XRP News: How Might Ripple’s Legal Victory Impact Future SEC Regulations?

The post XRP News: How Might Ripple’s Legal Victory Impact Future SEC Regulations? appeared first on Coinpedia Fintech News

During a podcast session with securities law professor J.W. Verret, Ripple’s chief legal officer, Stuart Alderoty, discussed the possibility of the U.S. SEC appealing the court’s decision regarding XRP. While Alderoty acknowledged that an appeal is possible, he remains confident that XRP’s non-security legal status will not be affected. He pointed out that Judge Analisa Torres’ ruling on secondary XRP sales as non-securities is now established law, which would stand even if the SEC proceeds with an appeal.

Ripple’s $125M Fine: Win or Loss?

Earlier this month, Judge Torres issued a final judgment in the Ripple case, imposing a $125 million penalty on the San Francisco-based company. Despite this hefty fine, Ripple has positioned the ruling as a victory, particularly because it resisted the SEC’s broader attempt to classify XRP as a security across all contexts. This mixed outcome has been seen as a win for Ripple, especially given the prolonged legal battle with the SEC.

Legal Experts Weigh-In

In response to the conversation, Bill Morgan, a prominent attorney, and XRP community member chimed in on the situation, noting that Stuart Alderoty expressed doubts about the SEC acting rationally when it comes to crypto. Alderoty claimed that a rational actor might avoid appealing, but the SEC’s current behavior implies otherwise. He said he wouldn’t be shocked by an appeal but that the second circuit’s prospects of reversal are fewer than 10%.

Morgan echoed Alderoty’s confidence, reminding the community that regardless of an appeal, it remains an established law that XRP and its secondary market sales are not securities.

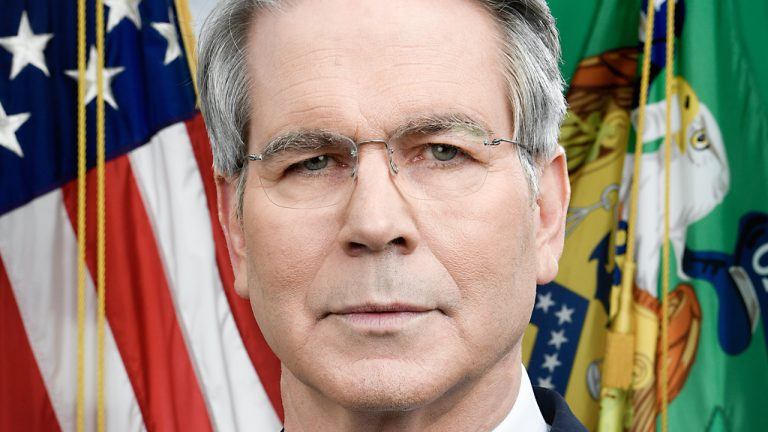

Notably, Marc Fagel, an ex-SEC official and legal expert with a deep understanding of securities law enforcement, entered the discussion. He explained that the decision for the SEC to appeal isn’t just about rationality or winning a single case. As a government entity, the SEC must consider how the outcome of this case could set a precedent that affects other actors and their broader regulatory program. Their focus is on the long-term impact of the legal decisions on their overall mission, not just the immediate outcome.

Impact on the Crypto Industry

In the aftermath of the ruling, Alderoty appeared on CNBC, boldly stating that the SEC lost on all key issues important to them. He also mentioned that the SEC has 60 days to decide whether to appeal the decision. This ruling has implications beyond Ripple, as Elliott Stein, Bloomberg’s senior litigation analyst, suggested that it could favor Coinbase’s ongoing legal challenges with the SEC.

Moving Forward: Ripple’s Win as a Turning Point?

Alderoty also thinks Ripple’s court win could affect the crypto market. He said the SEC’s strong approach to crypto had distracted them from its core duty, but hoped this verdict may help the industry go forward. Ripple’s win may influence regulatory contacts with the crypto sector.

Is this the beginning of the end for the SEC’s crypto crackdown?