Bitcoin Cash (BCH): Analyst Pinpoints Prime Moment For Strategic Buy

Recently, crypto analysts have been attracted to Bitcoin Cash (BCH); Alan Santana provided an extremely intricate analysis concerning the coin’s future. He advises investors though to hold off on accumulating BCH until the market shows clearer signs of stability.

The cautious outlook for Santana was based on the notion that, from his belief, the correction in the market wasn’t over yet. He indicated that BCH still might be due for a little room down to the bottom, likely to precede the bull market expected in 2025.

Strategic Accumulation And Market Timing

The analyst focuses on a meticulous accumulation strategy. Santana advises investors to wait for signals of the bottoming of the market before buying BCH. He says such patience can pay off handsomely. He also encourages one to look at both linear and logarithmic graphs, for each offers a different perspective into price action. This gives a greater overview of where BCH might be headed when both of them are combined.

Bitcoin Cash Pre-2025 Bull-Market Accumulation Zone & Strategy

Another amazing cryptocurrency project. You know our motto, we love all cryptocurrencies; the more the better.

Good evening ladies and gentlemen… Are you ready to be entertained?

Bitcoin Cash peaked before… pic.twitter.com/DMLJ077ufN

— Alan Santana (@lamatrades1111) August 13, 2024

Of course, these potential returns would be for those willing to follow the advice. However, he also cautioned that such gains would most likely have to travel through further declines on the market. Timing and patience in riding out wildly swinging markets are thus what seem to be emphasized more than anything else with his strategy.

BCH is independent of the broad market trend. In 2021, BCH led in May, a little ahead of other altcoins. In the year 2023, BCH started off in June to peak in April 2024. This time difference right here can give BCH an added strategic advantage for investors who understand that market behavior.

World Of Charts, another analyst, recently offered an upbeat prediction for Bitcoin Cash’s (BCH) price trajectory. WOC believes that BCH is almost ready for a big bounce in the upcoming weeks.

BCH was trying a number of resistance levels at the time of his research. These milestones functioned as obstacles that BCH had to clear in order to pursue new annual highs. According to the analyst, a significant price gain may occur if BCH is able to overcome these resistance levels.

Short-Term Outlook: Resistance And Growth

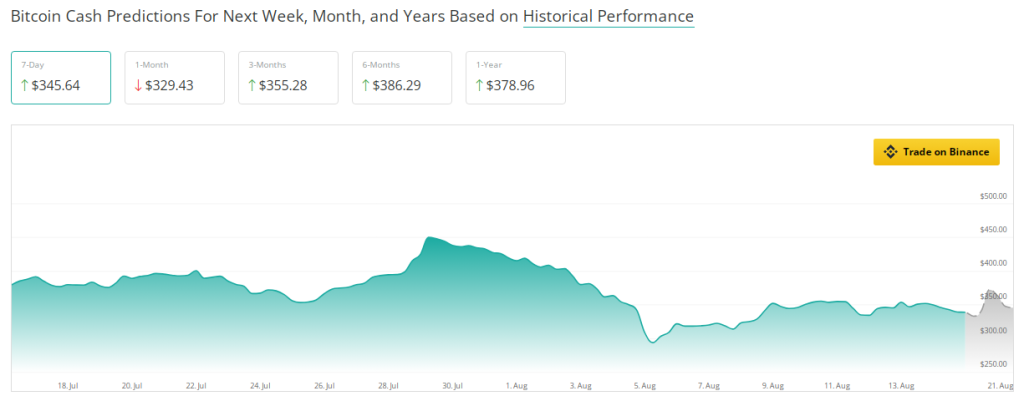

While Santana’s view for the long term is very conservative, the short-term BCH forecasts are pretty optimistic. CoinCheckup data interprets this to mean a possible 4.80% increase BCH over the next three months. This growth could be driven by steady accumulation and mild bullish momentum. Though modest, this could position BCH to test the $230-$240 resistance zone.

Further out, the six-month outlook for BCH is a projected 14% rise. Assuming BCH can break out of its current resistance levels, the target will be the $270-$280 zone. But more so important will be how the market reacts at those levels, and that shall be the determinant as to whether BCH will keep the momentum or there will be heavy pullbacks.

Featured image from Pintu, chart from TradingView