nearly 80% from January 2024 highs.

Even though prices have been consolidating, as evident in the daily chart, bulls need to push higher, clearing $0.60. However, a clean break above 40.80, or July highs, could spark demand. This surge may revive demand in the medium to long term.